Coding bootcamps are among the best ways to break into an exciting and fulfilling career in tech. However, many aspiring coders are concerned about the cost of coding bootcamps. While there is no form of FAFSA for coding bootcamps, you can pay for your education with loans for coding bootcamps and other aid programs.

This comprehensive guide will give you all the information you need to make a smart decision about how to pay for coding bootcamp. We’ll teach you about the different financing options, including coding bootcamp scholarships, private loans, monthly payments, government funding, and personal funding. Read below to learn more about paying for an online coding bootcamp.

Key Takeaways

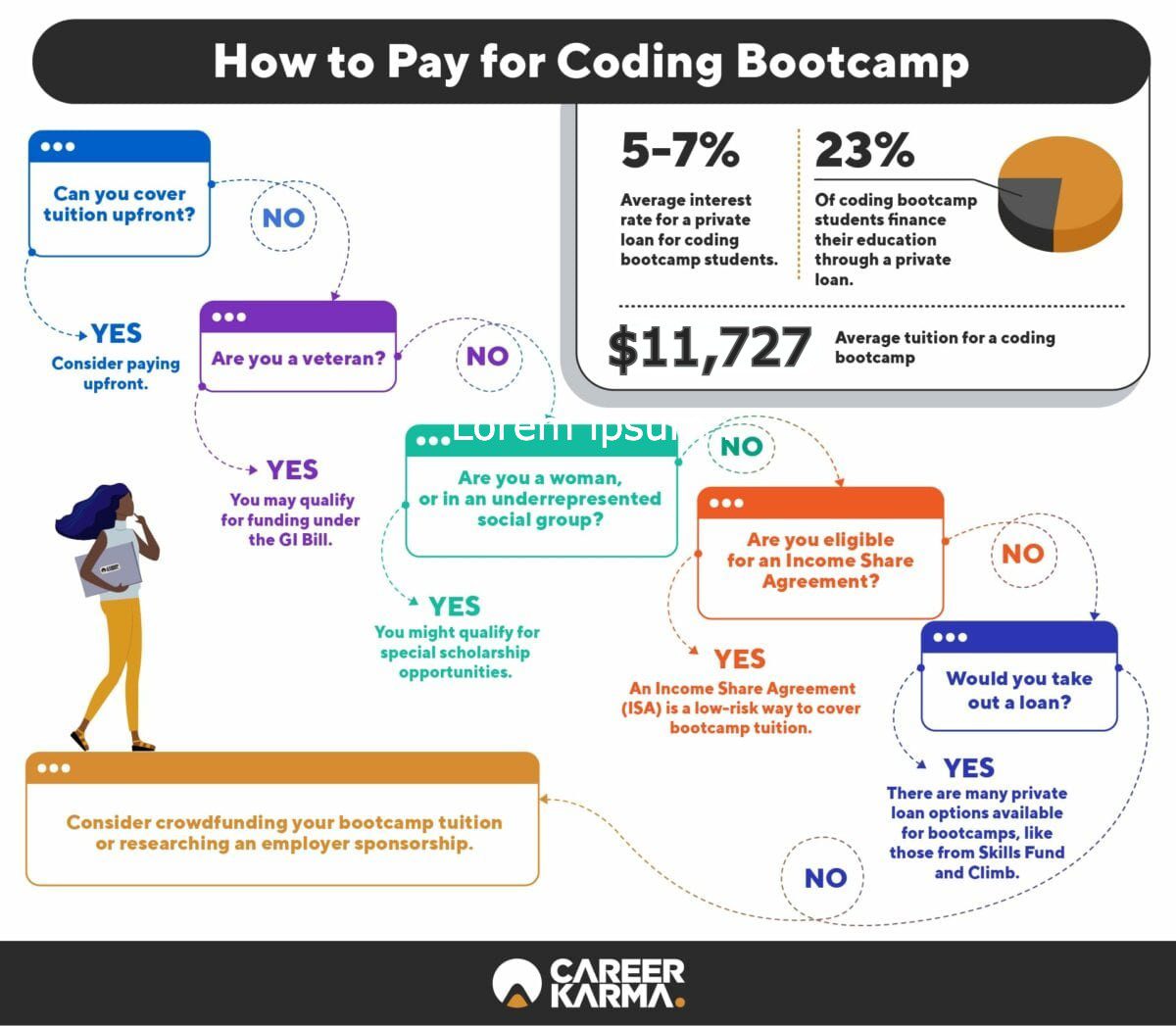

- Coding bootcamps are a cost-effective alternative to traditional computer science education, with an average total cost of $11,727.

- Various financing options are available to pay for coding bootcamps, including upfront payment, scholarships, deferred tuition, income share agreements (ISAs), coding bootcamp loans, and employer sponsorships.

- There are many coding bootcamp scholarships available. Some target specific groups, such as women and underrepresented communities.

- Deferred tuition programs and ISAs allow students to start paying tuition once they graduate and land an in-field job.

- Coding bootcamp loans can be obtained from bootcamps or partnered loan providers, even with no or bad credit.

- Some coding bootcamps offer job guarantees, providing a full or partial tuition refund if a student is unable to find a job within a specified period of time.

How Much Does Coding Bootcamp Cost?

According to research conducted by Career Karma, bootcamp training programs cost an average total of $11,727. This is much lower than annual tuition at a college. Coding bootcamps offer a great way for people to accelerate their knowledge of various technical concepts without spending too much money.

Choose a method of financing that is both flexible and manageable compared to how much you can expect to earn as a graduate. If you invest some time upfront evaluating your financing options, you are more likely to get the most out of your coding bootcamp education. With so many payment options available, you’re sure to find a method that works for you.

College vs Coding Bootcamp Cost

While the majority of coding bootcamps cost less than $12,000, college tuition and fees add up, on average, to $37,600 per year, according to the National Center for Education Statistics. This figure corresponds to private institutions, but even other types of schools have very high fees. This is because when you pay for college, you pay for access to its campus and student services. The average cost is even higher if you live in a dorm.

As we have shown you, coding bootcamps are much more affordable than traditional computer science education. Add to this the fact that bootcamps can be completed in a fraction of the time that it takes to earn a degree, and you can see why these programs are such attractive options for people looking to pursue lucrative careers in tech.

How to Pay for Coding Bootcamp

Coding bootcamps are known for their flexibility when it comes to payment. Whether you have excellent credit or have been struggling financially, there is a coding bootcamp financing option for you. These are the top payment methods to finance a coding bootcamp:

Coding Bootcamp Financing: A Closer Look

Upfront Payment

Paying tuition upfront is the lowest-risk option. Paying your school fees right away ensures that your learning is as stress-free as possible as you avoid the hassle of multiple payments. In addition, schools typically give discounts to those that do a one-time, lump-sum payment.

Case in point, General Assembly has a $450 discount for students who pay the full tuition upfront for an immersive program. Those interested in a part-time course can save $250 this way. Fullstack Academy, Hack Reactor, and Ironhack also offer similar deals.

Coding Bootcamp Scholarships

Coding bootcamp scholarships are another popular financing option. Coding bootcamps are renowned for their efforts to help people from all backgrounds start a tech career. One of the ways they do this is by offering a range of scholarships. Scholarships are a good option because students don’t need to pay them back.

Bootcamp scholarships typically have a specific type of student they aim to fund. For example, some bootcamps offer bootcamp scholarships for women and underrepresented groups. Flatiron School, for example, has awarded over $1 million toward women’s coding education through its Women Take Tech scholarship fund.

Some bootcamp scholarships are partial, which means they discount a large part of tuition but not the whole cost. Others cover the entire cost of tuition. Bootcamps such as General Assembly, Coding Dojo, Devmountain, and Hack Reactor offer scholarships to their students.

Deferred Tuition

Deferred tuition programs are now a common coding bootcamp financing option. Through these contracts, students will only pay the tuition cost after they graduate and get a job earning over a certain amount. Under a typical deferred tuition scheme, students pay a small deposit at the beginning of the course, although this is not always the case.

There are now a plethora of coding bootcamps that offer deferred tuition. Flatiron School, for example, partnered with the We Company to start the Access Labs program. This allows students to defer paying tuition until they have found a job paying over $35,000 per year. Other deferred tuition coding bootcamps include LearningFuze, Nucamp, and Thinkful.

Income Share Agreements

A common form of deferred tuition is a coding bootcamp income share agreement (ISA). ISAs allow students to attend a coding bootcamp with no tuition paid upfront in exchange for a percentage of their future income. Students only make payments as a percentage of their income once they graduate. To start making payments, students must earn over a certain amount, which is typically between $30,000 and $60,000.

This means that if a student becomes unemployed or underemployed, they will not have to make payments toward their education. Further, ISAs include payment caps that ensure successful students do not pay disproportionately for their cost of education.

The main advantage of ISAs is that they make schools more invested in the future of their students. ISAs incentivize coding bootcamps to give the best possible instruction and career services. This is because if the student does not succeed, the school gets paid very little or nothing.

Coding Bootcamp Loans

Many bootcamps have their own loan programs to help students get their education. Some also partner with loan providers like Climb Credit and Upstart. Even people with no credit or bad credit can find a loan that works for them so they can attend a bootcamp.

Paying for coding bootcamp with a private student loan means paying back your loans after graduation. In most cases, you cannot make contributions toward your loan until you graduate, after which the payment period will start. Make sure you’re prepared for the commitment of a loan before you sign an agreement.

Before you take out a loan to finance your education, you should check if the bootcamp has a partnership with any lenders. If you take out a loan with a bootcamp partner, you are less likely to experience communication breakdowns and more likely to have a positive experience.

GI Bill for Coding Bootcamp

The GI Bill was passed in 1944 after World War II. It was designed to help veterans reacclimate to civilian life. It gives them the capital they need for education, buying a home, or starting a business. In recent years, the money given to veterans for further education is now available to students who enroll in a short-term coding bootcamp.

Under the Post-9/11 version of the bill, veterans may be eligible for up to 36 months of college or career training. Eligible students must have been discharged honorably or still be on active duty. They also must serve or have served at least 36 months on active duty for the full suite of benefits. This includes money that can be spent on educational materials and living expenses.

Be sure to check out the full list of bootcamps eligible for GI Bill funds. Some of the coding bootcamps that accept the GI Bill are Codeup, General Assembly, Code Platoon, Galvanize, and DigitalCrafts. The GI Bill can be the answer if you are concerned about how to pay for coding bootcamp. Some of the benefits are offered even if you have served for less time.

Employer Sponsorships

You can always ask your employer if they would be willing to sponsor some or all of your tuition. Some employers sponsor skills development courses for their workers, including coding bootcamps. Through a bootcamp employer sponsorship model, your employer pays for all or some of your bootcamp tuition.

Companies benefit because bootcamps can help employees become more effective and productive. Bootcamp employer sponsorship is a great option if you already work in the tech field. It allows you to attend coding bootcamp while working. In addition, companies that offer student loan repayment benefits may also be willing to help workers by paying off their loans.

"Career Karma entered my life when I needed it most and quickly helped me match with a bootcamp. Two months after graduating, I found my dream job that aligned with my values and goals in life!"

Venus, Software Engineer at Rockbot

Crowdfunding

Finally, there is also the option of crowdfunding to finance your bootcamp. Crowdfunding platforms such as Indiegogo and GoFundMe allow people to raise money for causes including education. The benefit of crowdfunding is that it can be easy to raise the money you need. There is a wide audience to target who may be interested in helping you finance your education.

However, crowdfunding does have a few problems. The main one is that you will be competing with other people who are raising money for similar causes. Therefore, you will need to craft a strong profile to maximize your chance of raising the money you need to attend a coding bootcamp.

Can I Get Federal Financial Aid for Coding Bootcamp?

Unfortunately, there is no Free Application for Federal Student Aid (FAFSA) form for coding bootcamps. In fact, government grants for coding bootcamps are hard to obtain. Coding bootcamps are not accredited, which is why most federal funding options do not apply to these educational institutions.

Fortunately, in 2016, the Office of Educational Technology announced the Educational Quality through Innovative Partnerships program, or EQUIP. This program allows students to apply for federal financial aid including Pell Grants and federal loans.

This helps students to afford non-traditional education, such as an online course or a coding bootcamp. However, there is currently only one approved university that partners with EQUIP. It is possible that this will change in the future. In addition, the GI Bill and VET TEC are both options that military veterans and their families can take advantage of. In fact, a large number of coding bootcamps accept the GI Bill.

What Are the Top Bootcamp Lenders?

Climb Credit, Ascent Funding, and Upstart are some of the major companies that offer coding bootcamp loans. We see how they stack up against each other below.

| Climb Credit | Ascent Funding | Upstart | |

|---|---|---|---|

| Starting APR | 5.0% | 7.34% | 6.5% |

| Term | 3 years | 3 or 5 years | 3 years |

| Partners | Coder Camps, General Assembly, Hack Reactor | Fullstack Academy, DigitalCrafts, Coding Dojo | Launch Academy, General Assembly, Coding Dojo |

Private lenders usually charge between a five and eight percent Annual Percentage Rate (APR) on their loans. This is equal to the interest rate as well as extra fees on a loan for a whole year, which can add up. Loans offered by private lenders usually have shorter terms. This is because most bootcamps are shorter than other educational options such as community college or university.

Students who take out private loans can expect to pay back the money they borrowed in no more than five years. Most lenders expect students to pay back their loans between one and three years. In some instances, a lending partner may offer an interest-only loan for coding bootcamps.

However, private loans are not accessible to all students. Private lenders examine a borrower’s credit score, savings, and income-to-debt ratio. Students with a poor financial history may be denied access to a loan. Most private lenders do allow students to have a co-signer on their loan, someone who will pay back the money if the lender defaults.

Should I Pay for Bootcamp With an ISA or a Loan?

Whether you should pay for your coding bootcamp with an ISA or a loan depends on a variety of factors, such as your current financial situation, your expected salary after bootcamp, and your creditworthiness. Bootcamps such as General Assembly and Kenzie Academy offer ISA-based financing models to their students

The differences between ISA vs student loans are clear-cut. With an ISA, borrowers will only make payments when they earn over a certain amount. With a loan, on the other hand, the student will always have to repay, regardless of their financial situation. Another difference is that traditional loans accrue interest and have a balance, and ISAs do not.

ISAs focus on a student’s potential rather than credit score when considering eligibility. This opens up access to this financing model to more students, even those with bad credit or no credit card. In many cases, If a student is ineligible for a private loan, they could pay for their bootcamp through an ISA.

However, even if you qualify for an ISA, it may not be the right option for you. In an ISA, students may end up paying back more than they initially borrowed. This is because successful students will only stop making payments if their ISA term expires or if the payment cap is reached.

What Is a Coding Bootcamp Job Guarantee?

If you are looking for a foolproof way to get a job in tech, some coding bootcamps offer job placement guarantees. A coding bootcamp job guarantee often comes in the form of a full or partial tuition refund if the student is unable to land a job after graduation. Usually, students will get their money back if they can’t find a relevant job in six months.

There are also coding bootcamps that guarantee the student a job or internship within the bootcamp itself or with its parent company. Revature, for example, guarantees its students employment with one of its clients. Check the job placement rates at your preferred bootcamp to see how students fare in the job hunt.

Coding bootcamps with job guarantees include Byte Academy, Codeup, and CareerFoundry. However, before you join any, read the small print. These guarantees may only apply under certain circumstances. For example, the student may have to apply to a certain number of jobs per week and may not be allowed to turn down a job offer.

Top Coding Bootcamps With Job Guarantee

Attending a tuition-guarantee program can be an excellent way to minimize risk and ensure your money is not wasted if things don’t work out as planned. Read about some of the best tuition-guarantee schools below:

- Springboard. This school is an excellent option if you want to learn data analytics, UX design, and data science online. One of the great things about it is that you’ll receive a full refund if you do not get a job within six months of completing the bootcamp.

- Thinkful. This popular coding school gives students all their money back if they are not able to land a qualifying job six months after graduation.

- Bloom Institute of Technology. BloomTech offers a tuition-guarantee program. Students are refunded the whole cost of tuition plus 10 percent if they don’t get a job offer within a year of graduation.

- CareerFoundry. This coding bootcamp is so certain it will help you land your dream job in tech that it offers a 100 percent tuition refund. CareerFoundry is an excellent option to study UI/UX design, data analytics, and web development.

- Codeup. Students who join this web development coding bootcamp but fail to get a job within 180 days of graduation receive half of their tuition back.

Can I Get Paid to Learn Coding?

Yes, you can get paid to learn coding by attending a coding apprenticeship. Additionally, there are a few coding bootcamps that offer stipends to cover living expenses. Coding bootcamp stipends are meant to alleviate the financial burden of your education so you can focus fully on your studies.

A stipend is usually paid monthly, although some coding schools may operate on a different schedule. Some coding bootcamps don’t offer a stipend but will instead provide free housing. Other schools offer stipends that come in the form of a scholarship.

V School, for example, is a coding bootcamp with living stipend in the form of free housing and free public transportation for Career Changer students. This coding bootcamp is a great choice if you want to learn UI/UX design, web development, and full stack development.

Another coding bootcamp with living stipend is Big Nerd Ranch. Your registration fee at this bootcamp includes housing, meals, and even coffee. This school is a solid option for those pursuing a career in web development.

What’s the Best Way to Pay for Bootcamp in 2023?

The best way to pay for your coding bootcamp will always depend on your specific situation. From scholarships to loans and deferred tuition, there are many ways to pay for coding bootcamp. Before you settle on one, do proper research on the different coding bootcamp financing options available and coding bootcamp prices.

Coding bootcamps continue to be a great alternative to traditional computer science education in 2023. They provide high-quality education imparted by industry experts. For many, the biggest issue is figuring out how to finance them. We hope this article helps clarify your financing options so that the impact on your pocket is minimal and you can start your program with complete peace of mind.

How to Pay for Coding Bootcamp FAQ

There are many coding bootcamp scholarships for women. STEM scholarships for women who want to join a bootcamp include Sabio’s Jill H. Mays Scholarship, Coding Dojo’s Women in Tech Scholarship, and Lesbians Who Tech’s Edie Windsor Coding Scholarship.

No, in most cases, you cannot use a 529 plan to pay for a coding bootcamp. You can only use a 529 account if you are paying tuition to an eligible institution. Universities are considered eligible institutions. However, most bootcamps are offered by private companies, which means that using a 529 account is not an option.

Flatiron School, Thinkful, and Nucamp are some of the best online coding bootcamps in 2022. They allow students to learn from anywhere in the United States, often at slightly reduced rates. You can save lots of money if you live at home and avoid travel costs with an online bootcamp.

Yes, a coding bootcamp is worth it. Coding bootcamps provide high-quality, industry-standard education at affordable prices. You can learn from industry experts and get job-ready in just a few weeks. Tech jobs continue to be in high demand, and coding bootcamps allow you to upskill and enter the job market quickly.

With so many financing options available, you’re sure to find a method–or combination of methods–that works for you.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication.