Despite strong macroeconomic headwinds, the the demand for reskilling and upskilling continues to increase. Our research shows that the number of students choosing coding bootcamps to reskill or upskill is not only expanding but doing so at a faster pace than in 2022.

This report provides a comprehensive snapshot of the coding and tech bootcamp market for the years 2023 and 2024, based on data gathered using a variety of methods. Our primary focus is on the size and value of the market, enrollment trends, average tuition costs, and shifts in delivery formats and curricula.

The global IT training market is evolving rapidly, driven by technological advancements and increasing consumer demand. According to EMR, the market is currently valued at $81.44 billion and is projected to grow at an annual rate of 6.2% throughout this decade.

This study provides a comprehensive assessment of a critical segment within this dynamic space. The report offers valuable insights for potential investors evaluating opportunities in the bootcamp sector, as well as for students determining whether the bootcamp model aligns with their goals and expectations.

Table of Contents

- Key Findings

- Methodology

- Overview of the Market in 2024

- Bootcamp Costs and Financing

- Skills Taught at Bootcamps in 2024

- Top Bootcamp Employers and Employment Trends in 2023-24

- 2024 Geographic Data for Coding Bootcamps

- Innovations in Bootcamps: Adapting to the AI Revolution

- Partnerships and New Business Models

- The Future of the Bootcamp Model: Challenges and Opportunities

- Projections 2025

- Appendix

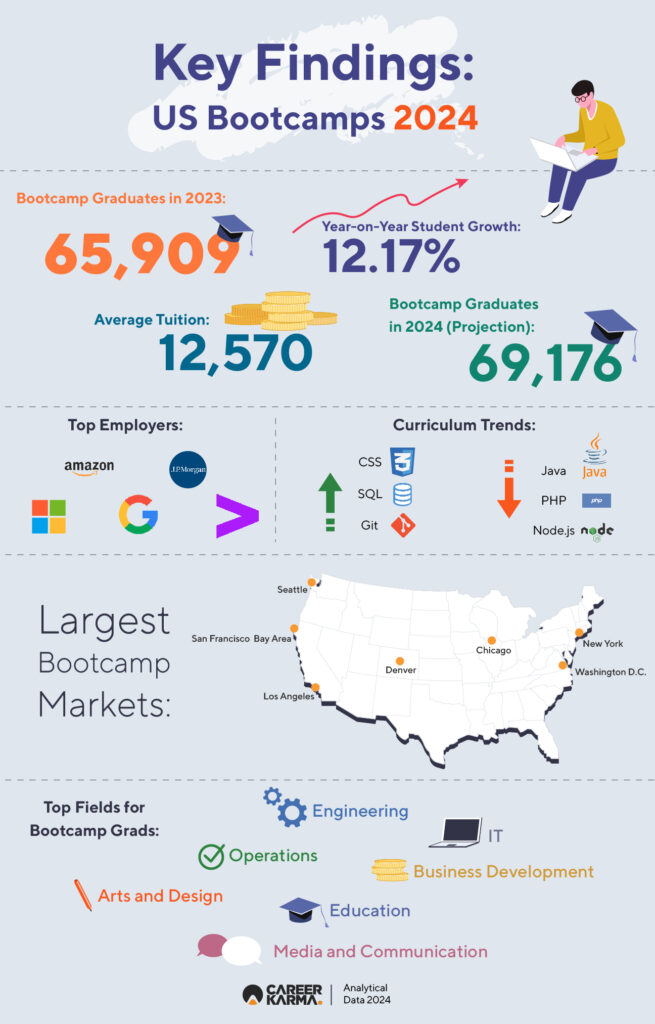

Key Findings

Market Size in 2023

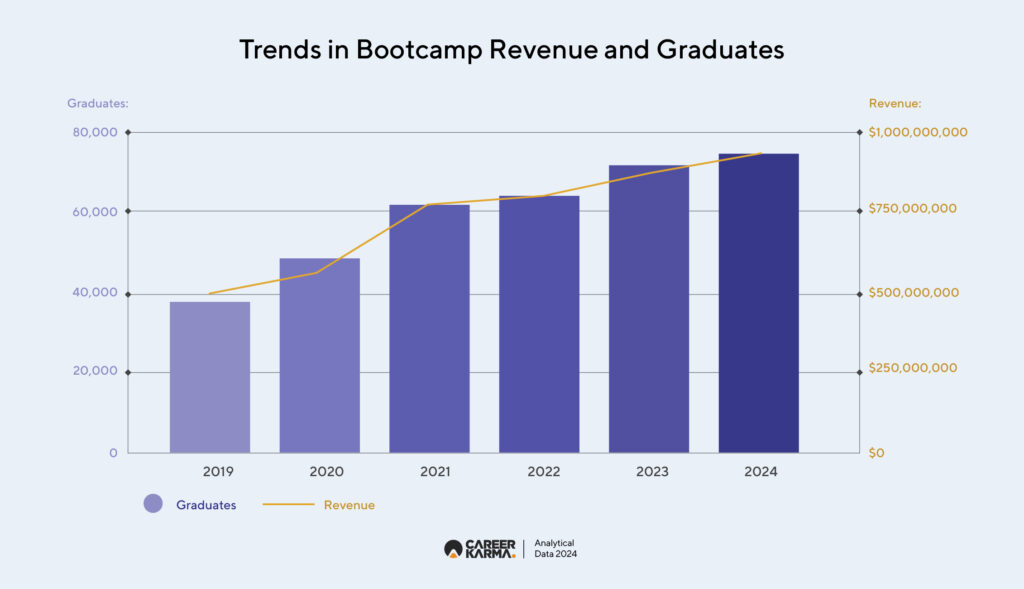

In 2023, the number of students who graduated from a bootcamp increased by 12.17%, from 58,756 in 2022 to 65,909. This is a faster pace of growth than what we saw in 2022 (3.23%), though it is significantly lower than the years 2020 and 2021 (both 30.32%).

The accelerated growth in 2023 underscores the industry’s resilience following the pandemic and the subsequent return to “normal.” Many had predicted a decline as workplace restrictions eased and the demand for engineers to develop remote work solutions waned. However, these fears have not materialized to the extent anticipated.

Instead, the bootcamp model has proven to be more robust than initially anticipated. This enduring appeal is no doubt rooted in the inherent flexibility of the bootcamp’s model. The need for fast and affordable IT training that adapts to people’s busy schedules and to quickly changing technologies remains a key concern for people looking to upskill or reskill in 2024.

Bootcamp Revenue in 2023

We estimate that coding bootcamps earned $800,998,110 in tuition revenue in 2023, a 10% increase over 2022. This pace of growth is notably higher than what we saw in 2022, when we put the year-over-year growth rate at 2.65%.

Coding bootcamp revenue grew

by 10% in 2023

2024 Projections

During the first half of 2024, 34,588 students graduated from a major coding bootcamp. Based on that figure, we make the following projections:

- Over 69,000 students will graduate from bootcamps in 2024, a 4.96% increase over 2023

- The industry will generate more than $826 million in revenue, 3.17% more than the previous year.

For a full explanation of how projections were generated, please see Appendix A.

Tuition

The average tuition for a coding bootcamp is $13,274. This number is not a big departure from tuition rates for the years 2021 and 2022, indicating that bootcamp providers have been reluctant to raise prices.

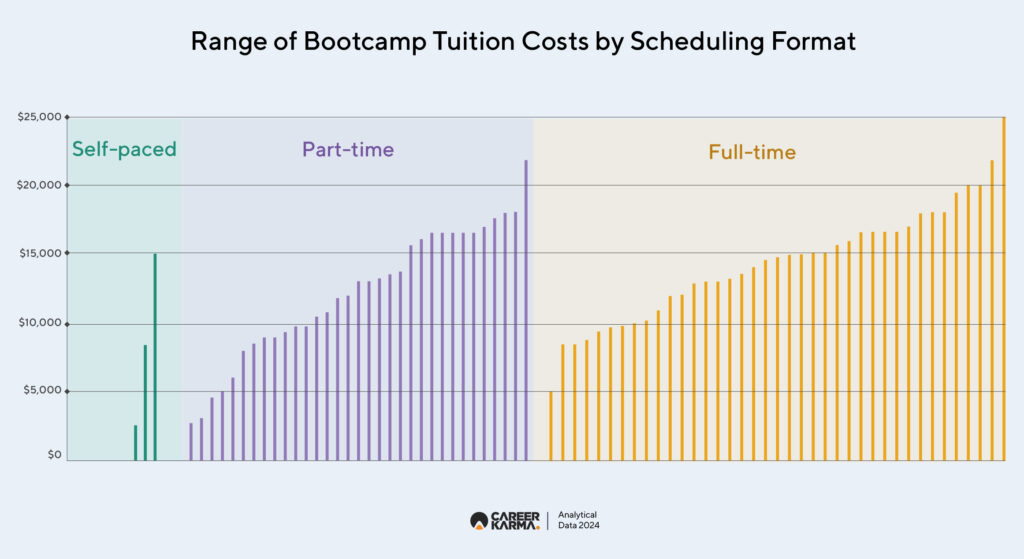

We also noticed different average costs across different formats:

- Full-time coding bootcamp programs cost $14,604 on average.

- Part-time coding bootcamp programs cost $12,116 on average.

- Self-paced coding bootcamp programs cost $8,662 on average.

Tuition Financing

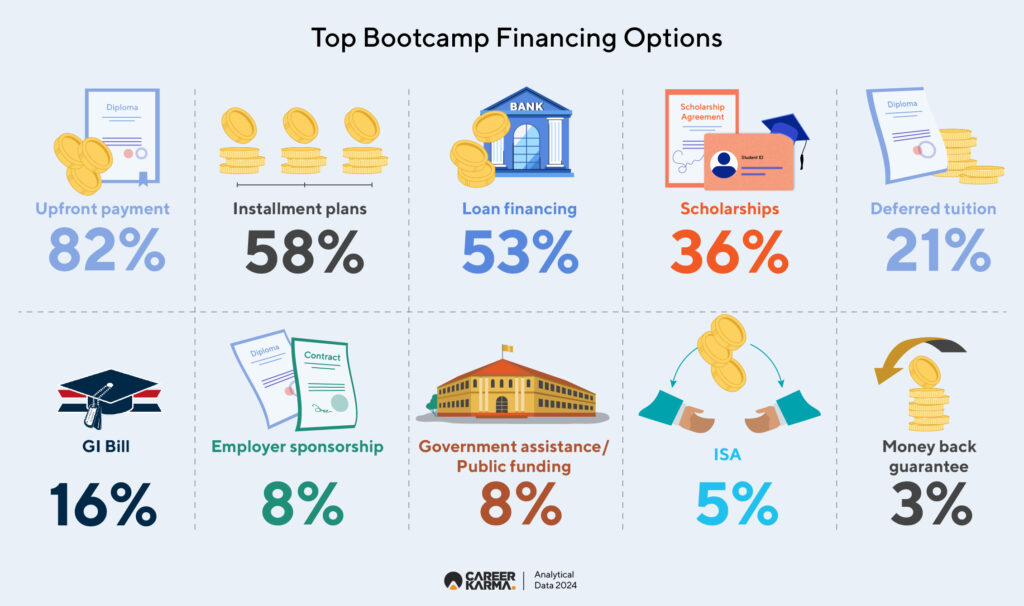

The most common financing methods in 2024 are:

- Installment plans

- Loans

- Scholarships

- Deferred payment plans

Notably, Income Share Agreements (ISAs) have declined sharply, from 23% of providers offering them in 2022, as reported in our last State of the Bootcamp Market report, to just 5% in 2024.

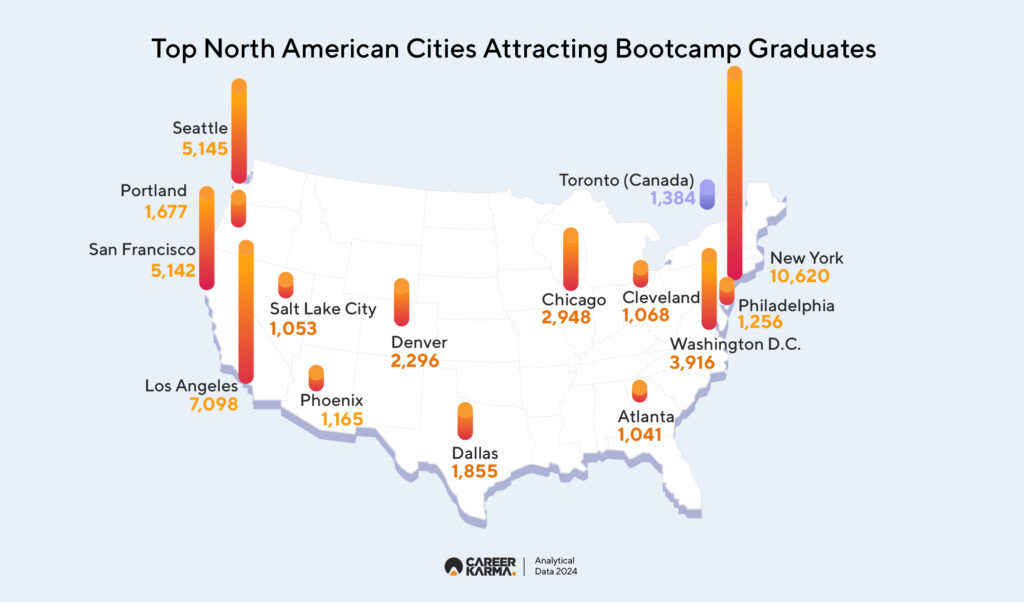

Top Cities for Graduates

The New York City Metropolitan Area remains the top destination for bootcamp graduates, followed by Los Angeles and Seattle. San Francisco has dropped from second to fourth place.

Emerging hubs include Washington, D.C. (#5), Chicago (#6), and Dallas (#8).

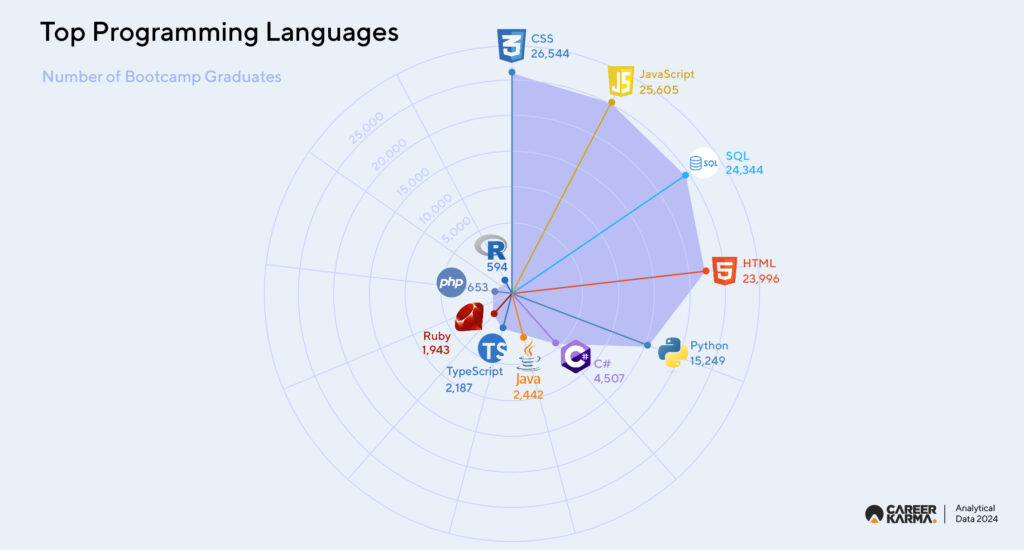

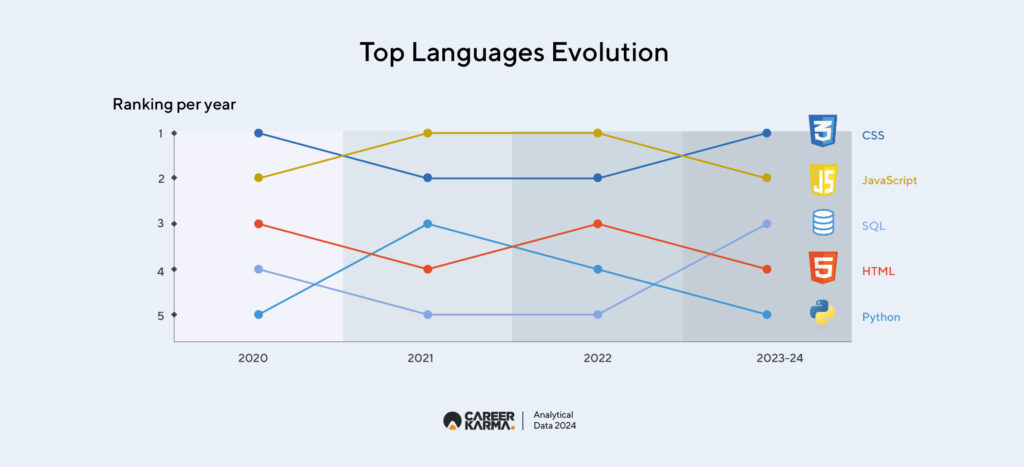

Top Skills

CSS has surprisingly overtaken JavaScript as the most learned programming language. SQL, HTML, and Python complete the top five.

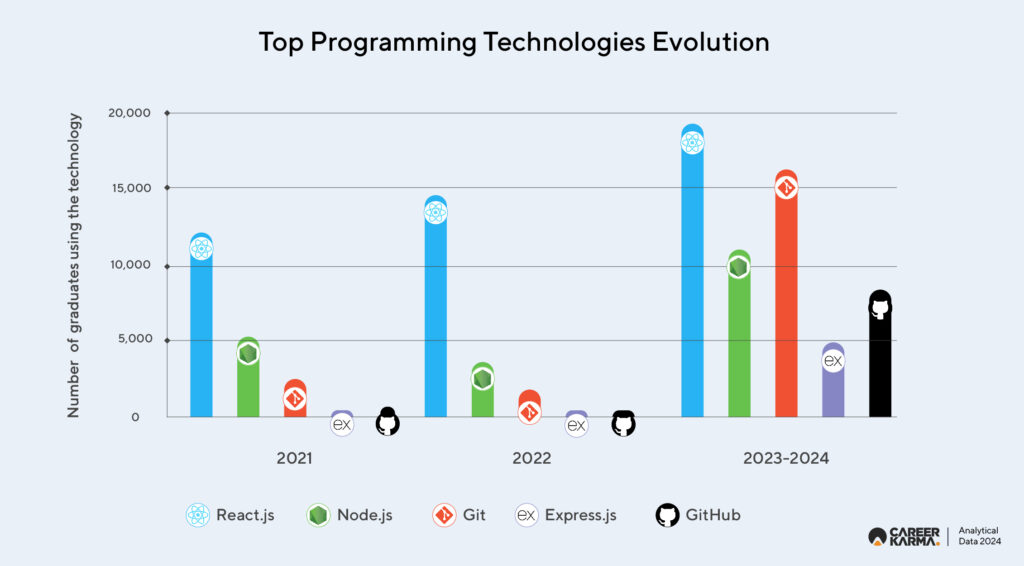

React.js remains the most popular coding technology among bootcamp graduates, maintaining its dominance in web development. Node.js, previously in second place, has been surpassed by Git, a widely used version control system. Express.js and GitHub complete the top five, highlighting the growing emphasis on collaborative development and backend frameworks.

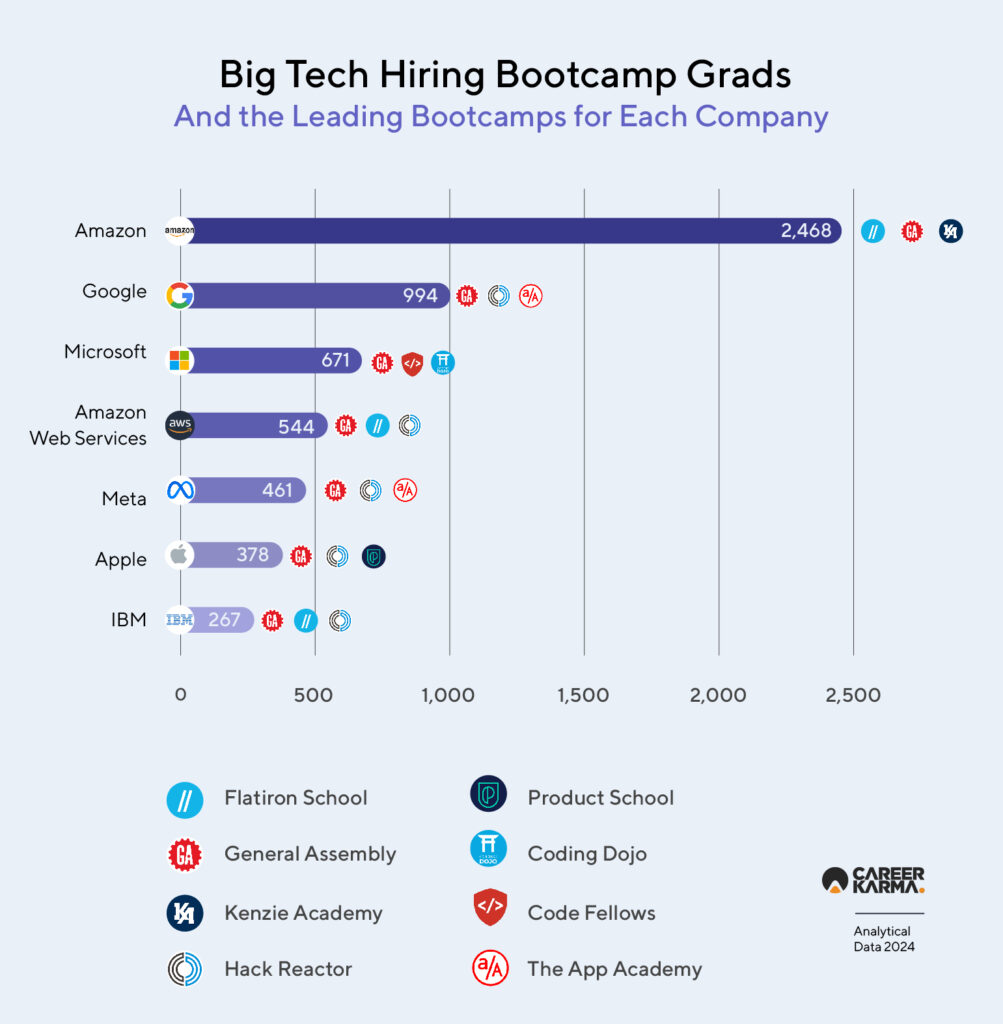

Top Employers

Big Tech continues to hire bootcamp grads, with Amazon, Google, and Microsoft among the top employers. Interestingly, many bootcamp providers themselves, such as Springboard, Le Wagon, and Tech Elevator, are also major employers, indicating that graduates are often hired as instructors.

Methodology

For the purposes of this study, extensive data was collected from two primary sources:

- LinkedIn for alumni data: Information on the number of graduates for each coding bootcamp, as well as alumni graduation year, place of residence, current employer, skills, and field of study, was gathered from LinkedIn.

- Bootcamps’ official pages for tuition data: Data on tuition and financing methods was collected manually by visiting each school’s official website.

For each source, a different list of bootcamps was used. For the LinkedIn data, we used the same list of bootcamps as in our previous reports. This was necessary to draw meaningful conclusions about the current size and evolution of the market. This list includes 128 tech bootcamps.

However, for tuition-related information, we used a different list to reflect the most relevant players in the industry. To create this second list, we were fortunate to have the counsel of Career Karma’s in-house bootcamp experts. We also considered the volume and quality of student reviews. This second list includes 110 schools. Both lists can be found in Appendix A.

To provide context for our data, a wide range of secondary sources was consulted. We relied primarily on Crunchbase for bootcamp-related financial data, as well as on sites like Technical.ly, and TechCrunch for news and market analysis.

Overview of the Market in 2024

The bootcamp industry continues to experience robust growth post-pandemic, defying predictions from analysts who anticipated a drop in demand once companies lifted Covid-19 restrictions and resumed in-office work. This resilience underscores a sustained appetite for technical skills across sectors.

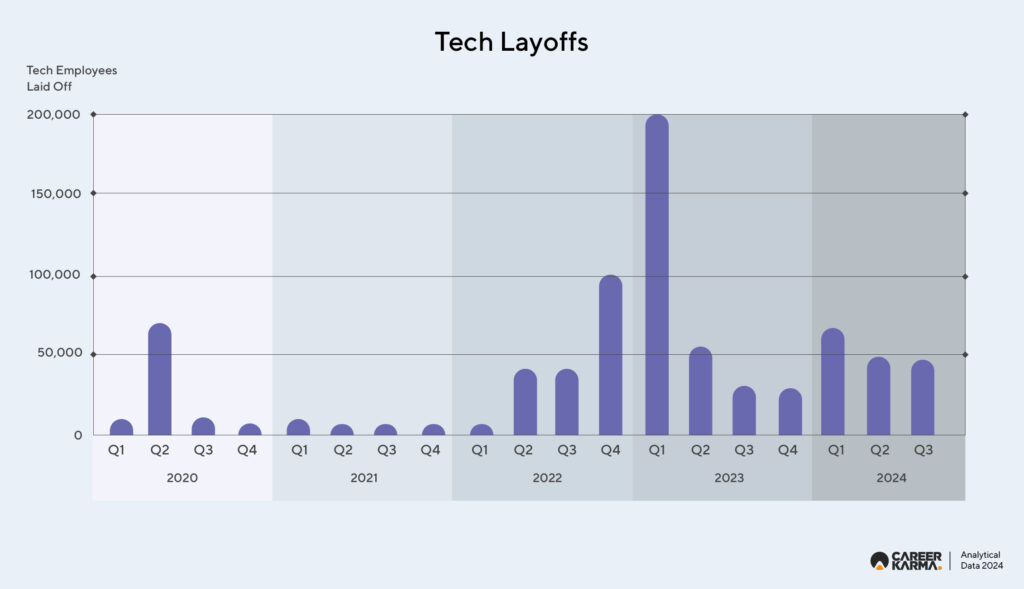

Though the pace of growth plateaued in 2021 and 2022 as the graph above suggests, it picked up momentum again in 2023 even amid a sharp increase in the number of layoffs in the tech industry. This resurgence is the result of both sustained demand for tech-related roles as well as the ability of bootcamps to adapt to a changing market.

"Career Karma entered my life when I needed it most and quickly helped me match with a bootcamp. Two months after graduating, I found my dream job that aligned with my values and goals in life!"

Venus, Software Engineer at Rockbot

Overall, we expect the industry to be worth $826.3 million by the end of 2024. This lands on the conservative end of a wide spectrum of projections. Here are what major research firms project:

- Expert Market Research estimates the industry to be worth $2.1 billion in 2023 and to grow at a rate of 17.3% between 2024 and 2032.

- Verified Market Research places its value at $899 million in 2023 and predicts that it will grow at a rate of 15% between 2024 to 2030.

- Coherent Market Research estimates the value at $556.2 million in 2024 and believes it will expand at 14.1% 2024 to 2030.

For an explanation of why our numbers are conservative, see Appendix A.

Growth in Student Enrollment

Alongside market growth, student enrollment in bootcamps has also surged. The number of students graduating from coding bootcamps grew by 12.17 percent from 2022 (58,756 graduates) to 2023 (65,909 graduates).

In 2024, this upward trend continues. Between January and June, 34,588 students graduated from coding bootcamps. Based on these figures, we project that by the end of 2024, approximately 69,176 students will have graduated from a major coding bootcamp.

If our projection holds up, the all-time coding bootcamp alumni population will reach 427,670 by the end of the year. In this scenario, 2023 and 2024 combined would account for 31.6 percent of the entire alumni body since the inception of the industry in 2012.

Top Trends 2023–2024

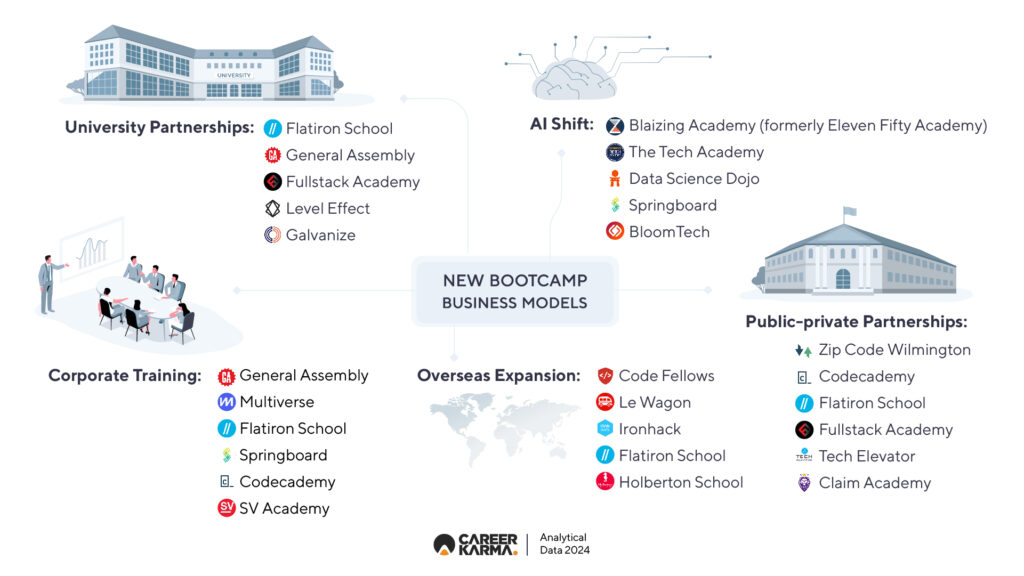

The past two years have brought fundamental changes to the bootcamp industry. Key trends include:

- Rise of Artificial Intelligence: The adoption of AI tools like those based on Large Language Models (LLMs) has spurred bootcamp providers to create new AI-focused programs, add machine learning topics to their curricula, and enhance the learning experience with new tools such as AI chatbots.

- Embrace of remote and hybrid formats: Our research shows that only 9.91 percent of tech bootcamps can be considered “primarily in-person” in 2024. Back in our 2020 report, we noted that only 13 of the 105 bootcamps we studied offered online options. Now online options are nearly universal.

- Bootcamp-University Partnerships: Academic partnerships are becoming more common as bootcamps seek to boost credibility and reach more students. Fullstack Academy, for example, now boasts over 100 such collaborations.

- Corporate Training: An increasing number of bootcamps are establishing enterprise divisions to train company workforces, signaling a significant shift toward B2B services.

- Public and Nonprofit Partnerships: Bootcamps are forming alliances with governments and nonprofits to make their programs accessible to broader demographics.

- Stackable Credentials: A noticeable trend in education has been the addition of “micro-qualifcations” to a provider’s offer. These qualifications “stack” on top of each other to build towards a larger credential, such as a degree.

Navigating Strong Headwinds

The macroeconomic environment has presented serious challenges that bootcamp providers have had to navigate. They include:

- Tech layoffs: A surge in layoffs peaked in early 2023.

- Job market pressures: A perceived scarcity of tech roles has intensified competition.

- Challenges from Massive Open Online Courses (MOOCs): Providers of MOOCs are expanding their offer with micro-credentials and partnering with employers to focus on entry-level skills, attracting students who could potentially be interested in a bootcamp.

Some major industry brands have succumbed to these pressures. These are some of the schools that have closed in 2023 and 2024:

- Kenzie Academy

- Code Fellows

- Rithm School

- Momentum

- Codeup

Most notably, 2U, the parent company of Trilogy Education, recently announced a strategic shift away from traditional bootcamps toward shorter, more affordable technical courses, which they describe as “microcredentials.”

However, our research shows that bootcamps that adapted to the challenges presented above have flourished, reaping substantial rewards. In terms of an increase in the number of graduates compared to 2022, these are the schools that grew the fastest in 2023:

- Coding Temple (157.5% increase in graduates)

- Operation Spark (69.2%)

- Holberton School (56.9%)

- Savvy Coders (56.8%)

- 4Geeks Academy (55.7%)

Drivers of Growth

Despite the less-than-ideal macroeconomic situation, the bootcamp industry is expected to continue expanding in coming years supported by the following key drivers:

- Societal adoption of technologies such as artificial intelligence, machine learning, and blockchain and ballooning demand for skills needed to develop solutions using these advancements.

- A strong demand for tech roles, including web developers, software engineers, and other key positions. According to the U.S. Bureau of Labor Statistics, these roles are expected to grow at a rate above the national average.

- The flexibility inherent to the bootcamp model. Flexible learning formats tailored for busy professionals seeking to upskill are in high demand, especially as coding technologies evolve rapidly.

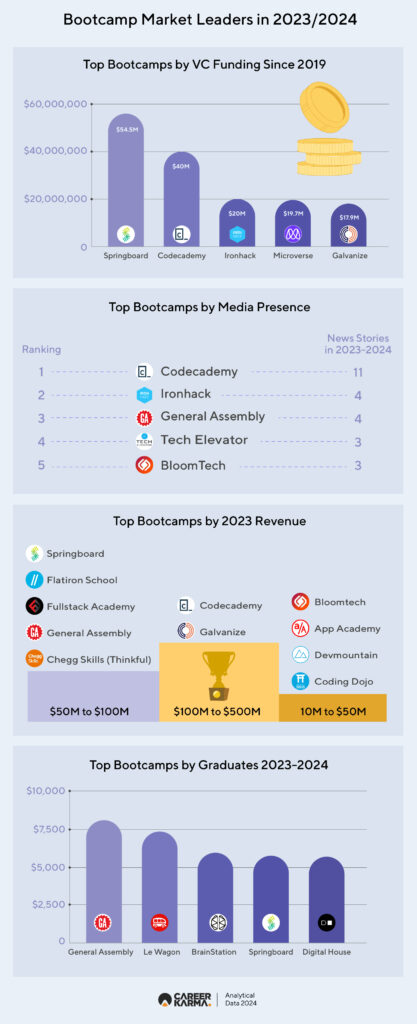

Top Players

The most relevant players in the coding bootcamp industry include several established players, most of which have been around for several years. Based on factors such as venture capital raised since 2023, the total amount raised since inception, 2023 revenue figures, and media coverage, we have determined that the leading bootcamps in 2024 are:

- App Academy

- Bloom Institute of Technology (BloomTech)

- Codecademy

- Devmountain

- Flatiron School

- Fullstack Academy

- Galvanize

- General Assembly

- Springboard

- Zip Code Wilmington

Based on data from Crunchbase, the biggest bootcamps by revenue in 2023 were Codecademy and Galvanize, with annual revenues ranging between $100 million and $500 million. Other notable players include BloomTech, App Academy, Devmountain (recently acquired by Hackbright Academy), and Coding Dojo, with revenues ranging between $10 million and $50 million.

In terms of funding raised since January of 2023, BloomTech leads with $14.6 million, followed by Springboard at $12.5 million, and Zip Code Wilmington with $160,000.

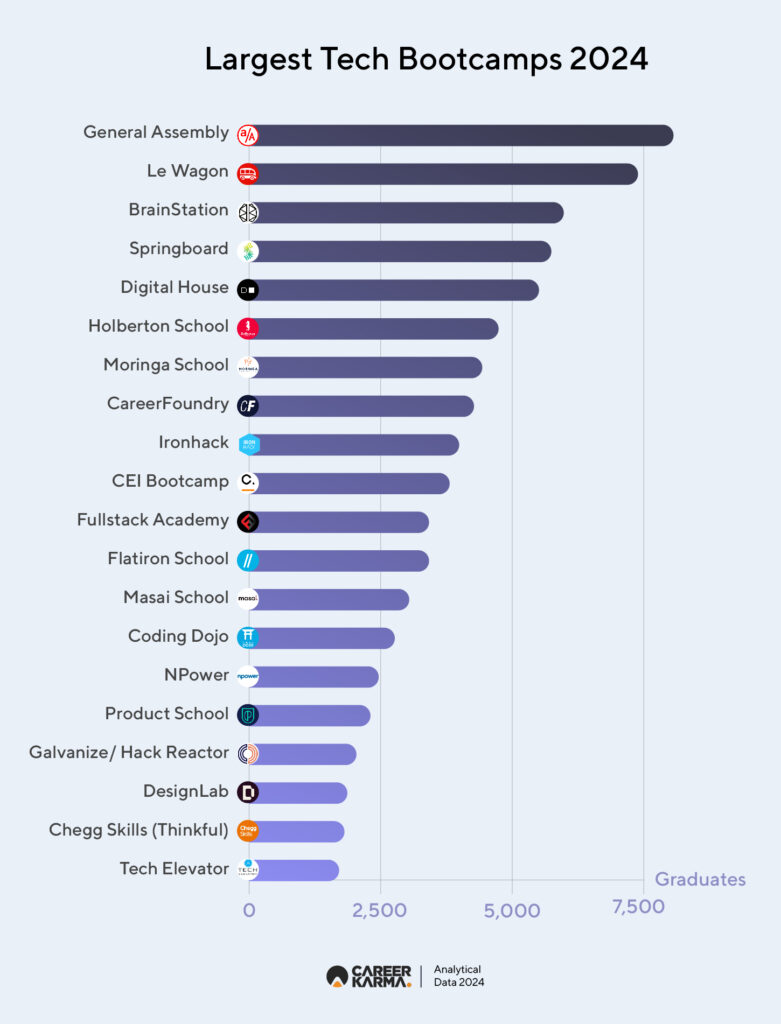

Top Bootcamps by Number of Graduates

Our top 20 of the largest tech bootcamps features many of the same names that made the list in 2023, but also some new additions.

General Assembly tops the list once again while Springboard goes down three spots to number four. Some of the other bootcamps that moved down in our list are Chegg Skills (Thinkful) falling 11 spots and Hack Reactor, falling 8 spots.

The bootcamp that made the biggest improvement are Holberton School, climbing six spots, and BrainStain, climbing three spots to number two. Both of these schools have focused on expansion, with Holberton penetrating Azerbaijan and France recently, and BrainStation building new campuses in New York and London.

Fastest Growing Bootcamps

| Coding Bootcamp | Year Founded | All-Time Alumni | Percentage of All-Time Alumni Who Graduated in 2023 or 2024 |

|---|---|---|---|

| Holberton School | 2015 | 5,823 | 82.45% |

| Coding Temple | 2015 | 941 | 77.26% |

| Moringa School | 2014 | 7,181 | 62.07% |

| Divergence Academy | 2014 | 915 | 59.56% |

| Altcademy | 2016 | 421 | 58.19% |

| Savvy Coders | 2015 | 439 | 56.26% |

| CEI Bootcamp | 1991 | 6,930 | 56.05% |

| NPower | 2001 | 4,639 | 53.89% |

| 4Geeks Academy | 2015 | 1,116 | 53.05% |

| Bethel Tech | N/A | 667 | 52.62% |

We can derive several key lessons from the list of the fastest-growing bootcamps.

First, adaptability to market needs, a focus on rapid skill acquisition, and clear pathways to employment are essential strategies for growth. While all the bootcamps on the list exhibit these traits, Savvy Coders and Divergence Academy stand out in these areas due to their emphasis on job-ready training and employment-focused programs.

Second, the rising demand for remote and self-paced learning is evident, with Microverse and Altcademy leading the way in providing accessible, flexible, and scalable education solutions. This highlights the importance of leveraging technology to reach a global audience.

Additionally, having a well-defined niche can be a game-changer. Code Platoon, which caters specifically to veterans, and Bethel Tech, with its focus on Christian values, demonstrate that aligning programs with the unique needs of specific communities can foster loyalty and drive growth.

Another crucial takeaway is the importance of forming partnerships with governments and non-profits to expand access to education. NPower is a prime example, leveraging collaborations with organizations like Ascendium Education Group, the Bob Woodruff Foundation, and the US Department of Labor to reach underserved populations and secure sustainable funding.

These lessons underscore the diverse approaches that bootcamps can adopt to scale effectively while meeting the evolving demands of students and employers.

Bootcamp Costs and Financing

In 2024, the average tuition for a coding bootcamp in North America stands at $13,274. This is just slightly higher than the number in our 2023 report, indicating that bootcamp prices have remained relatively stable. Operating in a tougher economic climate with heightened competition for tech roles, it is little surprise that bootcamp providers have been hesitant to raise tuition significantly.

Tuition Costs by Main Focus of Bootcamp

| Main Bootcamp Focus | Number of Bootcamps | Mean | Median |

|---|---|---|---|

| Coding (web development or software engineering) | 95 | $13,274 | $13,495 |

| Non-coding (data science, cyber security, UX/UI design, product management) | 15 | $9,185 | $8,124 |

| All bootcamps | 110 | $12,570 | $12,995 |

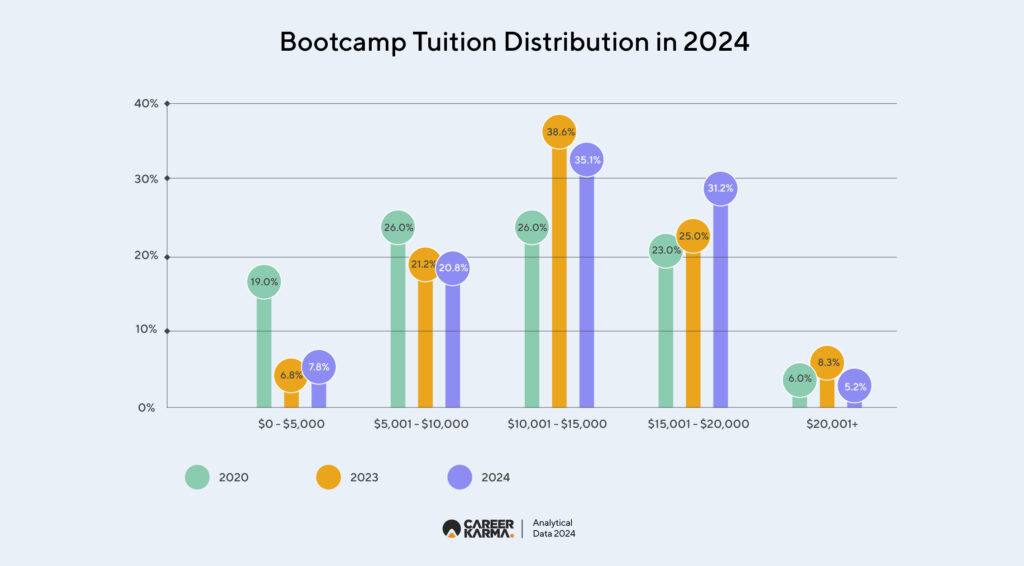

Most coding bootcamps are in the third and fourth tuition brackets (out of five), with two-thirds of providers pricing their programs between $10,000 and $20,000. The most notable change from 2023 is a six percent increase in the $15,001–$20,000 category, balanced by evenly distributed decreases in the $10,001–$15,000 and $20,000+ categories.

Overall, compared to 2023, there are no major shifts, suggesting that the industry has matured and prices have stabilized. The only visible trend is a shift toward higher-cost bootcamps, despite a moderate decline in the percentage priced above $20,000.

Coding Bootcamp Tuition by Scheduling Format

| Coding Bootcamp Format | Number of Programs | Mean | Median |

|---|---|---|---|

| All Formats | 82 | $13,274 | $13,495 |

| Full-time | 41 | $14,604 | $14,825 |

| Part-time | 34 | $12,116 | $12,450 |

| Self-paced | 3 | $8,662 | $8,500 |

| Subscription | 4 | $249 | $149 |

As expected, full-time programs are the most expensive option when it comes to scheduling format. This, however, is not always the case, as some schools charge more for part-time programs because they last longer, allowing students extended access to school resources.

The difference in cost between full-time and part-time programs is increasing, from $2,011 in 2023 to $2,488 in 2024. This may signal a strategy among providers to differentiate both options and target people with a busy schedule who can only commit to part-time programs.

It’s also interesting that the mean and median of full-time programs are very close. This tells us that most prices cluster around the center, with few outliers. It could suggest that bootcamps are pricing themselves similarly, a sign that the market has achieved a certain level of maturity.

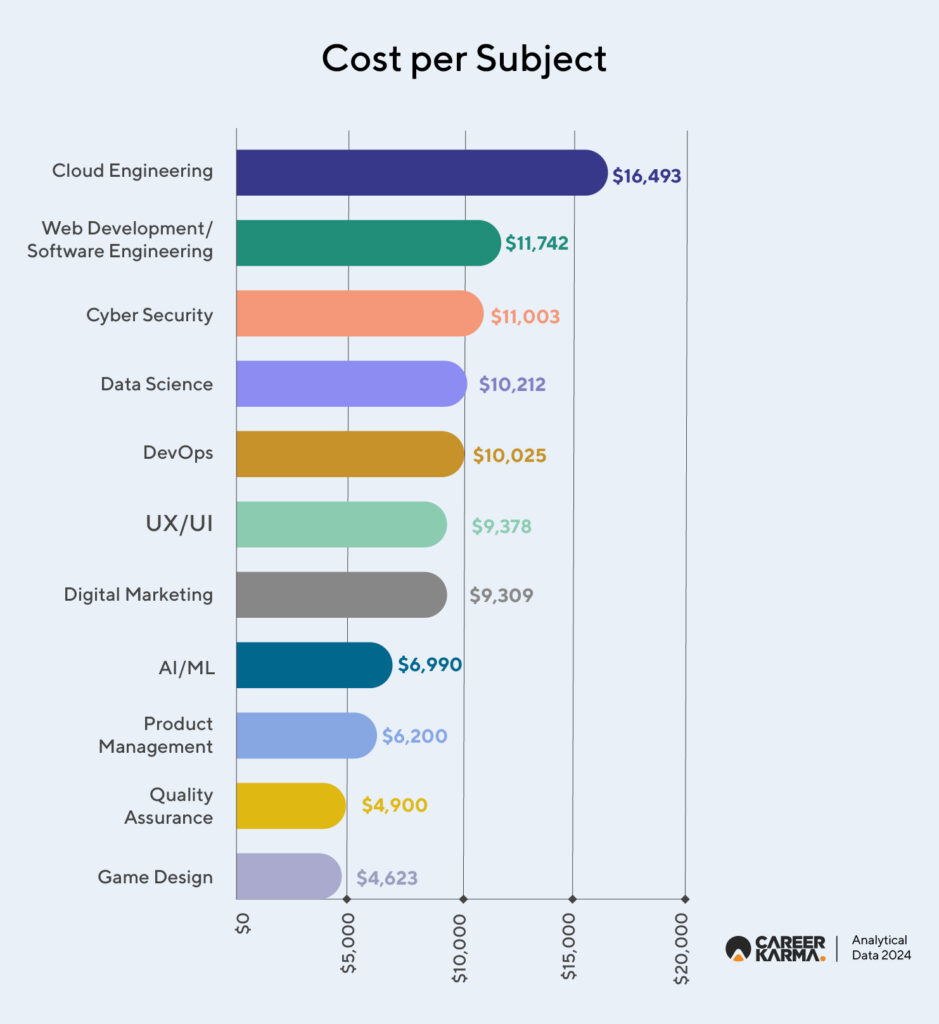

Cost vs Subject

It’s no surprise that bootcamps teaching skills required for high-salary roles with strong job prospects come with a higher price tag. We see this with cloud engineering, software engineering, cyber security, and data science, some of the best-paid fields in tech.

However, demand alone isn’t the only factor influencing pricing. Curriculum complexity, program length, and perceived return on investment play just as significant a role.

An interesting exception to this trend is product management bootcamps. Although product manager bootcamps are among the least expensive, product managers earn an average of $156,580 per year according to the Bureau of Labor Statistics. This is more than both software engineers and cyber security specialists.

Artificial intelligence (AI) and machine learning (ML) bootcamps are some of the least expensive programs today. This might seem surprising given the hype and demand for AI-related skills. The reason may lie in the fact that many programs in our sample focus on AI only tangentially, with the main emphasis on another field. Examples include Data Analytics with AI, Artificial Intelligence Product Certification (AIPC), and AI for Visual Design.

Market saturation may also be at play. With so many free or low-cost resources available to learn AI-related tools, from online courses to open-source tools, bootcamp providers may feel they need to keep prices low to attract customers.

Trends in Bootcamp Financing and Affordability

| Financing Option | Percentage of Bootcamps |

|---|---|

| Upfront payment | 82% |

| Installment plans | 58% |

| Loan financing | 53% |

| Scholarships | 36% |

| Deferred tuition | 21% |

| GI Bill | 16% |

| Employer sponsorship | 8% |

| ISA | 5% |

Compared to previous reports, the number of bootcamps offering income share agreements (ISAs) has dropped significantly. In 2023, ISAs were offered by 23 percent of schools; now, just 5 percent provide this option.

The decline isn’t surprising, given the controversies surrounding ISAs, such as the Consumer Financial Protection Bureau’s (CFPB) case against BloomTech this year. Over time, ISAs have gained a reputation for being potentially exploitative, which has impacted their popularity. As a result, a significant number of schools have dropped this financing option.

We also found out that around 8 percent of bootcamps advertise some sort of government assistance or public funding. The majority of these bootcamps can be partially financed through the Workforce Innovation and Opportunity Act (WIOA), a federal program designed to help job seekers who are unemployed or underemployed.

Additionally, some bootcamps receive funding from state-specific programs, such as New Jersey’s Training for Your Future Fund (TFF), the Washington State Worker Retraining Program, and the New Mexico Division of Vocational Rehabilitation (NMDVR).

Another important takeaway is that only three percent of bootcamps in our sample offer money back guarantees. The terms of money back guarantees can vary widely from school to school but generally it refers to a full refund if the student fails to secure an in-field job within a specified period of time, generally around six months. Some schools may refund the full amount while others reimburse only part of the tuition.

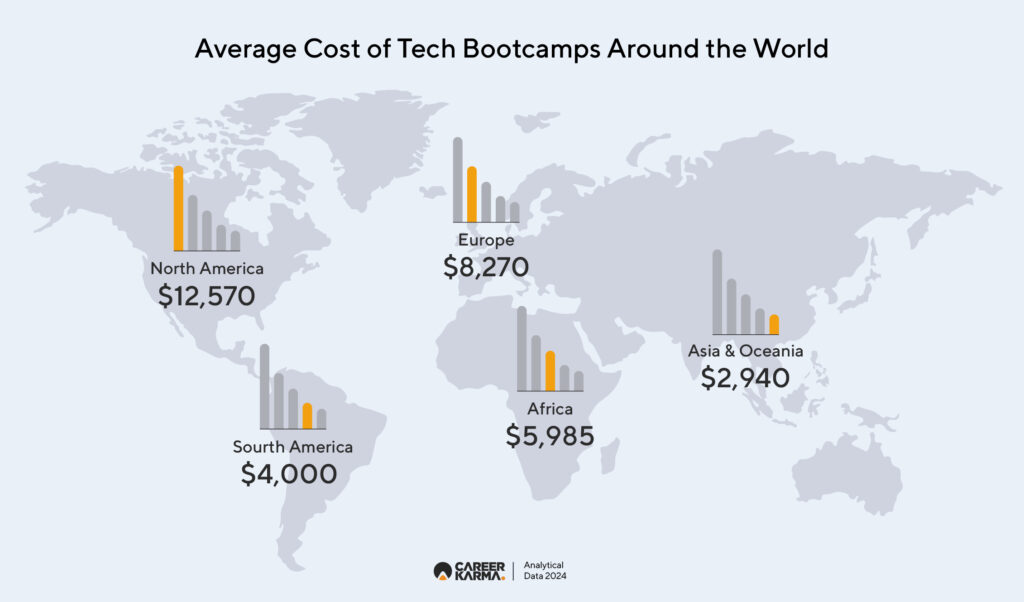

Tech Bootcamps: North America vs The World

Our sample included 110 tech bootcamps, 24 of which are based outside of North America or do not primarily target the North American market.

| Region | Average Tuition | Bootcamps in Sample |

|---|---|---|

| North America | $12,570 | 86 |

| Rest of world | $7,919 | 24 |

Although the sample size is relatively small, it is evident that tech bootcamps are significantly more expensive in North America. This comes as no surprise, given that North America represents the most mature market for bootcamps (the US being the birthplace of the coding bootcamp concept) and that the cost of living is higher here compared to other regions.

The Future of Bootcamp Financing

With ISAs gradually fading away, it’s likely that alternative financing options will emerge to replace them. These new financing tools may resemble ISAs but will drop some features considered exploitative, such as monthly repayments tied to a fixed percentage of salary.

One example is Nucamp, a bootcamp provider that offers a Fair Student Agreement (FSA), specifically promoted as not an ISA. It’s marketed as an honest and affordable alternative, with various options, including deferred payment and interest-only payments.

In fact, deferred payments and similar plans are expected to benefit most from the controversy surrounding ISAs. After all, students continue to seek ways to attend coding programs while minimizing upfront costs until they’re employed in the field.

Another shift may involve a rise in employer-sponsored bootcamps. Many bootcamps are already expanding into corporate training, and it’s a short step from there to establishing employer sponsorship programs. As bootcamps increasingly understand employer’s needs, they can develop sponsorship programs tailored to them.

As the industry matures and becomes more regulated, we’ll almost certainly see more providers achieving state or federal accreditation. This would make more bootcamps eligible for public funding. In our sample, eight percent of bootcamps already receive some type of public funding, either through the Workforce Innovation and Opportunity Act (WIOA) or state programs.

Finally, we project an increase in the number of scholarships and financial aid programs offered by bootcamps to support disadvantaged populations. Since their inception, bootcamps have redefined the tech industry’s perception of talent, contributing significantly to diversity and inclusion. Many bootcamps, such as Zip Code Wilmington and Coding Dojo, emphasize community impact alongside profitability, reflecting a commitment to social change.

This trend of providing financial aid to underrepresented minorities seeking tech careers is expected to grow. Additionally, we anticipate the emergence of more programs that charge little to no tuition, such as Ada Developers Academy, IT Works, and Founders and Coders. These institutions demonstrate how alternative funding models and mission-driven approaches can broaden access to tech education and create opportunities for those historically excluded from the industry.

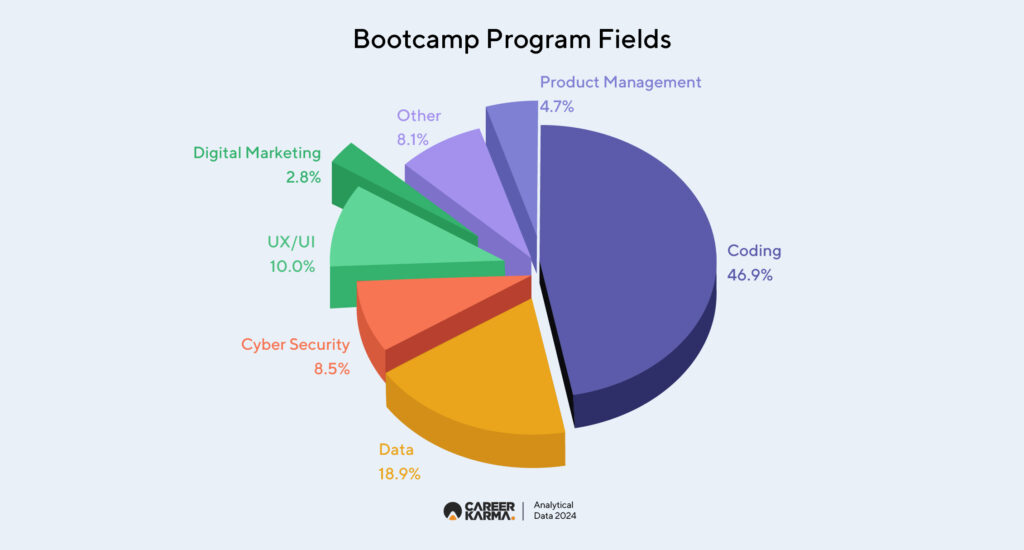

Skills Taught at Bootcamps in 2024

Coding bootcamps are celebrated for their flexibility and ability to adapt to the ever-evolving demands of employers. This adaptability is evident when we examine the tech fields that bootcamps are prioritizing in 2024:

| Tech Field | Number of Bootcamp Programs |

|---|---|

| Software Engineering/ Web Development | 110 |

| Data | 59 |

| Cyber Security | 32 |

| AI/ Machine Learning | 29 |

| UX/UI | 25 |

| Digital Marketing | 12 |

| Other | 11 |

| Product Management | 5 |

The landscape remains largely consistent with what we observed in our previous report, with one notable shift: the increased prominence of programs centered on artificial intelligence and related fields, such as machine learning, deep learning, and Large Language Models (LLMs). While these programs were a negligible part of the bootcamp offerings two years ago, they now make up over 10 percent of all programs, reflecting growing industry demand.

Top Programming Languages in 2024

For the first time since 2020, more bootcamp graduates report proficiency in CSS than in JavaScript. While the difference is small given the sample size, it may suggest a slight bias toward web design over software development in bootcamp curricula. Overall, the top five programming languages remain unchanged from our previous report.

Top Programming Technologies in 2024

| Programming Technology | Graduates |

|---|---|

| React.js | 19,416 |

| Git | 16,411 |

| Node.js | 11,129 |

| GitHub | 8,472 |

| Express.js | 5,028 |

| MySQL | 4,318 |

| MongoDB | 4,282 |

| Redux.js | 3,311 |

| Ruby on Rails | 2,660 |

| jQuery | 2,605 |

React.js continues to dominate bootcamp curricula, taking the top spot for the fourth consecutive year. Notably, its popularity has grown by a staggering 116% compared to 2023, ensuring its prominence in 2025 and beyond.

For the first time, Git has overtaken Node.js in the number two spot, signaling an increasing emphasis on teamwork and collaboration skills in bootcamp programs. Other technologies like MySQL, MongoDB, Redux.js, Ruby on Rails, and jQuery round out the top ten.

Top Specialties After Graduating from Bootcamp

Bootcamp graduates pursue a diverse range of roles, reflecting the broad scope of bootcamp programs. While many work in traditional tech roles like engineering or IT, others branch into fields such as business development, media and communications, and marketing.

| Top Work Fields for Bootcamp Graduates | % of Graduates |

|---|---|

| Engineering/ IT | 25% |

| Operations | 9% |

| Business Development | 8% |

| Arts and Design | 6% |

| Education | 6% |

| Media and Communication | 6% |

| Sales | 5% |

| Customer Success and Support | 5% |

| Marketing | 5% |

| Research | 4% |

Fastest-Growing Non-Programming Hard Skills

| Skills | Growth |

|---|---|

| Technical Support | 9,000% |

| Data Visualization | 5,847% |

| Agile Methodologies | 4,164% |

| Machine Learning | 715% |

| Data Analysis | 632% |

Data-related skills are experiencing rapid growth, driven by the increasing demand for data analysts and data scientists, fields with some of the brightest job prospects today. Unsurprisingly, machine learning has emerged as a key skill, reflecting the current surge in interest in artificial intelligence-driven solutions.

Top Soft Skills in 2024

In their efforts to develop well-rounded, highly employable tech professionals, coding bootcamps often include soft skills training in their curricula. Collaborative projects and pair programming are common features, and many bootcamps also offer lessons or workshops focused on networking and teamwork. Below are the most common soft skills reported by bootcamp graduates.

| Skills | Graduates |

|---|---|

| Communication | 15,894 |

| Leadership | 12,966 |

| Teamwork | 12,521 |

| Problem Solving | 10,504 |

| Analytical Skills | 2,871 |

| Management | 2,515 |

Top Bootcamp Employers and Employment Trends in 2023-24

Ultimately, the true benchmark for a bootcamp’s success lies in the job outcomes of its graduates. Do these intensive programs effectively lead to employment in the current tech job market?

To explore this, we analyzed hiring data from LinkedIn to identify top employers of bootcamp graduates in 2024. This approach highlights hiring trends, offering insight into which organizations are investing in bootcamp graduates.

| Company | Number of Bootcamp Graduates Hired |

|---|---|

| Amazon | 2,468 |

| JPMorganChase | 1,208 |

| 994 | |

| Springboard | 953 |

| Le Wagon | 900 |

| Accenture | 743 |

| Microsoft | 671 |

| Tech Elevator | 557 |

| Mercado Libre | 555 |

| Amazon Web Services (AWS) | 544 |

| Meta | 461 |

| Walmart | 428 |

| Apple | 378 |

| Microverse | 298 |

| PNC | 288 |

| Nashville Software School | 280 |

| US Army | 278 |

| Deloitte | 278 |

| IBM | 267 |

| Salesforce | 236 |

| Devmountain | 224 |

| Globant | 222 |

Bootcamp graduates continue to make strides in the job market. However, the data for 2024 reveals several emerging trends, signaling a broader shift in how industries see bootcamp-trained talent.

Traditional Tech Companies Lead the Way but Are Not Alone

Amazon remains the top bootcamp employer, having increased its hires from 1,077 in 2021-22 to 2,468 in 2024, a 129 percent growth. Meanwhile, Apple hired only 48 graduates in 2021-22, compared to 378 in 2024, showing growth but remaining modest compared to tech giants like Amazon or Google.

That said, the appetite for bootcamp-trained talent has spread to sectors beyond technology, highlighting the broader applicability of bootcamp skills beyond traditional tech roles. Industries such as finance, healthcare, and consulting, represented by companies like JPMorgan Chase, Deloitte, and Accenture, and even the military (US Army) are actively tapping into bootcamp talent to support their tech-driven efforts.

Latin America as a Talent Hub

Bootcamps with strong presence in Latin America, like Holberton School and Digital House, are gaining traction, with regional employers such as Mercado Libre and Globant actively hiring their graduates. This trend suggests that Latin American companies prioritize local bootcamp graduates to support their regional digital transformation initiatives.

Legacy Bootcamps Maintain Dominance

From the bootcamp outcomes perspective, legacy bootcamps Flatiron School, General Assembly, and Galvanize’s Hack Reactor remain consistently dominant across both time periods, frequently listed by big tech companies. Their consistent presence among top employers like Amazon, JPMorgan Chase, and Accenture highlights their ability to provide industry-relevant training and build strong employer networks.

These trends demonstrate both the growing acceptance of bootcamp credentials and the challenges graduates face in navigating the current job market.

Rise of Self-Employment

Self-employment was not explicitly tracked in the 2021-22 data but has become a significant pathway in 2024, with 1,982 bootcamp graduates pursuing freelance, entrepreneurial, or consulting roles.

This self-employment trend might reflect the following:

- The flexibility and remote opportunities enabled by the gig economy have allowed bootcamp graduates to offer their skills on project-based or contract terms to multiple clients. For companies, this means access to a flexible, skilled workforce without committing to full-time hiring.

- That said, the rise in self-employment could also indicate challenges in securing traditional full-time roles, as some graduates use freelancing as an interim step while navigating a competitive job market.

What This Means for Bootcamps and Students

For prospective bootcamp students, the above trends highlight the following considerations:

- Tech Industry Opportunities. Bootcamps remain an alternative pathway into the tech industry. Enrolling in bootcamps with solid connections to companies that consistently support bootcamp talent, like Flatiron School, General Assembly, and Galvanize’s Hack Reactor, can be a strategic choice to enhance their chances of landing opportunities with these employers.

- Specialized Training for Non-Tech Sectors. Students interested in exploring opportunities outside traditional tech roles, such as finance, consulting, or healthcare, should consider bootcamps offering specialized tracks in fields like fintech, data analytics, or cloud computing. These programs align with industries undergoing digital transformation and can open doors to diverse career paths.

- Regional Opportunities in Latin America. For students targeting roles in Latin America, choosing bootcamps with strong regional networks, such as Holberton School or Digital House, can provide a distinct advantage.

The 2024 trends also offer several key takeaways for bootcamps aiming to deliver strong student outcomes:

- Stronger Employer Partnerships. Partnerships with major employers like Amazon, Google, and Accenture are essential. These companies consistently hire large numbers of bootcamp graduates, demonstrating the value of established hiring pipelines. Bootcamps should prioritize building and maintaining these relationships to secure opportunities for their alumni.

- Expand Specialized Tracks. As industries such as finance and consulting increasingly turn to bootcamp talent, bootcamps should consider diversifying their offerings. This approach can attract a wider range of students while aligning with the needs of the job market.

- Regional Growth Opportunities. Regional expansion is another key area of growth. Bootcamps can emulate the success of Holberton School and Digital House by tailoring their curriculums to local markets and building strong networks with regional employers to create new opportunities for their graduates.

2024 Geographic Data for Coding Bootcamps

The 2024 geographic data for coding bootcamps highlights significant trends in the global distribution of tech talent, with a mix of established hubs, emerging markets, and decentralized growth across regions.

The insights reflect the increasing accessibility of tech education through bootcamps, the growing diversity of talent locations, and the evolving priorities of tech ecosystems worldwide.

Top North American Cities for Bootcamp Students in 2024

| Top North American Cities | Bootcamp Graduates |

|---|---|

| New York City Metropolitan Area | 10,620 |

| Los Angeles Metropolitan Area | 7,098 |

| Greater Seattle Area | 5,145 |

| San Francisco Bay Area | 5,142 |

| Washington DC-Baltimore Area | 3,916 |

| Greater Chicago Area | 2,948 |

| Denver Metropolitan Area | 2,296 |

| Dallas-Fort Worth Metroplex | 1,855 |

| Portland Metropolitan Area | 1,677 |

| Greater Toronto Area | 1,384 |

With 10,620 graduates, the NYC Metro Area remains North America’s top hub for bootcamp graduates, growing by 1,801 graduates compared to 2023. New York’s tech ecosystem benefits from a range of industries, including fintech, media, and e-commerce, supported by major employers like Google, Meta, and many startups. The city’s proximity to Wall Street further enhances its appeal for bootcamp graduates specializing in data analysis and cyber security.

The Los Angeles Metropolitan Area saw a massive surge with 7,098 graduates (+4,995), solidifying its position as a major tech market. This growth is driven by the fusion of entertainment and technology alongside a thriving startup culture, especially in regions like Santa Monica and Venice Beach. Bootcamps in Los Angeles can take advantage of this momentum by introducing specialized tracks focused on entertainment-related tech fields, such as AR/VR, game development, and digital media production.

The Greater Seattle Area experienced a similar spike, with 5,145 graduates (+4,458). This rise is likely driven by the presence of major tech companies like Amazon and Microsoft, which dominate the city’s tech landscape.

In comparison, the San Francisco Bay Area recorded 5,142 graduates (+2,430). While it remains a leading player in the tech sector, its growth has been steady rather than explosive, possibly due to the high cost of living in the area.

On that note, cities like Denver (2,296 graduates) and Salt Lake City (1,053 graduates) are emerging as tech-friendly alternatives to traditional hubs like San Francisco and New York. These cities draw talent due to their lower living costs, increasing employer demand, and strong quality-of-life features, making them particularly appealing to younger professionals.

For individuals considering enrolling in a bootcamp, exploring opportunities in cities outside the traditional tech hubs is a worthwhile option. These locations often present less competition while experiencing rapidly growing job opportunities. Choosing specialized bootcamps that align with regional industries, such as fintech in New York or clean tech in Denver, can provide a significant advantage and ensure compatibility with local job market demands.

Top US States for Bootcamp Students in 2024

| Top US States | Bootcamp Graduates |

|---|---|

| California | 10,814 |

| Texas | 10,046 |

| New York | 8,629 |

| Florida | 4,820 |

| Colorado | 4,092 |

| Washington | 3,954 |

| Illinois | 3,351 |

| New Jersey | 1,951 |

| Pennsylvania | 1,718 |

| Oregon | 1,517 |

| Arizona | 1,458 |

| Utah | 1,124 |

| Georgia | 1,120 |

| Kansas | 997 |

Thanks to Silicon Valley and Los Angeles, California (10,814 graduates) remains the epicenter for coding bootcamps. However, its high costs and changing work preferences from in person to remote are allowing other states to close the gap. For example, Texas, with 10,046 graduates, is quickly catching up, bolstered by Austin’s growth as a major tech hub and the affordability of cities like Dallas and Houston.

Colorado (4,092 graduates) is also emerging as a regional hub, with Denver at the forefront. The city offers a high quality of life and lower costs compared to coastal cities, and it has a focus on industries such as clean technology, healthcare IT, and data analytics, which enhances its appeal.

Florida (4,820 graduates) is making significant strides in becoming a tech-friendly state. Cities like Miami are attracting tech startups and remote workers, thanks to tax advantages and an increasingly international business climate. Similarly, Washington (3,954 graduates) continues to benefit from the presence of Amazon and Microsoft, along with a strong tech ecosystem in the Seattle area.

Top Cities and Regions Outside of North America for Bootcamp Students in 2024

| Top Non-North American Cities and Regions | Bootcamp Graduates |

|---|---|

| London Area, United Kingdom | 4,997 |

| Greater Madrid Metropolitan Area, Spain | 3,052 |

| Catalonia, Spain | 2,210 |

| Greater Rome Metropolitan Area, Italy | 1,494 |

| Greater Dublin, Ireland | 1,422 |

| Greater Munich Metropolitan Area, Germany | 1,274 |

| Lombardy, Italy | 1,193 |

| Auvergne-Rhône-Alpes, France | 1,091 |

| Paris, France | 1,033 |

| Apulia, Italy | 1,018 |

| Greater Bengaluru Area, India | 973 |

| Valencian Community, Spain | 953 |

Non-North American cities and regions reflect a rising demand for bootcamp graduates, with Europe leading the way and developing economies close behind. Bootcamps that strategically grow their presence in these areas, offer tailored programs, and target high-growth industries are well-equipped to take advantage of these new opportunities.

With 4,997 graduates, London leads non-North American cities, thanks to its thriving startup environment, close ties to global financial markets, and the presence of major tech firms bolster its dominance. Spain is also carving out a significant role in Europe’s tech education scene. Madrid (3,052 graduates) and Catalonia (2,210 graduates) stand out as key regions, attracting multinational companies looking to set up their European bases.

Looking past Europe, cities in India, Turkey, and the Philippines are rising as influential centers for bootcamp graduates, indicating the expansion of tech education in developing economies. Bengaluru (973 graduates), often called India’s “Silicon Valley,” leads this movement, backed by the country’s robust IT sector and strong focus on software development.

In the Philippines, Manila (856 graduates) is capitalizing on its affordable education system, English fluency, and an increasing emphasis on outsourcing and software services to position itself as a rising tech hub. Likewise, Istanbul (852 graduates) stands out in Turkey due to its advantageous location, which connects Europe and Asia.

Top Countries for Bootcamp Students in 2024

With 23,674 graduates, the US far outpaces other countries, reflecting its widespread adoption of bootcamps. That said, Europe and Africa show promise. In Europe, Spain (3,144 graduates) stands out as a key player, buoyed by a growing tech ecosystem in cities like Madrid and Barcelona.

In Africa, countries like Nigeria (1,515 graduates) and Kenya (911 graduates) are gaining traction. The rise in smartphone usage, the growth of e-commerce, and a thriving fintech sector fuel this growth, leading to a heightened demand for skilled tech talent across the continent.

Finally, Pakistan’s strong numbers (811 graduates) point to a rising interest in bootcamp education. This surge is likely linked to the increasing focus on remote work opportunities and the popularity of freelancing platforms, positioning bootcamp education as a gateway to the global tech market.

The 2024 geographic data for coding bootcamps reflects a rapidly evolving landscape where tech education and opportunities are becoming more decentralized and globally accessible.

Innovations in Bootcamps: Adapting to the AI Revolution

How do you teach coding in a world where AI can already write code? With the tech industry changing rapidly, coding bootcamps are taking a fresh approach to keep their graduates competitive. By combining AI skills training, hybrid learning models, and AI-driven support tools, bootcamps are preparing students for a job market where AI tools and human expertise work side by side.

Bootcamps are embracing AI

to ensure students are prepared

Shift in Skills Focus

Perhaps one of the biggest innovations in coding bootcamps is their emphasis on AI skills training. Recent research from PwC’s 27th Annual Global CEO Survey reveals that 69 percent of CEOs globally anticipate that generative AI will drive skill development needs among their workforce in the next three years.

This trend aligns with what’s being called the “GenAI Revolution” as organizations increasingly integrate generative AI tools like GitHub Copilot or OpenAI Codex to reduce the volume of “grunt work” often assigned to entry-level coders.

As AI takes on more routine tasks, many companies are moving away from traditional entry-level coding roles and toward more advanced roles where human insight and complex problem-solving are essential. The World Economic Forum’s Future of Jobs Report 2023 highlights this trend, noting how companies prioritize AI and big data in their skills strategies and plan to dedicate around nine percent of their reskilling initiatives to these areas.

To prepare learners for an increasingly AI-driven economy, coding bootcamps and platforms have updated their offerings to teach skills that complement AI rather than compete with it.

In a recent interview, Zubair Desai, Curriculum & Instruction Manager at Hack Reactor, says their curriculum now includes an introduction to GitHub Copilot so students can practice with AI tools in a real-world context.

Other bootcamps like LEARN Academy, Le Wagon, Fullstack Academy, and Springboard now offer dedicated AI-focused programs that teach skills like machine learning, big data analysis, natural language processing, and responsible AI. By doing so, bootcamps teach students how to integrate AI tools into their workflow.

While the focus of coding bootcamps has shifted to meet these technical skill demands, it’s worth noting that their programs continue to place a strong focus on soft skills development alongside technical training.

Through collaborative projects, pair programming, code reviews, and real-world capstone projects, bootcamps continue to build skills like teamwork, effective communication, and decision-making, skills less likely to be impacted by automation, adding value where AI lacks human nuance and insight.

AI Tools in Bootcamp Classrooms

The rise of AI is not only changing what bootcamps teach but also how learning happens. Hack Reactor, for instance, encourages students to use ChatGPT to prepare for job interviews by practicing responses to various questions. “We’ve found that the students who take advantage of using ChatGPT to study beforehand have an easier time getting into the interview mindset,” says Desai.

To further support students, bootcamps are integrating AI chatbots to offer instant feedback and round-the-clock support. Just last year, Flatiron School took a significant step by introducing its very own chatbot designed to “use analogies, diagrams, and code challenges, helping students better understand complex concepts and hone problem-solving skills,” the press release says.

Many bootcamps have also adopted grading tools like CodeGrade to streamline the assessment process, ensuring students receive timely feedback on their projects. This AI-driven support allows students to keep pace, especially with fast-paced programs of coding bootcamps.

However, the impact of AI goes far beyond supporting students. AI assistants are increasingly being integrated into processes across the board to boost efficiency, minimize errors, and deliver personalized experiences. For instance, TripleTen employs AI assistants to address inquiries from prospective students, while many other educational institutions leverage similar tools to streamline tasks such as recruitment, onboarding, and payroll management.

Hybrid Learning Models

Outside of AI integration, many bootcamps like General Assembly, Nucamp, and Thinkful are embracing a hybrid learning format, which blends online and in-person instruction, to cater to a wider range of students.

The hybrid bootcamp model offers the best of both worlds: flexibility and practical skill-building. Students can first learn foundational theories and concepts at their own pace online. Once they have a solid grasp of these concepts, they can apply this knowledge in person as they work through hands-on projects, workshops, and networking events.

Understandably, hybrid bootcamps typically come with a slightly higher cost than traditional in-person programs. They typically cost around $14,000, around $800 more than the average coding bootcamp, to account for added resources.

Partnerships and New Business Models

As the demand for skilled tech professionals grows, coding bootcamps are finding that partnerships with other organizations are no longer just beneficial, they’re essential for long-term growth and sustained relevance in the tech industry.

Over the past few years, several business and partnership models have emerged within the coding bootcamp industry, including:

- Collaborations with universities to lend academic credibility to coding bootcamps and extend educational resources to students.

- Government and nonprofit partnerships to increase funding sources and accessibility for underserved communities.

- Expanding from B2C to B2B has become a common strategy in recent years, with many established bootcamps opening enterprise divisions to serve the training needs of corporate partners.

- An AI shift is underway, whether that means adapting curricula to new AI-driven tools, incorporating such tools in the learning environment, or even rebranding.

- Overseas expansion to capitalize on emerging markets has been the strategy of choice of several of the bootcamps in our study.

Boosting Standards with University Partners

Coding bootcamps partnering with universities is nothing new and has given rise to what is known as “university bootcamps”. These programs offer flexible learning options for students where some classes are conducted by bootcamp instructors on university campuses, while others allow students to earn college credits that can contribute toward a degree.

Fullstack Academy’s partnership with 17 universities, such as the University of San Diego, University of Michigan, and Colorado State University, is a great example of this trend.

Another bootcamp, Level Effect, which specializes in cyber security training, also offers instruction to those pursuing roles as SOC Tier 1 and 2 Analysts. The program carries 59 college credits, which students can apply to a Bachelor of Science degree at Purdue University Global.

Even more, universities are increasingly partnering with online course providers such as Trilogy Education Services/edX, Promineo Tech, and ThriveDX to offer bootcamp programs through universities’ continuing education departments. Other universities are launching their very own bootcamps, such as Wake Tech. In August, Wake Tech announced the launch of a cyber security bootcamp with the support of the National Science Foundation (NSF).

By embedding bootcamp programs within a university ecosystem, the hope is that learners gain more access to resources, with the university affiliation potentially adding weight to their resumes and improving their job prospects. For bootcamps, these partnerships extend their reach, increase enrollments, and boost their credibility, especially among students who may be wary about independent bootcamps.

Driving Inclusion with Public-Private Partnerships

In an effort to make their services more accessible and appeal to a larger market, coding bootcamps have also ventured into partnering with nonprofits and government entities, bridging opportunity gaps present in traditionally underserved communities in the tech industry.

A notable example is Zip Code Wilmington’s “Break Into Tech Scholarship” initiative, funded by a $4.5 million grant from the state of Delaware. Recognizing the need to support local economic growth and uplift low- to middle-income residents, Zip Code Wilmington is reskilling over 200 Delaware residents between 2022 and 2025 with free training in Java development, data analysis, and data engineering.

By reskilling Delaware residents, the program lays the groundwork for graduates to potentially become local entrepreneurs or work high-paying tech jobs and contribute to the state’s growing tech ecosystem. For Zip Code Wilmington, this partnership solidifies its reputation as a catalyst for tech talent and entrepreneurship in the region.

Similarly, the career exploration app Black Genius Academy, launched in 2023 through a partnership between Career Karma and Google’s Tech Equity Collective (TEC), takes aim at racial equity in the tech workforce. Targeted specifically at aspiring Black tech professionals, this app provides free career navigation coaching and resources while giving users the chance to apply for and secure full-tuition grants with bootcamps such as App Academy and Hackbright Academy. Although TEC is not a nonprofit, its social impact mission aligns with those of nonprofits, working to address systemic racial inequities in the industry.

Here are a few more recent examples of partnerships with non-profits and private industry players that illustrate the trend:

- In October 2024, Skillsoft’s Codecademy started collaborating with the private nonprofit Mark Cuban Foundation (MCF) to offer free AI and coding education to underserved high school students.

- General Assembly and Adobe launched the Creative Skills Academy, a free program that provides top-tier training in marketing and creative skills to members of underserved communities.

- In January, Tech Elevator joined forces with Tech Impact to offer tuition-free courses for Delaware residents.

- Flatiron School partnered with VMware to train military personnel for engineering roles.

- Fullstack Academy started working with CyberUp to facilitate cyber security apprenticeships.

- The Scottish digital skills academy CodeClan joined forces with Flatiron School to deliver its offerings through Flatiron School’s remote learning platform.

Through these strategic partnerships, coding bootcamps are not only achieving their business goals but also driving significant social impact in the tech industry.

Expanding from B2C to B2B

Several bootcamps have pivoted toward corporate training. Notable examples include General Assembly, Flatiron School, and Multiverse, each of which has an enterprise division offering custom training solutions. Corporate training presents an excellent opportunity for bootcamps to build long-term partnerships with companies, which can lead to consistent revenue and insulate bootcamps from fluctuations in individual student enrollment.

With a shrinking pool of potential students and declining employer-sponsored training programs, coding bootcamps should consider expanding into the B2B market. As companies increasingly seek efficient, targeted training solutions to upskill or reskill their workforce, bootcamps are presented with a lucrative opportunity to fill this gap. In an environment where tech skills need frequent updating, bootcamps’ ability to adapt their curricula quickly provides a unique value to employers looking for flexible, industry-aligned training options.

For instance, bootcamps that focus on specialized fields like data engineering or AI can become go-to partners for companies in need of ongoing skills training to stay competitive. Moreover, B2B collaborations may open doors for bootcamps to offer apprenticeships or internships in tandem with employers. This approach not only creates clear pathways for students to secure employment but also addresses the hiring demands of companies.

The Future of the Bootcamp Model: Challenges and Opportunities

In 2024, a turbulent tech job market continues to challenge bootcamp graduates as they navigate an industry still reeling from unprecedented layoffs. In 2023, big tech layoffs peaked, with 264,220 employees let go (a 59.87 percent increase from the previous year), creating intense competition in the job market.

Many job-seeking graduates spend months in the hiring process, which has affected bootcamps’ ability to attract new students given the lower certainty of immediate job placement in the industry.

Bootcamps must adjust to this new employment landscape by diversifying their offerings beyond traditional development roles and aligning with emerging tech fields where demand is growing, such as AI and cyber security.

Challenges from MOOCs

With the growth of Massive Open Online Courses (MOOCs) like Coursera and edX, coding bootcamps are encountering new challenges. While bootcamps and MOOCs offer alternatives to traditional higher education, they have historically served different student demographics and needs.

Bootcamps are traditionally geared toward adult learners and career changers, providing targeted training with a strong focus on immediate employment, often with robust career support. In contrast, MOOCs typically attract younger students looking to build skills at their own pace without the urgency of immediate job placement.

Bootcamps and MOOCs also provide unique benefits to their university partners: bootcamps bring industry connections and practical training, while MOOCs prioritize accessibility and scalability. This differentiation allows each to play distinct roles within the education ecosystem.

However, as MOOC platforms expand to offer more career-oriented products, such as “micro-credentials” and certificates, and bootcamps move toward online delivery, the line between the two is gradually diminishing.

To differentiate themselves, coding bootcamps must emphasize the immersive and highly practical nature of their programs, alongside the job search support that MOOCs still lack. This could include leaning further into stackable credentials and promoting lifelong learning opportunities.

Schools like General Assembly and App Academy have been drawing from this playbook for years, expanding their offerings to include shorter, more affordable courses and workshops. This restructuring has helped them remain competitive and a top choice for students seeking quick credentials to advance their careers.

Lifelong Learning and Stackable Credentials

Stackable credentials have emerged as one of the most transformative trends in higher education over the past five years. This approach involves accumulating smaller, modular qualifications sequentially, with each building on the one before.

The implementation of stackable credentials varies widely depending on the training provider. For instance, edX, now part of 2U, offers “MicroBachelors” that act as stepping stones to a degree. At Harvard Extension School, students can progress from a microcertificate to a graduate certificate and eventually to a master’s degree by completing an increasing number of courses.

Stackable credentials enable students to address immediate skill gaps while working toward larger educational goals. They offer an affordable, flexible way to enhance one’s skillset without requiring a long-term commitment, allowing learners to tailor their educational paths to their needs. Employers, meanwhile, benefit from a workforce that is consistently upskilling.

The trend is thriving: According to Strada Public Viewpoint research, 62 percent of Americans would prefer skills training or another nondegree option if they enrolled in a program within the next six months.

2U’s recent shift towards shorter, more affordable technical programs or “microcredentials” epitomizes this trend and is perhaps the biggest indication that winds are changing in the edtech industry. Demand for long-term, intensive training may be waning and bootcamps need to adapt by doubling down on continuous learning and leaning further into stackable credential models.

For those late to the party, the first step is to restructure their course offerings to align with leaders in the field. For example, Nucamp allows students to take courses one at a time, eventually completing a software engineering bootcamp pathway. Additionally, bootcamps can seek partnerships with colleges to integrate their programs into broader educational pathways, enabling graduates to earn credit toward a degree.

Ensuring Transparency and Accountability

The credibility of the bootcamp industry has come under scrutiny following recent scandals, most notably the case involving BloomTech. In April, the Consumer Financial Protection Bureau (CFPB) barred BloomTech from offering loans as a financing option to students due to misleading practices around Income Share Agreements (ISAs) and allegedly inflated job placement rates. Cases like this create distrust among prospective students and employers alike, underscoring the need for greater transparency.

However, the BloomTech controversy should be seen in context. The bootcamp industry is still in its early stages, having emerged just over a decade ago. As the sector grows and its players become more influential in the broader economy, it is expected that regulations will continue to evolve, providing clearer guidelines and fostering greater accountability.

In the meantime, many bootcamps are turning toward independent verification to improve transparency. The practice of using third-party verifiers to ensure accurate outcome reporting is now widespread, providing prospective students with clearer, more reliable data. This is crucial in an industry where high placement rates are a significant draw.

Another effective option is joining the Council on Integrity in Results Reporting (CIRR), a nonprofit that sets standardized guidelines for reporting job placement data. CIRR membership requires schools to meet stringent criteria for transparency and accountability to prevent misleading practices.

Finding Ways to Scale

The bootcamp model faces significant challenges with expansion. Our data indicates that only the top 18 percent of bootcamps exceed 1,000 enrolled students annually, suggesting that scaling within the existing market is challenging.

Tech bootcamps, a term traditionally associated with in-class teachings, have been meeting these scalability challenges by creating online and hybrid programs. These formats allow them to accommodate more students without overwhelming physical resources. Hybrid models may be particularly attractive for smaller schools, affording a good balance between the benefits of in-person instruction and the accessibility of online learning.

Another approach to alleviating scaling pressures is by leveraging AI assistants. A growing number of coding bootcamps are incorporating AI to manage larger cohort sizes effectively. AI assistants support students during and after lessons, complementing the efforts of instructors. From Springboard to Le Wagon, these programs utilize AI tools as virtual tutors to enhance teaching and optimize the overall learning experience.

Progress in Bootcamp Accreditation

One of the primary obstacles for bootcamps is the lack of formal accreditation, which limits their ability to compete with universities for recognition and funding. Many employers still prioritize degrees from accredited institutions over bootcamp certifications, which can deter prospective students who are seeking credentials that are widely recognized and valued in the job market.

That said, the bootcamp industry has made significant strides toward formal recognition in the last few years. In 2022, Turing School of Software & Design and NYC Data Science Academy earned accreditation, marking a significant step toward industry recognition. Outside North America, Le Wagon UK became the first bootcamp to achieve accreditation from the Chartered Institute for IT. These examples highlight a growing acceptance of bootcamp models, yet they remain the exception rather than the norm, indicating that industry-wide accreditation is still a long-term goal.

While formal accreditation would bring credibility and potentially make bootcamps eligible for federal aid, it would also require extensive, time-consuming reviews that could hinder their ability to adapt curriculum swiftly to technological advancements. Thus most bootcamps choose not to seek accreditation, prioritizing agility and placing the emphasis on practical skills over traditional credentials.

The problem is that without the access to government-backed funding options that accreditation would open, bootcamps often rely on private loans or Income Share Agreements (ISAs) to offer financing to students. However, this reliance on private funding models limits access for prospective students who come from low- to middle-income families.

As the demand for tech skills grows, adapting to these challenges will be crucial for bootcamps to sustain growth and compete as a viable alternative to traditional education.

Opportunities: Spotlight on Cyber Security and Apprenticeships

The demand for cyber security professionals in the US is high, with an estimated 500,000 unfilled roles, a figure that is only expected to rise as AI adoption increases. These cyber security roles are essential not only in tech but also across sectors crucial to national security, such as education and healthcare, where protecting sensitive data is paramount.

To meet this workforce demand, the US government recently introduced the “Service for America” initiative, designed to recruit top talent in cyber security and AI through skills-based training and apprenticeships. By promoting alternatives to traditional degrees, this initiative positions coding bootcamps as prime candidates for delivering accessible cyber security training.

Some bootcamps, such as Code Platoon, General Assembly, and Ada Developers Academy, have already incorporated apprenticeship programs that provide hands-on experience and increase employment prospects for students. With a recent federal allocation of $244 million to expand apprenticeships, bootcamps are well-positioned to benefit from the increased support for skills-based training initiatives.

Despite growing demand, the US apprenticeship system, especially in tech, remains relatively underfunded compared to other developed nations. This presents a strategic opportunity for bootcamps to engage in apprenticeship development and expand their relevance in the current job market, especially in a market where traditional higher education pathways may lack agility.

Projections 2025

The bootcamp industry is poised to continue growing at a healthy pace in 2025 and beyond. For all of 2024, we project growth will decelerate to 5 percent as the industry contends with a challenging macroeconomic environment, characterized by layoffs in the tech sector and intense competition for tech roles.

However, we anticipate growth will accelerate again in 2025 as the strategies bootcamps have been implementing in recent years start yielding results and late adopters begin embracing them.

These strategies include leveraging the ongoing AI boom, forming partnerships with public and private entities, collaborating with companies to upskill their workforce, and expanding into emerging markets. Additionally, bootcamp providers must tap into the growing demand for cyber security professionals and capitalize on federal-level initiatives promoting skills-based training through apprenticeships.

If the industry collectively moves in this direction and seizes the opportunities outlined above, we expect growth in the coming years to reach the mid to high teens, aligning with the projections of other analysts already referenced in this study.

Citation

The authors encourage readers of this report to cite its data and findings for the benefit of all industry observers. When citing this report in online publications, please hyperlink back to it using the following anchor text: Career Karma’s 2024 Bootcamp Market Report.

In academic work, please cite document as:

Adolfo Perez-Gascon and Nicole Maske. (2024). State of the Bootcamp Market Report 2024. Career Karma: https://careerkarma.com/blog/bootcamp-market-report-2024

Acknowledgments

The authors would like to thank the following individuals for their invaluable guidance and support during the development of this report: Galina Bakinova, Assad Bokhari, Alex Consiglio, Yuriy Manoylo, Odane Richards, and Michael Thomas.

Conflict of Interest Disclosure

Career Karma matches career switchers to bootcamps and job training programs. Career Karma is paid by bootcamps to help prospective students prepare for and get accepted into a training program based on their needs.

Appendix: Detailed Methodology and Lists of Bootcamps

The figures presented in this report are more conservative than those proposed by most major research firms, primarily due to our methodological consistency. For example, while we estimate that the industry generated just over $800 million in 2023, some research firms consulted for this study place the figure at between $899 million (Verified Market Research) and $2.1 billion (Expert Market Research).

We believe this is because analysts have expanded their definition of a bootcamp over the years, while we have stuck to a much narrower definition.

As used in common parlance, the term “bootcamp” has become diluted, now encompassing a wide range of programs and certifications with varying time commitments and rigor. This is likely the definition used by the aforementioned research firms. For our part, we adhered to the definition used in our 2023 report:

Coding bootcamps are short-term vocational education programs focused on teaching in-demand digital skills, with a clear commitment to helping students land jobs or advance careers in tech.

Programs included in our definition are:

- Full-time courses requiring at least 30 hours per week over a short duration.

- Part-time programs requiring at least 15 hours per week over a longer duration.

- Self-paced programs with mentorship components (e.g., 1:1 or 1:2 mentorship).

This definition accommodates the rise of self-paced bootcamp programs over the past three years while maintaining a narrower scope than those used by some other analysts.

Throughout this report we use the term “tech bootcamp.” For the purposes of this study, a tech bootcamp is defined as a program with the same attributes as a coding bootcamp regarding format, duration, and objectives but encompassing a wider range of tech-related subjects, including data analysis, data science, cyber security, and UX/UI design. In other words, a coding bootcamp is a tech bootcamp but a tech bootcamp is not necessarily a coding bootcamp.

For our LinkedIn data, our objective was to use the same list of schools as in our 2023 report. However, we were unable to gather data for a few schools on that list. To maintain the same sample size, we added a few new schools that we deemed relevant. These schools are marked with an asterisk (*).

The limitations of our LinkedIn data remain unchanged from previous reports. Since the information on bootcamp graduates in our dataset is self-reported, there is a slight bias favoring bootcamps that prioritize LinkedIn profile development as part of their career support services.

Additionally, the data fluctuates when users join or leave the platform. For example, checking a bootcamp’s LinkedIn page on two consecutive days for the number of 2023 graduates may yield different results, even though the actual count of 2023 alumni has not changed since December 31, 2023.

These fluctuations, however, are likely random and evenly distributed across the bootcamp market, minimizing any significant impact on the accuracy of our analysis. To ensure consistency, we collected all graduate data from LinkedIn on November 15, 2024, and have used this dataset consistently throughout the report. This approach guarantees the internal reliability of the data across the report’s sections.

Schools headquartered outside of North America or primarily targeting regions outside of North America are marked with an asterisk in the tuition list.

Note on Projections

The LinkedIn data was gathered in mid-November, which means we were working with incomplete figures for 2024 and had to make projections. To simplify, we assumed that the data collected roughly represents the first half of the year.

Typically, there are four major cohorts per year: Spring, Summer, Fall, and Winter. At the time of data collection, the Fall cohort had either just ended or was about to conclude in the coming months, meaning students from this cohort would likely not have updated their profiles yet. Consequently, out of the four cohorts, our data primarily reflects only two. This is why we believe it is reasonable to assume that the data represents roughly half of the year.

List A: Bootcamps Used for Alumni Data Analysis

4Geeks Academy

Academy Pittsburgh

Actualize

Ada Developers Academy

Alchemy Code Lab

Altcademy

Austin Coding Academy

Awesome Inc U

Beginex

Betamore Academy

Bethel Tech

Bloc

BloomTech

BoiseCodeWorks

Bottega

BrainStation

Burlington Code Academy

Byte Academy

CareerFoundry

Carolina Code School

CEI Bootcamp *

Centriq Training

Claim Academy

Cleveland Codes

Code Fellows

Code Immersives

Code Platoon

Code Stack Academy

CodeBoxx

CodeCrew Code School

Coder Foundry

Codesmith

Codeworks

Coding Dojo

Coding Temple

CodingNomads

Cook Systems Fast Track D

Covalence

Cultivating Coders

Data Application Lab

Data Science Dojo

DaVinci Coders

Deep Dive Coding

DesignLab

DevLeague

DevMountain

DevPoint Labs

Digital Creative Institute

Digital House

DigitalCrafts

Divergence Academy

Eleven Fifty Academy

Epicodus

Evolve Security Academy

Flatiron School

Flockjay

Founders and Coders

Fullstack Academy

Galvanize

Geekwise Academy

General Assembly

Grace Hopper Program

Grand Circus

Hack Reactor

Hackbright Academy

HackerYou

Helio Training

Holberton School

Inventive Academy

Ironhack

Juno College

Kenzie Academy

Launch School

LaunchCode

Le Wagon

LEARN Academy

LearningFuze

Lighthouse Labs

Makers Academy

Masai School *

Max Technical Training *

Metis

Microverse

Momentum

Montana Code School

Moringa School *

Nashville Software School

Noble Desktop

Nology

NPower

Nucamp

NYC Data Science Academy

Operation Spark

PDX Code Guild

Platform by Per Scholas

Prime Digital Academy

Product Faculty

Product School

Pursuit

Queens Tech Academy

Recurse Center

Redwood Code Academy

Resilient Coders

Rithm School

Sabio

Savvy Coders

SecureSet Academy

Skill Distillery

Software Guild

Springboard

Suncoast Developers Guild Academy

Tech Elevator

Tech Talent South

Tech901

Techtonica

The App Academy NL

The Data Incubator

The Dev Masters

The Tech Academy

Thinkful

Tradecraft

TrueCoders

Turing School

TurnToTech

V School

We Can Code It

Woz U

Zip Code Wilmington

List B: Bootcamps Used for Tuition Analysis

10x Academy

4Geeks Academy

Actualize

Altcademy

Alterra Academy *

App Academy

Avocademy

Big Blue Data Academy *

Blaizing Academy

Bloomtech

Boolean *

Bottega Tech

BrainStation

CareerFoundry

CCS Learning Academy

Claim Academy

Clarusway

Code Fellows

Code for All_ *

Code Institute *

Code Platoon

Codecademy

Coder Foundry

Coders Campus

Codesmith

Codeworks *

Coding Bootcamp Praha *

Coding Dojo

Coding Temple

Columbia Engineering Boot Camps

Concordia Bootcamps

Constructor Academy *

Course-Net

CourseCareers

Covalence

Data Science Dojo

Data Science Dream Job

DataCamp

Deep Dive Coding

Designlab

Develhope *

DevLeague

Devmountain

DigitalCrafts

Divergence Academy

Elevate

ENTITY Academy

Evolve Security Academy

Flatiron School

Founders and Coders

Fullstack Academy

Galvanize

General Assembly

Georgia Tech Boot Camps

Hackbright Academy

Henry *

Holberton School

iO Academy *

Ironhack *

ixperience (Cape Town) *

ixperience (Lisbon) *

Launch School

Le Reacteur *

Le Wagon *

LEARN Academy

LearningFuze

Lighthouse Labs

Makers Academy *

Manzoor The Trainer (MTT)

MAX Technical Training

Microverse

MIT xPRO | Bootcamps

Nashville Software School

NEXT Academy *

Nucamp

NYC Data Science Academy

Prime Digital Academy

Product Faculty

Product Gym by Elevate

Product School

RMOTR

Rutgers Bootcamps

Sabio

School of IT *

SheCodes

Simplilearn

Skill Distillery

Skillcrush

Springboard

SV Academy

Syntax Technologies

Tech Elevator

TECH I.S.

Tech Talent & Strategy

The Bridge *

The Odin Project

The Tech Academy

TripleTen

TrueCoders

Turing College *

Turing School of Software & Design

UCLA Extension Boot Camps

Udacity