Since publishing our last reports, the tech bootcamp space has continued to evolve within a world still recovering from the COVID-19 pandemic. We’ve observed this industry’s resilience and adaptability, as well as its continued growth despite the many challenges the global economy has faced over the last few years.

Overall, our 2023 State of the Bootcamp Market Report shows that the US bootcamp industry continues to grow, which indicates that students are still finding value in this form of training to start new careers in tech. On the whole, students who attend bootcamps are picking up diversified, in-demand skill sets and are benefiting from the wider availability and versatility of bootcamp programs and the opportunities they afford.

This increased availability and versatility of bootcamp programs represents significant innovation within the field. In our 2020 report, for example, we noted that only 13 of the 105 bootcamps we studied had online options. Now, in 2023, online bootcamp programs are the norm. The growing trend of remote education has allowed top coding bootcamps to offer more flexible scheduling options that each cater to the varying needs of a diverse learner base. Coding bootcamps have also been expanding their offerings by introducing courses in related fields, including cyber security, data science, and UX/UI design.

Although hiring patterns in the tech industry remain in flux, bootcamp students who take advantage of their schools’ career services and employer networks are finding employment in the tech industry at steady rates. Furthermore, as the bootcamp market consolidates and converges around a standard way of doing business, bootcamps are providing students with a reliable educational standard, which serves as a critical form of self-regulation.

In our efforts to create a comprehensive snapshot of current trends in the bootcamp space, we focused our attention on seven key areas of the market. Based on independent analysis of alumni data collected from LinkedIn and bootcamp websites, our seven key findings are summarized below.

Key Findings

Market Size

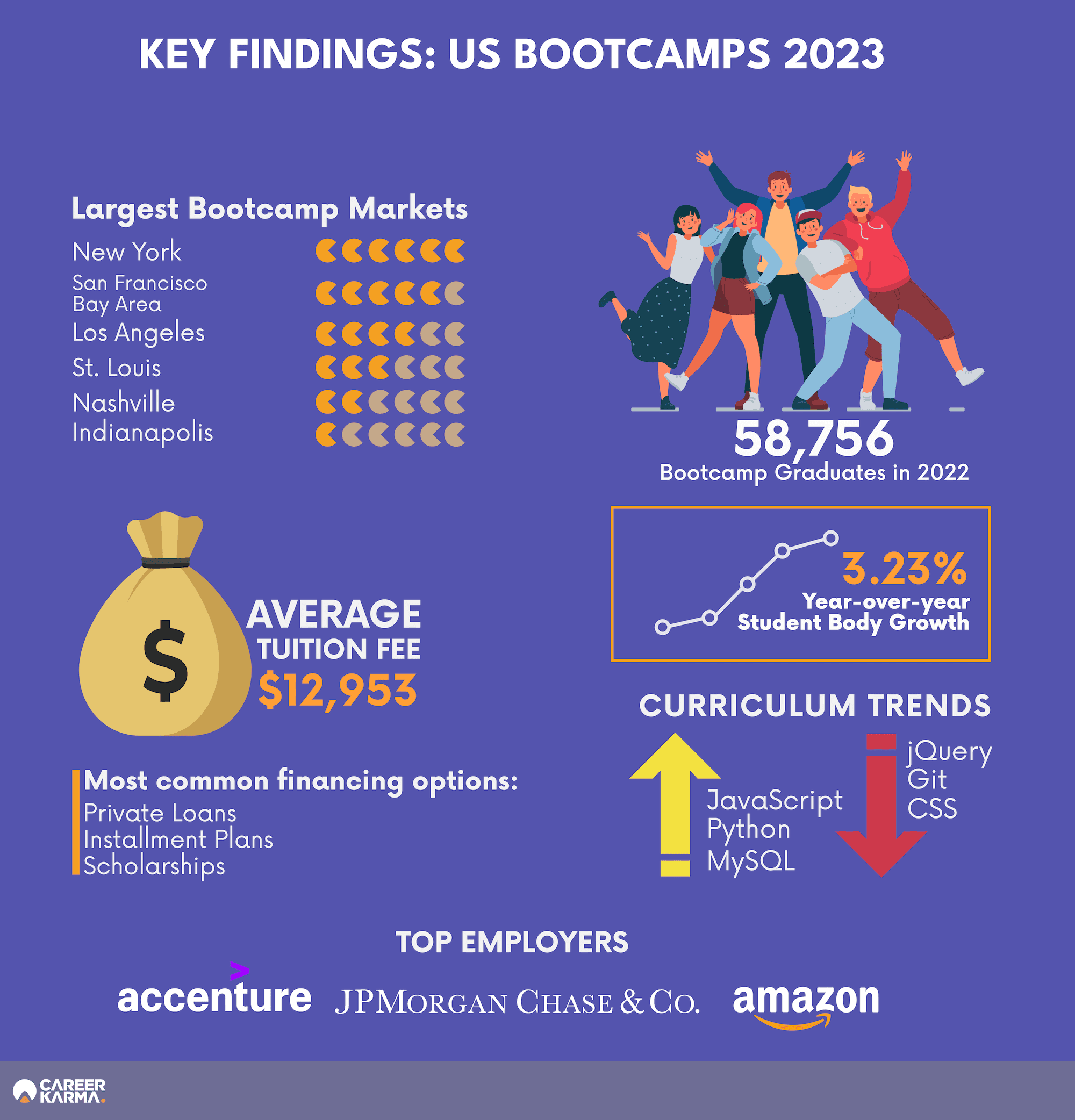

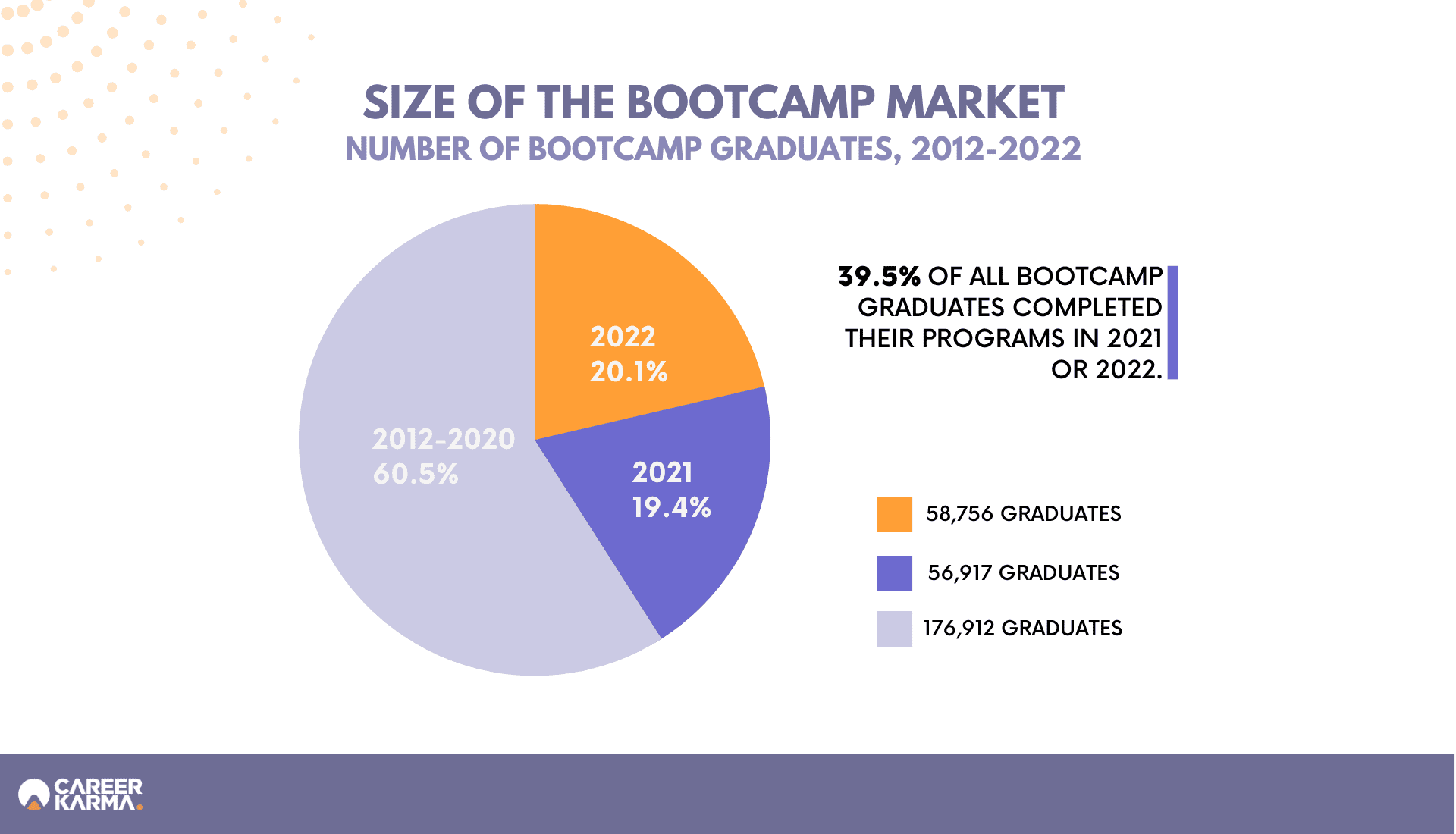

The student body served by American coding bootcamps grew by 3.23% from 2021 (56,917 graduates) to 2022 (58,756 graduates). Between 2021 and 2022, 115,673 people graduated from a bootcamp, which accounts for 39.53% of all graduates since the inception of coding bootcamps. Expressed in terms of the annual increase in the all-time total number of bootcamp graduates, the bootcamp market grew by 32.17% in 2021, from 176,912 to 233,829, and by 25.13% in 2022, from 233,829 to 292,585.

Bootcamp Revenue

We estimate that US coding bootcamps earned at least $727,688,765.80 in 2022. This figure, just shy of three-quarters of a billion dollars, is over $200 million higher than the number we quoted in our last report.

Tuition

The average tuition across all tech bootcamp programs is $12,953. If we only look at coding bootcamp programs, namely those with a software engineering or web development focus, the average tuition is $13,035. We also found that coding bootcamp tuition costs vary slightly by format:

- Full-time coding bootcamp programs cost $14,237 on average.

- Part-time coding bootcamp programs cost $12,226 on average

- Self-paced coding bootcamp programs cost $9,408 on average.

Tuition Financing

The most common forms of tuition relief that bootcamps offer are private student loans through preferred partners (61% of bootcamps), installment plans (52%), scholarships (43%), and deferred tuition plans (30%). Income share agreements (ISAs) are available at only 23% of bootcamps.

Top Cities

Bootcamps in major tech hubs continue to thrive as they have in previous years. Of the people who completed their programs in 2021 or 2022, 8,819 now live in New York City while 2,712 live in the San Francisco Bay Area. At the same time, coding bootcamps are also becoming more prominent in less traditional metropolitan areas, especially in cities like St. Louis and Indianapolis that are quickly gaining relevance in the tech industry.

Top Skills

Bootcamp coursework continues to adapt when necessary to accommodate current and projected trends in the labor market. While hard skills related to software development remain most prominent, many bootcamps have diversified their offerings to provide training in related fields. As of 2023, there are 99 coding bootcamp programs according to our definition and 112 bootcamp programs covering non-development fields, such as web design, cyber security, product management, and data science.

Top Employers

The companies that hired the most bootcamp graduates in 2021 and 2022 were Amazon with 1,077 hires, Accenture with 819, and JP Morgan Chase & Co with 400. The bootcamps that placed the most graduates at these companies were Flatiron School, Ironhack, Kenzie Academy, Tech Elevator, and Thinkful.

Citation

The authors encourage readers of this report to cite its data and findings for the benefit of all industry observers. When citing this report in online publications, please hyperlink back to it using the following anchor text: Career Karma’s 2023 Bootcamp Market Report.

In academic work, please cite document as:

Juberg, Marc, Jemma Mercer, and Valentina Bravo. (2023). State of the Bootcamp Market Report 2023. Career Karma: https://careerkarma.com/blog/bootcamp-market-report-2023/

Methodology Overview

In order to make meaningful comparisons with our previous findings, we followed the methodology laid out in our 2021 report as closely as possible. Even so, the number of schools in our sample increased from 101 to 115, mainly due to the tech industry’s changing definition of what counts as a bootcamp. In our last two reports, we defined a tech bootcamp as follows:

An immersive, employment-focused educational program of typically three to twelve months, designed to help adults develop industry-oriented skills relevant to pursuing careers in tech.

We further specified that, to qualify for inclusion in our study, a bootcamp must “offer full-time instruction totaling at least 30 hours per week.” However, given the rise of online programs across the industry and the recent success of flexible, self-paced, and mentorship-driven bootcamps like Springboard, we no longer feel that these criteria are adequate. The selection criteria for the current report have been updated according to the following revised definition:

Coding bootcamps are a form of short-term vocational education focused on teaching in-demand digital skills, with a demonstrated commitment to helping students land jobs or advance careers in tech. They might consist of full-time programs of at least 30 hours per week over a short duration, part-time programs of at least 15 hours per week over a longer duration, or self-paced programs with a 1:1 or 1:2 mentorship component.

Using this expanded definition and applying it to the US market, we manually collected tuition data for all of the full-time, part-time, and self-paced programs offered by the bootcamps in our sample. We then gathered graduate data from LinkedIn for as many of these schools as we could, from which we were able to learn about the skills these graduates acquired, the places they live, and the companies at which they work. Whereas the analyses in our last report tended to focus on all-time graduate data, we used this report as an opportunity to look more closely at recent alumni, namely those who graduated in 2021 or 2022.

For an extended look at our methods and research steps, as well as a list of all of the bootcamps we studied for this report, see Appendix A.

Size of the US Bootcamp Market

In 2022, 58,756 people graduated from a tech bootcamp in the United States. The US bootcamp market has grown by 3.23% since 2021, when there were 56,917 US bootcamp graduates. This number is lower than the year-over-year growth figure in our last report, which was 30.32%.

Another way to assess the growth of tech bootcamps in the United States is by looking at how much the total body of bootcamp graduates is expanding from year to year. Viewed from this angle, the bootcamp alumni population grew by 32.17% from 2020 to 2021, from 176,912 to 233,829 total graduates, but only by 25.13% from 2021 to 2022, from 233,829 to 292,585 total graduates.

Nevertheless, the market remains strong overall, with 115,673 out of all 292,585 historical bootcamp graduates having completed their programs in 2021 or 2022. Given that the first bootcamps started enrolling students in 2012, this means that nearly 40% of bootcamp students have completed their studies in just the past two years.

The annual revenue in the bootcamp market also contributes to this picture of overall health. In 2022, bootcamps brought in $727,688,765.80, nearly three-quarters of a billion dollars. After removing tuition-free bootcamps from consideration, we arrived at this figure by multiplying the average bootcamp tuition, which will be discussed in a later section, by the total number of bootcamp graduates in 2022. This number is higher than the $518,981,000 that bootcamps made in 2020, according to our last report. According to US Inflation Calculator, the 2020 revenue figure expressed in 2022 dollars is $586,846,712.68, still significantly lower.

Taken together, this information speaks to the continued viability of tech bootcamps as a form of higher education in the United States. These schools continue to find students to teach, and the slowing rate of growth need not be cause for concern. Indeed, the continued growth during difficult times is a testament to the industry’s resilience and adaptability against a backdrop of continued economic uncertainty. The ways in which bootcamps have responded to the challenges facing both the tech job market and the global economy are creating a roadmap to long-term stability.

Largest Bootcamps by Number of Graduates

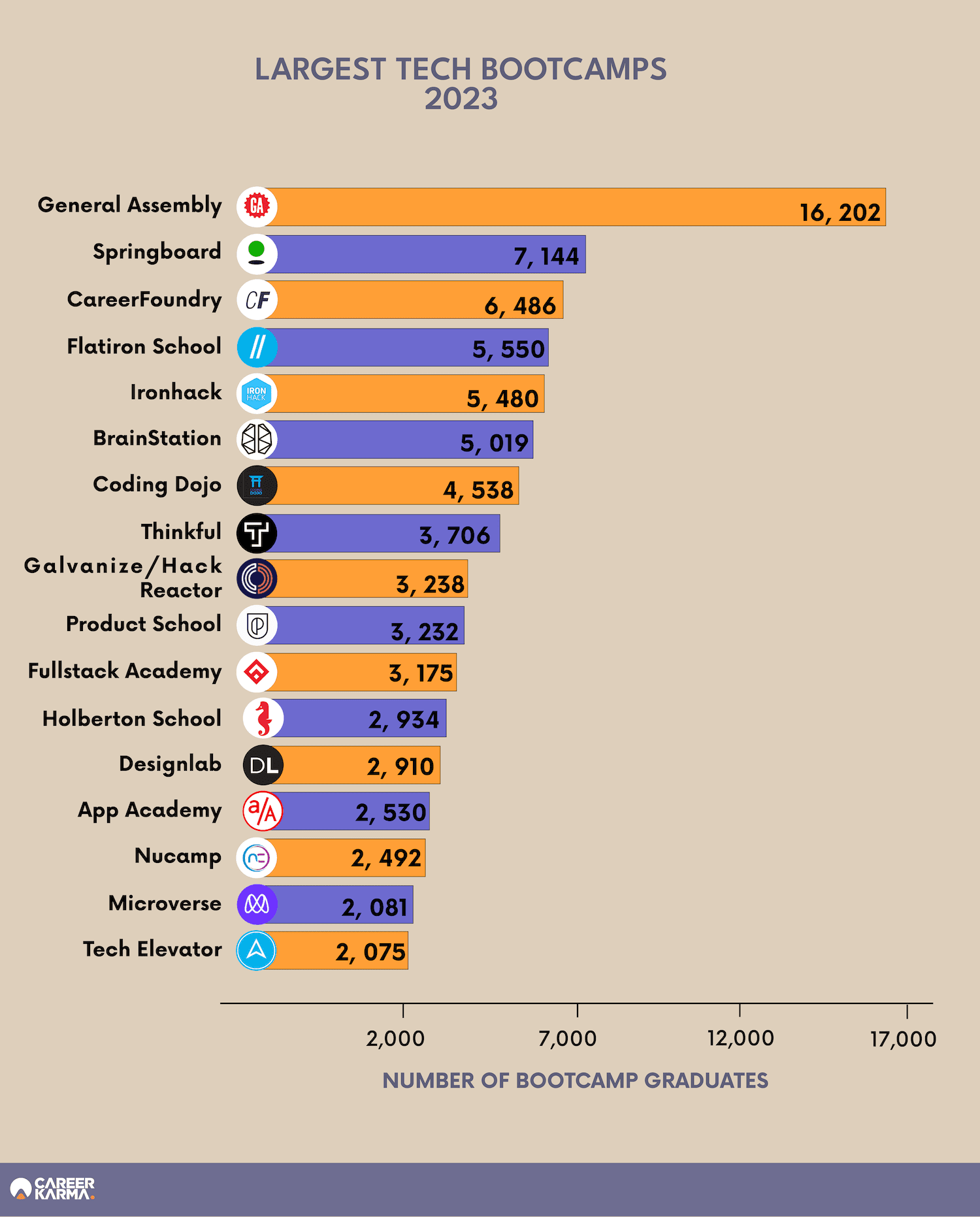

Our list of the current largest coding bootcamps was calculated based on the number of students and graduates reported on LinkedIn in 2021 and 2022. In accordance with the rising emphasis on remote learning, every school on this list offers online programs, with some schools designed to operate entirely online.

"Career Karma entered my life when I needed it most and quickly helped me match with a bootcamp. Two months after graduating, I found my dream job that aligned with my values and goals in life!"

Venus, Software Engineer at Rockbot

Schools such as CareerFoundry, Springboard, and Coding Dojo show significant growth compared to our previous report, with Coding Dojo making its first appearance on the top ten list. All three coding bootcamps offer online courses that are designed to include a combination of scheduling flexibility and high levels of support from instructors and teaching assistants.

Springboard’s model of offering an online pre-packaged curriculum that learners can move through at their own pace is made especially appealing to students with the addition of 1:1 mentorship along with career coaching. CareerFoundry provides a similar model with the same emphasis on personalized mentorship and has moved from eighth place in our previous report to third.

General Assembly, Flatiron School, Ironhack, and BrainStation remain leaders of the bootcamp space and have maintained high positions on our list.

Fastest-Growing Coding Bootcamps in 2021-22

To calculate the fastest-growing coding bootcamps, we determined what percentage of each school’s total alumni pool graduated in 2021 or 2022. The table below shows which schools have seen the most significant growth in their graduation numbers over the last two years compared to previous years. Because we only wanted to consider major bootcamps for this comparison, we excluded schools with an overall alumni population below 1,000.

The coding schools that appear on this table make for an interesting study in what methodologies, trends, and pedagogical practices have proven successful in helping coding bootcamps grow over the past two years.

| Coding Bootcamp | Year Founded | All-Time Alumni | Percentage of All-Time Alumni Who Graduated in 2021 or 2022 |

|---|---|---|---|

| Holberton School | 2015 | 3,085 | 95.1% |

| Nucamp | 2017 | 2,785 | 89.5% |

| Microverse | 2017 | 2,332 | 89.2% |

| Kenzie Academy | 2017 | 1,608 | 72.1% |

| Designlab | 2013 | 4,136 | 70.4% |

| Springboard | 2013 | 10,714 | 66.7% |

| Coding Dojo | 2013 | 6,887 | 65.9% |

| Codeup | 2013 | 1,496 | 60.2% |

| Thinkful | 2012 | 6,578 | 56.3% |

| Fullstack Academy | 2012 | 5,772 | 55.0% |

| Tech Elevator | 2015 | 3,800 | 54.6% |

| CareerFoundry | 2013 | 12,760 | 50.8% |

| Woz U | 2017 | 1,064 | 50.8% |

| LaunchCode | 2013 | 2,809 | 50.4% |

| The Tech Academy | 2014 | 1,392 | 48.7% |

| Nashville Software School | 2012 | 2,193 | 48.0% |

Holberton School has seen significant growth, enrolling 2,934 students in 2021 and 2022, likely due to its 2021 pivot from an in-person bootcamp in San Francisco to an edtech SaaS company with a large network of schools located in the US, Europe, Latin America, and Africa. Holberton now works with local partners who are better able to understand their own markets’ unique needs.

Nucamp has made noticeable efforts to increase transparency and maintain affordable tuition prices in recent years. It intentionally does not publicize its job placement rate, instead providing regularly updated data gathered from graduate survey responses. Its most expensive program, the Complete Software Engineering Bootcamp Path, costs significantly less than average at $5,644. Addressing affordability and transparency, Nucamp recently developed its Fair Student Agreement (FSA) as an alternative to income share agreements. FSA payments are not based on future income and the amount and frequency are mutually agreed upon ahead of time.

A significant trend suggested in this table is that students are placing an increasingly high value on credibility. Kenzie Academy, upon joining forces with Southern New Hampshire University in 2021, became one of the first coding bootcamps to be accredited by an organization operating under the jurisdiction of the US Department of Education. This unusual step gives the school’s curriculum a level of authenticity that no doubt appeals to students.

In 2022, Codeup followed suit by earning accreditation for its bootcamps, and in 2023, Coding Dojo was acquired by Colorado Technical University, another accredited institution of higher learning. Getting their curriculums reviewed through official channels within the United States higher education system seems to have given these schools another level of legitimacy, possibly resulting in increased enrollment.

The Cost of Tech Bootcamps: Upfront Tuition by the Numbers

Across all 99 of the for-profit tech bootcamp programs we studied in early 2023, the average upfront tuition was $12,953. The range spanned from $1,760, which is how much Altacademy charges for its self-paced full stack web development course, to $36,000, which is the price tag associated with Holberton School Miami’s software engineering program. Average bootcamp tuition has gone up by $1,226 since 2020, when we estimated it as $11,727.

The average coding bootcamp

costs $12,953

Our sample consisted of 89 coding bootcamps and 10 non-coding tech bootcamps. Whereas we define the former as schools that offer a software engineering or web development program, we define the latter as schools that offer training in tech disciplines other than software engineering or web development. In early 2023, the average coding bootcamp tuition was $13,035 and the average non-coding bootcamp tuition was $9,295.

This information, along with the median tuition costs across coding, non-coding, and all programs, is displayed in the table below.

Upfront Tuition Costs by Main Focus of Bootcamp

| Main Bootcamp Focus | Number of Bootcamps | Mean | Median |

|---|---|---|---|

| Coding (web development, software engineering) | 89 | $13,035 | $13,500 |

| Non-coding (data science, cyber security, UX/UI design, product management) | 10 | $9,295 | $7,249 |

| All bootcamps | 99 | $12,953 | $13,038 |

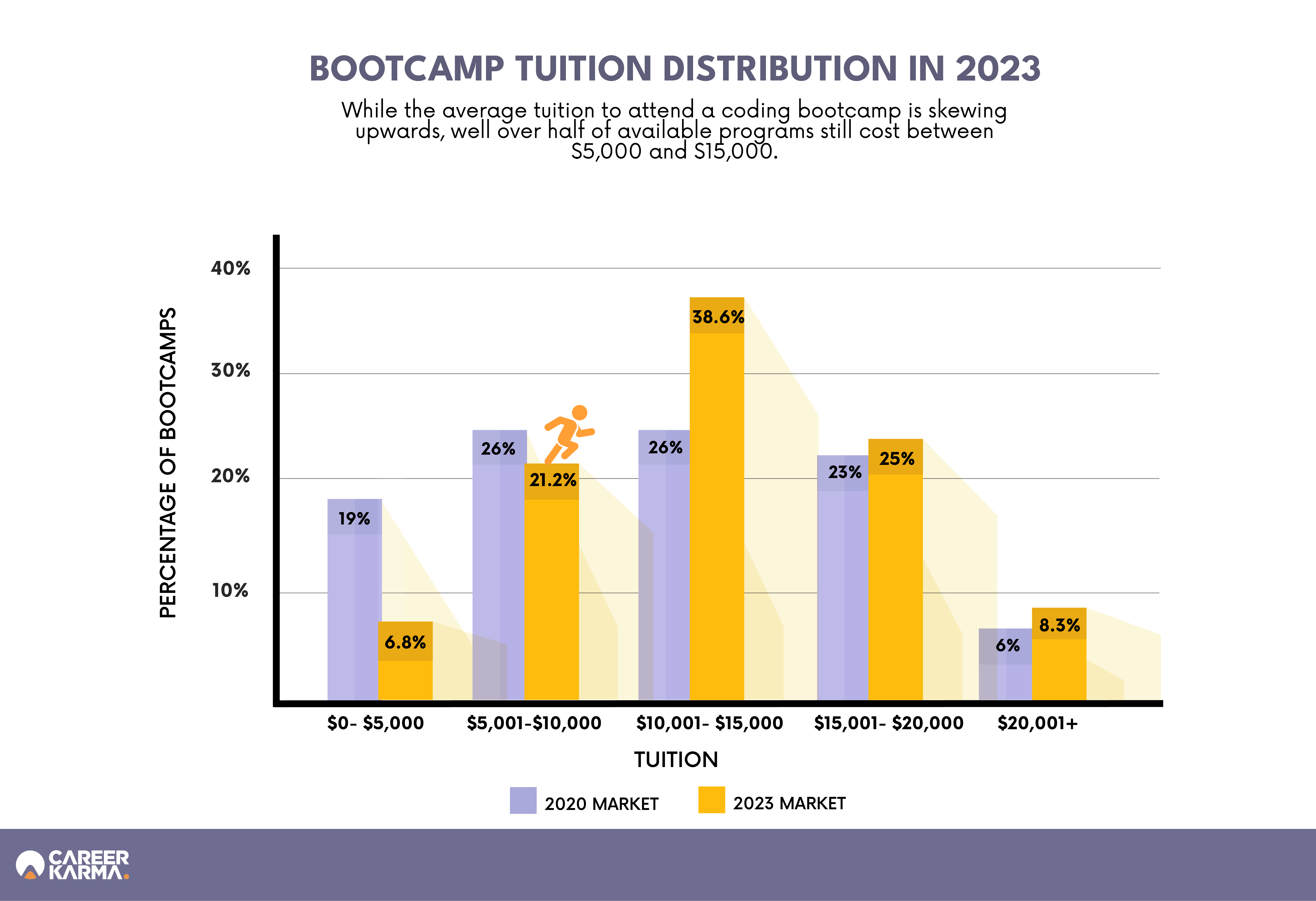

The fact that the median coding bootcamp cost and the median cost overall were so close to their respective means suggests that costs are normally distributed across the entire range. The relatively large distance between the mean and median tuition costs of non-coding bootcamps is attributable to the comparatively small sample size. In the chart below, we can clearly see the bell shape in the distribution, which reflects the overwhelming tendency for bootcamp tuition costs of any type to cluster around the average.

Bootcamp tuition costs in 2023 occur in the middle part of the distribution at a greater frequency than they did in our 2021 report, where we noted that only 25.9% of bootcamps charged between $10,000 and $15,000. If we combine the first, second, and third bars on the graph, we find that 66.6%—exactly two-thirds of bootcamp programs—cost less than $15,000. In 2020, the equivalent figure was 70.3%. As tuition prices have risen, they have become more stable and predictable. The overall effect is that bootcamps are not much less affordable than before.

In fact, once we account for inflation, we can even say that the cost of bootcamp education has gone down slightly. According to US Inflation Calculator, the 2020 average cost of $11,727 is equivalent to $13,676 in 2023 dollars. This means that, if the average 2020 bootcamp were offered today, it would cost $723 more than the current average.

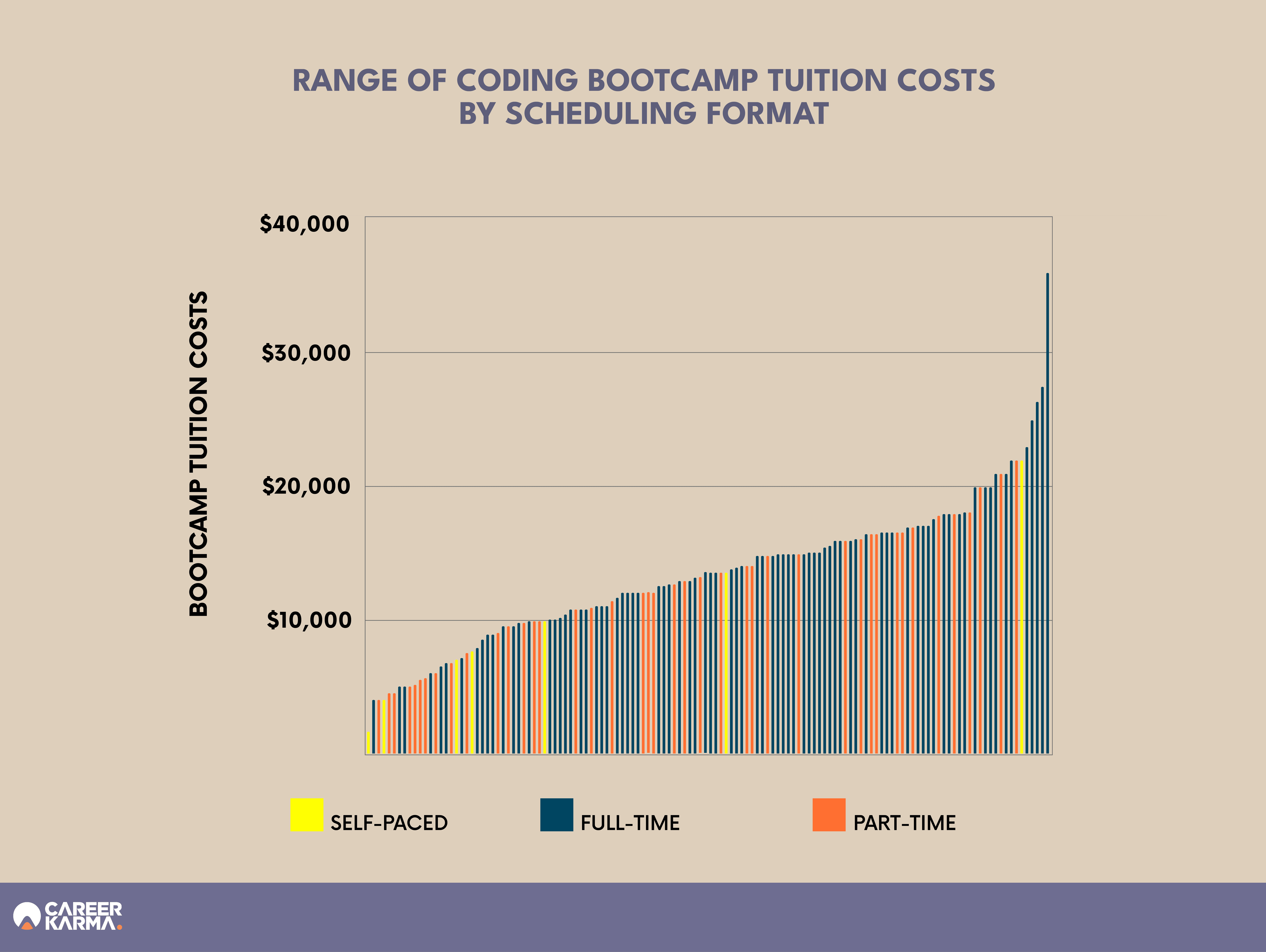

Coding Bootcamp Tuition by Scheduling Format

We also wanted to see how the format of a bootcamp affects the cost. To do this, we collected data on every software engineering and web development program that the bootcamps in our sample offer. The number of programs in our sample came out to 132 programs across 89 bootcamps, some of which offer the same program in multiple formats.

| Coding Bootcamp Format | Number of Programs | Mean | Median |

|---|---|---|---|

| All Formats | 132 | $13,035 | $13,500 |

| Full-Time | 83 | $14,237 | $14,000 |

| Part-Time | 42 | $12,226 | $12,350 |

| Self-Paced | 7 | $9,408 | $7,650 |

These data show that full-time programs are more expensive than part-time programs on average, but not by much. Both averages and both medians are within $1,250 of the average cost of any coding bootcamp program. Self-paced programs are significantly less expensive than either full-time or part-time bootcamps, suggesting that students pay a premium for instructor-led learning opportunities, which may carry other advantages.

To get a better sense of how the costs of these programs are distributed, we charted every program for which we collected data, lined their prices up from lowest to highest, and color-coded them as follows: blue for full-time, orange for part-time, and yellow for self-paced.

Trends in Bootcamp Financing and Affordability

Quality comes at a price, and even though the inflation-adjusted tuition cost of the average bootcamp has decreased, bootcamp programs still represent a significant financial investment. However, bootcamps have managed to keep real costs down over the last few years despite continuing to make advancements in the variety, flexibility, and credibility of their training.

Improvements and reforms in the financing options that bootcamps have at their disposal are also lessening the financial burden. The table below, based on the same schools from which we collected tuition information, shows the 10 most common financing options that tech bootcamps advertise to applicants.

| Financing Option | Percentage of Bootcamps |

|---|---|

| Upfront payment | 89% |

| Private student loan | 61% |

| Installment plan | 52% |

| Scholarships | 43% |

| Deferred tuition | 30% |

| GI Bill benefits | 25% |

| Income share agreement (ISA) | 23% |

| Living stipend | 9% |

| Employer sponsorship | 9% |

| Workforce Innovation and Opportunity Act (WIOA) grant | 7% |

Most of these options require students to shoulder at least some burden or risk, and it should come as no surprise that the most common ones are the safest for bootcamps’ bottom line. Somewhat surprisingly, ISAs, despite having risen to prominence through their association with coding bootcamps, are now offered by less than a quarter of schools. We will discuss the declining fortunes of ISAs in the next section, but first, let’s briefly summarize all of the bootcamp industry’s most common financing options:

- Upfront payment. Almost every coding bootcamp allows students to pay tuition in one upfront payment before classes begin. Some schools provide discounts for students who choose this payment option.

- Student loans through private providers. A large number of coding bootcamps partner with providers like Ascent Funding and Climb Credit to allow students to pay tuition using private loans. The terms of the loan vary based on the provider, the school, and the individual student’s financial situation.

- Installment plan. This form of payment allows students to cover the cost of the bootcamp in multiple pre-arranged installments, often spread throughout the course. This lowers the financial burden of having to pay full tuition all at once.

- Scholarships. Scholarships and discounts are opportunities offered by numerous bootcamps to lower the cost of tuition. Most bootcamp scholarships are designed to help low-income students and students from traditionally underrepresented communities in tech access an education.

- Deferred tuition. Deferred tuition plans allow students to pay tuition in regular fixed payments after they have graduated. Unlike ISAs (see below), the amount students must pay is not affected by their income.

- GI Bill financing. Veterans and their family members are often able to cover some or all of their bootcamp tuition using VET TEC and GI Bill benefits. This is only the case for VA-approved programs. Some examples of coding bootcamps that are VA-approved include Code Fellows, Code Platoon, DevLeague, and General Assembly.

- Income share agreements. ISAs allow students to pay for their coding bootcamp with a fixed percentage of their future income. While many schools still offer ISAs, including Galvanize, General Assembly, and Le Wagon, this financing model has come under increased scrutiny in recent years.

- Employer sponsorship. Some bootcamps, including General Assembly, encourage students to speak to their employers about the possibility of receiving tuition reimbursement. Many companies have budgets set in place to help employees upskill.

- Workforce Innovation and Opportunity Act (WIOA) grants. WIOA grants are designed to help low-income individuals access career training services. Claim Academy, Coding Temple, and Deep Dive Coding are three WIOA-approved coding bootcamps.

- Living stipends. A living stipend is a fixed amount of money that students receive to use on basic expenses like rent, food, and transportation. Some coding bootcamps offer living stipend scholarships while others allow students to take out additional loans to help cover the cost of living.

The Fall of ISAs and the Future of Bootcamp Financing

Income share agreements saw a surge in popularity in the bootcamp market in the late-2010s. Several major coding bootcamps offered ISAs, and for some, they were one of the school’s largest selling points. As a payment method that allows students to complete their education before making payments, ISAs come with the clear benefit of increasing access to the tech industry by removing financial barriers to the high-value training that students need. In their ideal form, ISAs go hand in hand with bootcamps’ mission. By tying payments to students’ future earnings, they incentivize institutions to provide whatever high-quality education and support is necessary to ensure students land well-paying jobs.

However, ISAs are now offered by less than a quarter of bootcamp providers. Additionally, the majority of traditional educational platforms that experimented with ISAs in the late 2010s no longer engage in the practice. Of roughly 15 accredited colleges and universities that experimented with ISAs in the late 2010s, only four had yet to pause or end their programs as of 2022.

There are various contributing factors behind the waning popularity of ISAs. Regulation regarding ISAs has been inconsistent from state to state, causing confusion for students and institutions alike. Until an order from the Consumer Financial Protection Bureau in 2021 made it clear that ISAs are loans, they were often inaccurately marketed by bootcamps and universities as a debt-free alternative to traditional loans or credit.

New regulatory structures for ISAs introduced in a 2022 congressional bill could address another problem spot for the industry. The bill aims to provide a standard set of disclosures and additional protections for borrowers, allowing students to better understand what they are agreeing to and to ensure they are not taken advantage of. A report from Social Finance provides context to explain the need for such a bill:

The primary area of concern for critics of ISAs thus far has been contract terms that are unfavorable to students, particularly as they relate to potentially deceptive marketing, high implied annual percentage rates in the event of high realized incomes, potentially insufficient protections in the event of disruptive life events or low incomes, and potentially burdensome aggregate income shares for individuals who take on multiple ISAs or combine ISAs with loans.

Multiple lawsuits brought against ISA providers speak to how dozens of students have found ISAs to be misleading and exploitative. The complaints note predatory and exorbitantly high-cost ISA programs, including one that could total more than $250,000 over a two-year course, and several cases of deceptive marketing.

In place of ISAs, many coding bootcamps have pivoted to alternative payment methods that provide the same or similar benefits. Most important among these benefits is the assurance that all students have access to enrollment, even if they cannot afford upfront tuition. Dozens of coding bootcamps partner with lenders like Climb Credit and Ascent Funding, making private student loans the second most popular payment method today. Installment plans are another popular option that softens the blow of tuition without the additional stress of accumulated interest.

Another promising alternative is deferred tuition plans, which, like ISAs, allow students to pay for their education in installments after they have graduated and landed a job. The essential difference between the two is that, with a deferred tuition plan, students know ahead of time exactly what they will owe, increasing transparency. Transparent deferred tuition plans don’t charge a percentage of students’ future income. A good example is Nucamp’s Fair Student Agreement, which doesn’t kick in until after graduation and is made up of clear, fixed payments.

Springboard’s deferred tuition option, meanwhile, comes with a form of job guarantee, giving students an extra buffer of six months to search for a job and a tuition refund if they fail to find one. Springboard is one of several bootcamps that now offer a job guarantee as a way to provide credibility.

Technical Skills Taught at Bootcamps

Bootcamps recognize how essential it is that their graduates are equipped with the right skills once they enter the job market. A major benefit of the bootcamp format is that it allows for a great deal of flexibility, enabling schools to adapt and update their curricula as necessary to keep up with the demands of local employers and larger industry-wide trends.

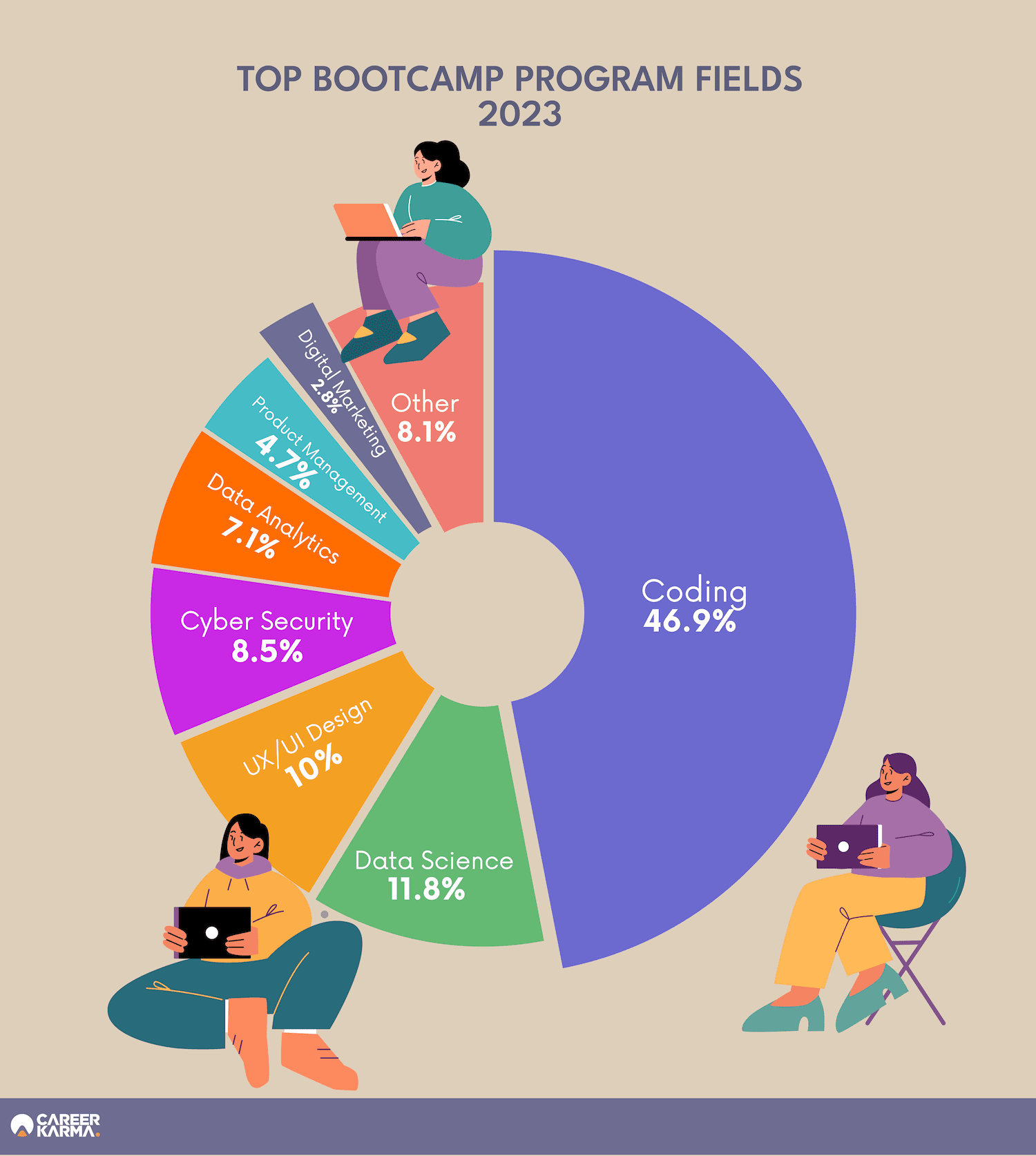

Based on the schools and programs for which we collected tuition data, here are the top in-demand fields that tech bootcamps cover in 2023, ranked by number of programs offered.

| Tech Subject | Number of Bootcamp Programs |

|---|---|

| Coding (Software or Web Development) | 99 |

| Data Science | 25 |

| UX/UI Design | 21 |

| Cyber Security | 18 |

| Data Analytics | 15 |

| Product Management | 10 |

| Digital Marketing | 6 |

| Other (Tech Sales, Mobile Development, Internet of Things, Cloud Engineering, Blockchain Engineering) | 17 |

While coding-based programs remain the most prevalent, it is significant to note that a large portion of coding bootcamps now offer courses in other in-demand fields. By offering a wider range of programs, bootcamps are able to cater to students with varying interests and become a viable educational pathway to a significantly larger range of career options.

The fact that these burgeoning programs most commonly cover subjects like data science (11.8% of the market), UX/UI design (10%), and cyber security (8.5%) also provides evidence that coding bootcamps are adapting to meet market needs. All three fields have notably high projected job outlooks from BLS, with 36% for data science, 35% for information security analysts, and 16% for web and digital interface designers. Additionally, amidst a level of uncertainty in the tech industry, Gartner’s IT spending forecast names data science and cyber security as two areas where the demand for talent is likely to significantly outstrip supply in the coming years.

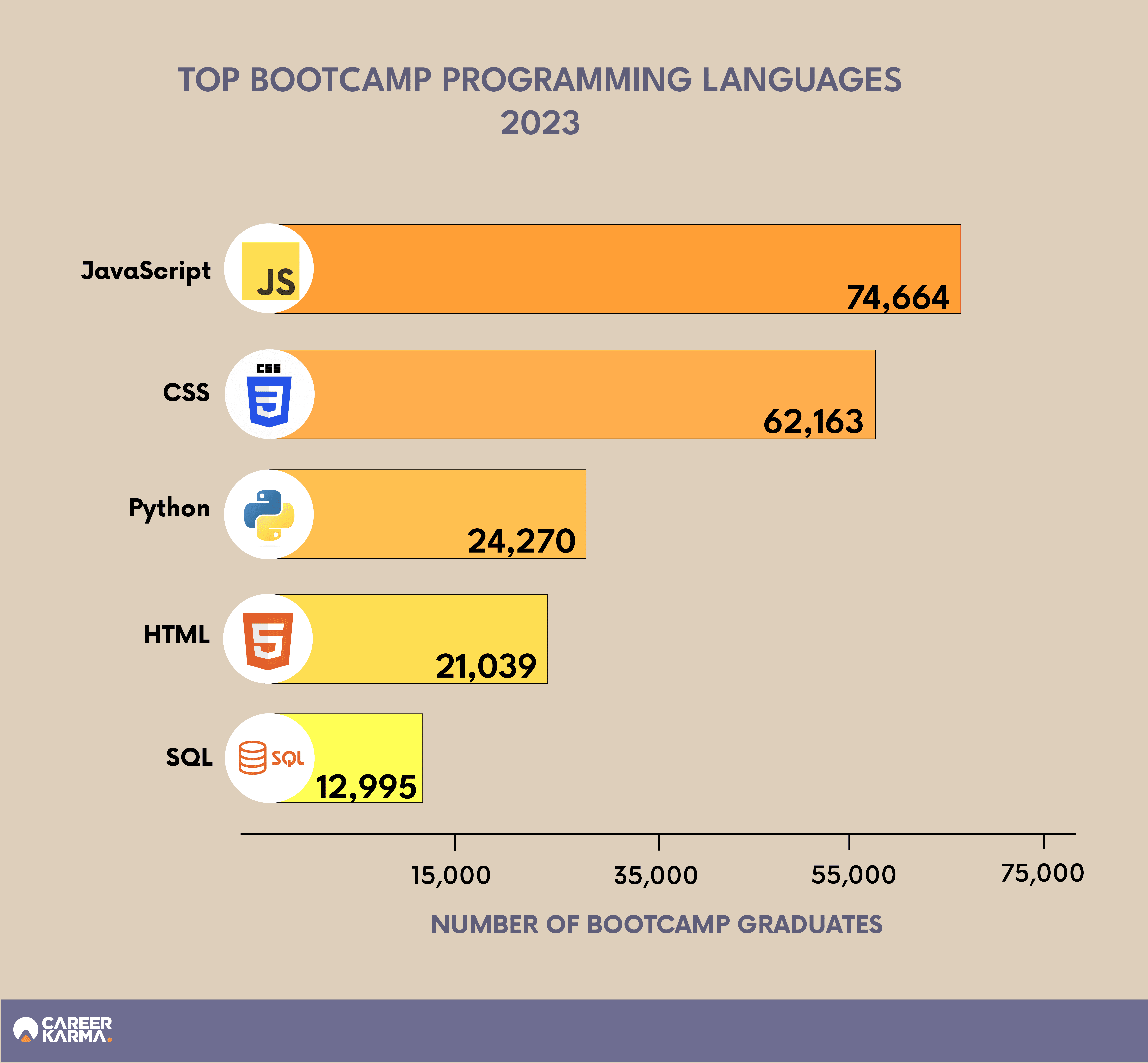

By analyzing LinkedIn data, we can also get an idea of what skills students are learning during their bootcamp programs and determine how accurately they reflect the needs of the market. Our research shows that the top programming languages coding bootcamp graduates report knowing include:

Top Programming Languages in 2021-22

| Programming Language | Graduates |

|---|---|

| JavaScript | 74,664 |

| CSS | 62,163 |

| Python | 24,270 |

| HTML | 21,039 |

| SQL | 12,995 |

| Java | 5,563 |

| C | 3,791 |

| PHP | 2,329 |

| Ruby | 1,165 |

| TypeScript | 766 |

| C# | 761 |

These data show that while the top five languages taught at bootcamps have not changed since our previous reports in 2020 and 2021, there have been changes in their order of importance, with JavaScript and Python both rising in popularity. Both languages are known for their versatility and can be utilized in a range of high-paying entry-level tech jobs. These results are congruent with trends in the field, as JavaScript, HTML/CSS, SQL, and Python are currently the most commonly used languages among developers, according to the Stack Overflow Developer Survey.

Three of the most prevalent languages, JavaScript, CSS, and HTML, are essential to web development, so their appearance on this list is no surprise. BLS reports a 30% job growth rate for web developers between 2021 and 2031, which is significantly higher than average. Software engineers have a similarly impressive job outlook of 26%.

Python’s rise in prominence on bootcamp curricula since 2020 might be partially due to a recent surge in the field of data science. As well as its uses in software engineering, Python is among the most commonly used languages for machine learning and artificial intelligence.

The languages included in coding bootcamp curricula, as well as the overall program offerings, are directly in line with current and projected trends in the labor market.

Top Programming Technologies in 2021-22

| Programming Technology | Graduates |

|---|---|

| React.js | 27,110 |

| Node.js | 9,283 |

| Ruby on Rails | 8,392 |

| MySQL | 4,913 |

| Git | 4,588 |

The top programming technologies covered in coding bootcamps that aren’t languages have shown more variation since our last report, with MySQL replacing jQuery in the top five. While these data show that bootcamps still prioritize tools used for web development, MySQL and Git are widely utilized by tech professionals in various fields. Experience with fundamental software development tools, such as Git, ensures bootcamp graduates are better prepared to succeed in a wider range of careers.

Top Non-Coding Bootcamp Fields in 2021-22

| Subject | Graduates |

|---|---|

| Design | 15,673 |

| Data Science | 7,209 |

| Cyber Security | 3,286 |

| Data Analytics | 2,987 |

| Operations Management | 1,882 |

| Digital Marketing | 1,148 |

Our data reveals that web design courses have produced the largest number of graduates outside of traditional coding programs, although some graduates of web development bootcamps might also have reported design as a field they focused on during their programs.

Data science bootcamps also appear to hold significant demand amongst students, with over 7,200 graduates. This finding aligns with the popularity of data science bootcamps, which as we saw in the pie chart above, account for 11.8% of all tech bootcamp programs. As non-coding programs are still relatively new offerings for many tech bootcamps, it will be interesting how these numbers change in the coming years.

To get a clearer sense of the specific in-demand tools and topics that students of non-coding bootcamps are learning, we also collected data on the five most common non-programming hard skills:

Top Non-Programming Hard Skills in 2021-22

| Non-Programming Skill | Graduates |

|---|---|

| Photoshop | 9,610 |

| Figma | 6,024 |

| User Experience | 6,070 |

| Project Management | 5,871 |

| User Interface Design | 4,362 |

The data reflects that in-demand tools in the web design field, such as Photoshop and Figma, are just as prevalent among bootcamp graduates as coding technologies like MySQL and Git. This result supports the idea that a significant number of students are taking advantage of increasingly diversified coding bootcamp course offerings, especially those that include UX and UI design training, although it is also important to note that web design skills are also occasionally covered in more coding-based web development courses.

Top Soft Skills in 2021-22

In the interest of preparing well-rounded graduates that are attractive to potential employers, most bootcamps incorporate soft skill training into their curriculum. Some assign collaborative group projects that mimic a real-world workplace environment or include workshops on networking and interpersonal skills. The most common soft skills reported by bootcamp graduates include:

| Soft Skill | Graduates |

|---|---|

| Teamwork | 34,766 |

| Leadership | 6,827 |

| Communication | 3,131 |

| Management | 2,143 |

| Problem Solving | 973 |

This list of soft skills shares significant overlap with our previous findings, with skills related to leadership, management, and teamwork remaining especially prevalent.

In addition to incorporating soft skills into the main body of the bootcamp program, many coding schools provide students with job search training that includes non-technical skills such as how to build a resume, communicate one’s strengths in a job interview, and network effectively.

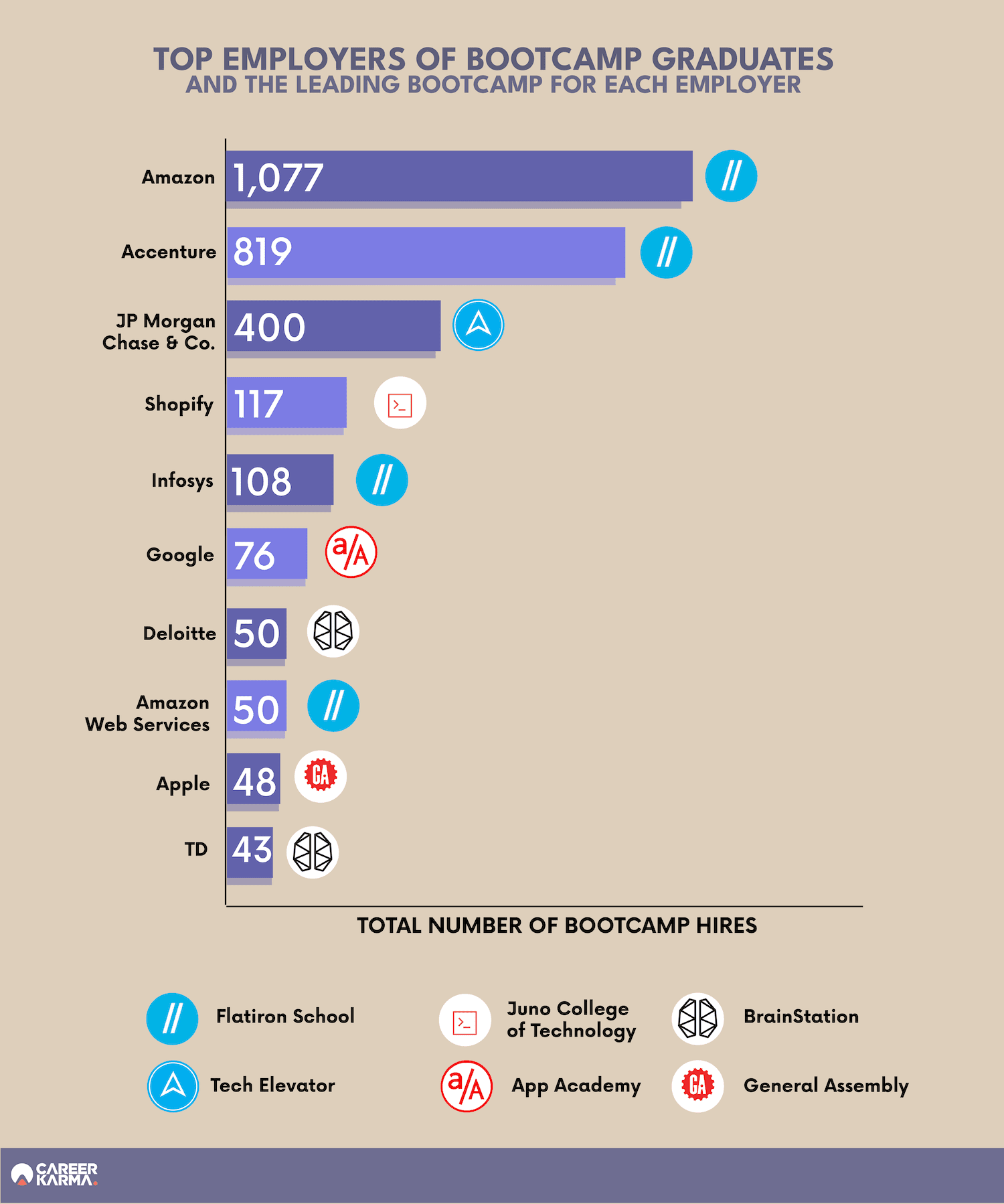

Top Bootcamp Employers

At a time when the tech industry is going through a significant upheaval, it is especially important to evaluate bootcamp outcomes and assess whether this learning model is still an effective path toward tech employment. The results of our LinkedIn research show significant changes in where bootcamp graduates are getting hired that reflect the evolving bootcamp space and speak to the benefits of such an adaptable model.

Top Employers of Bootcamp Graduates in 2021-22

| Company | Bootcamp Graduates Hired | Top North American Bootcamps |

|---|---|---|

| Amazon | 1,077 | Flatiron School Kenzie Academy |

| Accenture | 819 | Flatiron School Ironhack |

| JP Morgan Chase & Co. | 400 | Tech Elevator Thinkful |

| Shopify | 117 | Juno College of Technology BrainStation |

| Infosys | 108 | Flatiron School Woz U |

| 76 | Galvanize App Academy | |

| Deloitte | 50 | BrainStation Ironhack |

| Amazon Web Services (AWS) | 50 | Flatiron School Galvanize |

| Apple | 48 | General Assembly Thinkful |

| TD | 43 | BrainStation Lighthouse Labs |

One of the most obvious results reflected in this data is that the traditional tech giants that made up the top employers of bootcamp graduates in our previous reports show signs of being replaced by comparatively smaller companies. Google and Apple have slid down the list while Meta, Microsoft, and IBM are absent from the table altogether.

While bootcamp graduates may not be finding employment straight away at tech giants as often in 2022 and 2023 due to hiring freezes after large layoffs, that doesn’t mean they aren’t getting hired or that the bootcamp model is no longer effective. It is simply an indicator that bootcamps today have adapted and diversified to better serve graduates who are entering a changing job market.

When coding bootcamps first emerged as a learning model in the early 2010s, most were consolidated in traditional tech cities, perfectly situated to funnel students into rapidly growing tech giants. The first major bootcamp, General Assembly, was founded in 2011 in New York City. App Academy, Flatiron School, and Bloc quickly followed in 2012, all with headquarters in San Francisco or New York City, right around the time when companies like Apple, IBM, and Google began dropping the degree requirement for tech roles.

In today’s economy, massive tech companies are far more conservative with their hiring, but that is not the full picture of the current state of the tech economy. For example, CompTIA’s State of the Tech Workforce report predicts a net increase of 272,323 new tech jobs in 2023. So, while some household-name companies have significantly reduced hiring, tech skills are no less in demand now than they were before the pandemic.

Metropolitan areas including Seattle, Salem, Little Rock, Washington DC, and Richmond saw an increase in tech job postings in February of 2023 compared to January of 2023, and tech employees who lost their jobs during the pandemic had little trouble identifying new opportunities. A ZipRecruiter survey from 2022 found that 79% of recently laid-off employees found new jobs in tech within three months. Within six months, that number increased to 95%.

Amid an explosion of ecommerce, digitalization, and remote communication, tech skills are in demand in nearly every industry. As a result, opportunities in tech are less confined to the same handful of companies and are far more geographically diverse than they used to be.

Strengths of the Bootcamp Model

Career services, especially employer networks, are a common feature of coding bootcamps and have proven integral to graduates’ success. Bootcamps are familiar with the needs of potential employers in their area and often form hiring partnerships that make it significantly easier for graduates to land their first jobs. In fact, a large number of bootcamp graduates who have been hired by tech giants, such as Amazon, attended schools that have standing partnerships with the company.

Kenzie Academy, located in Indianapolis, IN, works with Amazon to train employees through the Amazon Technical Academy. This relationship provides the school with unique insight into the exact skills Amazon is looking for in new developers, and as a result, Kenzie Academy has been able to place over 300 graduates at Amazon in the last two years. Tech Elevator in Cincinnati, OH, has successfully placed over 100 graduates with JP Morgan Chase & Co, also due to a standing hiring partnership.

Most major bootcamps have a widespread hiring network that can include everything from small-scale startups and local companies to Fortune 100 corporations. Ironhack has over 600 hiring partners while BrainStation has over 6,500. By actively seeking diverse pathways to employment, coding bootcamps aren’t reliant on the same tech giants to hire the majority of their students. Bootcamps can thrive in less traditional metropolitan areas by building strong hiring partnerships with local companies that are eager for tech talent while simultaneously maintaining and growing relationships with large and small businesses all over the country.

Top Cities for Bootcamp Students

The goal of this section is to investigate which cities and metropolitan areas across the country and worldwide have significant concentrations of bootcamp graduates. While previous iterations of our State of the Bootcamp Market Report analyzed the geographic locations of all bootcamp graduates, we are focusing exclusively on students who graduated in 2021 and 2022 to ensure our conclusions reflect recent trends.

Top US Cities for Bootcamp Graduates in 2021-22

Below, we list the top 15 US metropolitan areas with the highest number of recent bootcamp graduates. These data reflect where graduates currently live, not necessarily where they studied.

| Location | Graduates |

|---|---|

| New York City Metropolitan Area | 8,819 |

| San Francisco Bay Area | 2,712 |

| Rochester, New York Metropolitan Area | 2,103 |

| Los Angeles Metropolitan Area | 1,280 |

| Greater St. Louis | 1,029 |

| Nashville Metropolitan Area | 862 |

| Greater Indianapolis | 832 |

| Portland, Oregon Metropolitan Area | 778 |

| Denver Metropolitan Area | 745 |

| Salt Lake City Metropolitan Area | 717 |

| Greater Seattle Area | 687 |

| Greater Minneapolis-St. Paul Area | 605 |

| San Antonio, Texas Metropolitan Area | 585 |

| Kansas City Metropolitan Area | 535 |

| Columbus, Ohio Metropolitan Area | 527 |

Compared to our previous report, recent bootcamp students are far less congregated in traditional tech hubs. While New York City and San Francisco still unsurprisingly stand out as top cities, a number of less expected areas are quickly gaining ground, even surpassing cities like Seattle with well-established tech labor markets.

It is undeniable that a surge in remote work and online learning has had a significant effect on this data. Nearly every major coding bootcamp now offers an online option, which was not the case three years ago. Students from anywhere in the country can access a bootcamp education and find remote employment without having to relocate. However, similar to our discussion on bootcamp graduate employers, the geographic diffusion of graduates is also a symptom of coding bootcamps adapting to address an evolving market.

Brookings reports that the pandemic years caused a shift in the tech industry, temporarily slowing job growth in traditional tech hubs and diffusing tech activity to a wider set of places, identifying Atlanta, Dallas, Denver, Miami, Orlando, San Diego, Kansas City, St. Louis, and Salt Lake City as cities that saw significant positive growth. For example, St. Louis saw an increase in its tech growth rate from 3.9% in the period spanning 2015 to 2019 to 4.8% in 2020 alone.

Up-and-coming metropolitan areas in the tech industry correspond closely with the cities where we find rising numbers of bootcamp graduates. It is no coincidence that many of these cities also host thriving coding bootcamps. Kenzie Academy in Indianapolis, LaunchCode in St. Louis and Kansas City, Nashville Software School in Nashville, and The Tech Academy in Portland all appear on our list of the fastest-growing coding bootcamps by number of students.

Top US States for Bootcamp Graduates in 2021-22

| Location | Graduates |

|---|---|

| California | 10,505 |

| New York | 8,879 |

| Texas | 3,068 |

| Missouri | 1,450 |

| Washington | 1,255 |

| Ohio | 1,181 |

| Tennessee | 1,093 |

| Indiana | 1,037 |

| Colorado | 899 |

| Utah | 716 |

| Oregon | 709 |

| Minnesota | 590 |

| Pennsylvania | 484 |

| Michigan | 472 |

| Florida | 415 |

The trend of up-and-coming corners of the tech market hosting large numbers of bootcamp graduates remains true at the state level. Texas, in third place after California and New York, hosts a tech scene that has been growing for years in cities like San Antonio, Austin, and Dallas. The state has a projected tech job growth rate of 4.4% for 2023, according to the CompTIA State of the Tech Workforce report.

Missouri, home to Kansas City and St. Louis, ranks ahead of Washington, despite Seattle’s reputation as one of the most important tech hubs in the world. Ohio is another state growing in prominence. In 2022, Intel began work on two new semiconductor plants in Columbus, OH. In the same year, venture capitalists invested $110 million into Columbus startups.

While coding bootcamps in traditional tech cities are still prominent in the industry, and many graduates are still able to kick off careers at giant tech companies, new trends show that coding bootcamps are also able to thrive and support students in non-traditional areas by quickly adapting to where the demand for tech skills is growing and by forging strong partnerships with companies of all sizes to take advantage of employment opportunities wherever they appear.

Top Countries for Bootcamp Graduates in 2021-22

While the US is home to more bootcamp students than any other country, the bootcamp model continues to expand internationally. The tables below provide further information about where coding bootcamps are rising in prominence globally.

| Country | Graduates | Area With Most Graduates |

|---|---|---|

| United States | 75,598 | New York Metro (8,819) |

| Argentina | 57,513 | Greater Buenos Aires (35,724) |

| France | 29,998 | Greater Paris (11,230) |

| Canada | 8,334 | Greater Toronto (3,575) |

| Spain | 8,175 | Greater Madrid Metro (2,402) |

| United Kingdom | 6,067 | London Area (1,689) |

| Germany | 4,819 | Berlin Metro (1,249) |

| Italy | 4,247 | Greater Milan Metro (1,007) |

| Kenya | 3,037 | Nairobi County (2,527) |

| Chile | 2,275 | Santiago Metro (1,217) |

With over 57,000 bootcamp graduates, Argentina has a flourishing bootcamp scene. Le Wagon, Coderhouse, Digital House, and MindHub are just four of the bootcamps with campuses in Buenos Aires. Some coding bootcamps, such as Le Wagon, Ironhack, and Nucamp, are designed to accommodate international students and host communities and campuses in major cities all over the world, including Paris, London, Toronto, Buenos Aires, and Madrid.

Canada is another country that has embraced the bootcamp model. Juno College of Technology and Lighthouse Labs, which both have locations in Toronto, shared a combined 1,701 total graduates in 2022 and both bootcamps have successfully placed graduates at companies like Shopify and TD. Ironhack, with ten campuses worldwide and over 600 partner companies, has placed students at international companies including Accenture, Capgemini, and Deloitte.

Coding Bootcamps in 2023: Navigating the Post-COVID Economy

The pandemic years marked a period of significant change for coding bootcamps, forcing schools to quickly respond to online learning and unprecedented economic forces. Now that the dust is settling, bootcamp providers have the opportunity to reflect and adapt to the changing demands of the industry.

Mixed Signals in the Tech Labor Market

The last few years have seen a fluctuating tech industry, often marked by seemingly contradictory messages and an air of uncertainty. In 2022, About 150,000 workers were laid off in the tech sector, with companies of every size making drastic cuts. However, data from Business Insider shows that many tech giants, including Alphabet, Meta, Amazon, Microsoft, and Salesforce, have grown in their headcounts compared to pre-pandemic numbers.

There are many reasons to explain mass layoffs. Companies like Meta are likely scaling back as a result of overhiring during the pandemic years. Others attribute the trend to social contagion, claiming that businesses are laying off employees primarily because they see everyone else doing it. Despite concerning headlines, unemployment is hovering around a half-century low and CompTIA projects a net growth of 272,323 new jobs in the tech industry in 2023.

Looking further into the future, BLS predicts that computer and information technology occupations have a job growth rate of 15% over the next decade. Specific corners of the information sector have even more promising growth rates. Tech salaries have also been trending upward, implying sustained demand. Dice reports that the national average tech salary increased by 2.3% between 2021 and 2022, noting particularly significant wage growth in cities including Phoenix, Tampa, Portland, Columbus, and Charlotte.

It may be accurate to say that the tech industry is reshuffling rather than stumbling. Amy Glaser, senior vice president at Adecco, a human resources and staffing firm, recently observed:

In reality, it’s more of a rebalancing from the white-hot market post-pandemic. We’ve heard a lot about layoffs, but there were still so many unfilled jobs in the tech sector that what we’re seeing is a lot of folks who have been displaced or lost their jobs in the last few months, are very quickly finding new opportunities.

Gartner’s IT spending forecast predicts that demand for tech talent will significantly outstrip supply until at least 2026, naming data science, software engineering, and cyber security as areas where the talent supply remains especially tight. Surging fields like artificial intelligence are creating new occupations, such as “prompt engineer,” that did not exist a few years ago. These new fields often require a mix of traditional programming skills and an extensive understanding of emerging technologies like generative AI.

Despite fears that newly-developed AI technology might replace tech jobs like programmer and software developer, many experts believe that AI advancement is more likely to act as an aid to tech workers, citing its inability to make eloquent, thoughtful decisions as a major limitation. Continually advancing AI tools will likely affect the tech job market in unpredictable ways in the years to come, but that doesn’t have to mean a decline in demand for tech skills. It might simply lead to modifications to previous roles or an emergence of newly sought-after skills.

Coding Bootcamps and Their Response to Signals in the Job Market

The coding bootcamp industry has continued to grow over the past few years, despite its being a turbulent period for the tech sector. Our analysis suggests that the software development skills currently being covered in the majority of coding bootcamp programs will remain in demand and will help graduates remain competitive in the job market. This may be especially true if bootcamps continue to develop diverse course offerings in fields like data science and cyber security.

We have discussed how flexibility and the ability to frequently update course curricula is a major benefit of the coding bootcamp model. Seattle bootcamp Code Fellows provides an example of this in action. The school recognizes how new AI tools are reshaping the tech industry and, in response, has integrated tools like ChatGPT into its curriculum.

Recent Gallup polls shine some light on how students have benefitted from the education they received from 2U-powered bootcamps, with one reporting that students had a median income growth of 17% in the year following graduation. Another reveals that 86% of polled students say they reached a positive outcome as a result of their program. Additionally, a Forbes report explores how many of the careers students prepare for in coding bootcamps are known to be particularly recession-proof, including software developer and data scientist. These are roles that are essential in nearly every industry, making these workers resilient in the face of layoffs.

A topic that is directly relevant to coding bootcamp graduates and their success on the job market is degree requirements, especially as bootcamps are often seen as an alternative to traditional universities. The Burning Glass Institute investigated degree requirements in tech roles advertised by various major tech companies. While the report shows there is room for growth in this area at some companies, it also found notable progress. For example, only 31% of software developer roles at IBM had a degree requirement. At Accenture, the number was 40% for the same role.

Coding Bootcamps Beyond 2023: What Does the Future Hold?

Learning from the lessons of COVID, coding bootcamps are pursuing paths toward sustained success and accessibility. These include completing the transition to online modes of instruction, experimenting with innovative pedagogical and workforce training strategies, and figuring out how to embrace accreditation without sacrificing the versatility and efficiency of their programs.

Growth and Enhancement of Online Training and Services

The demand for online learning has increased significantly in the wake of the COVID pandemic. Venture funding for education technology in the US grew from $1 billion to $8 billion between 2017 and 2021, the largest online universities have seen an 11% average increase between 2019 and 2020, and enrollment in MOOCs exceeded 220 million learners in 2021.

It should come as no surprise that coding bootcamps are riding this wave. Leading educational technology company 2U acquired edX in 2021 for $800 million. The deal paved the way for edX to replace Trilogy, another 2U property, as the top provider of university bootcamps. Bringing its long history of delivering online versions of name-brand college courses to its new base of over 50 university partners, edX is solidifying the trend toward elearning in the bootcamp space. For a full rundown of acquisitions within the bootcamp space since our last report, see Appendix B.

The online bootcamp trend has been solidified by other recent business activity, from the purchase of Kenzie Academy by Southern New Hampshire University (SNHU) in March 2021 to Perdoceo’s $52.8 million acquisition of Coding Dojo in February 2023. Both SNHU and Perdoceo specialize in online college degrees, and their investment in bootcamps extends the reach of their online higher education services to non-degree career pathways. As the gap between college degrees and bootcamp certificates continues to narrow in the minds of employers, the universality of remote options for workforce training will only strengthen the opportunities and prospects of bootcamp students.

These developments have accelerated the move away from in-person bootcamps. Back in our 2020 report, we noted that only 13 of the 105 bootcamps we studied offered online options. Now, coming out of the pandemic years, online options are nearly universal, with fewer schools offering an on-campus option at all. Furthermore, many of the pioneers of online bootcamp education, such as Springboard, CareerFoundry, and Thinkful, are now among the largest bootcamps in the industry. Their success proves that schools do not need to offer in-person education, or attempt to simulate it, to remain competitive in the bootcamp market.

Other successful schools that got their start as in-person bootcamps have utilized virtual campuses as a way of maintaining the benefits of traditional in-person learning. Schools such as General Assembly, Flatiron School, Coding Dojo, App Academy, and Fullstack Academy offer instructor-led remote classes that allow for a higher degree of interaction between peers and instructors. Virtual attendance is often just as important as with in-person lessons and students can benefit from the structure and guidance that is lost in self-paced programs.

It is relevant that remote work is on the rise in the tech industry as well. The 2022 Stack Overflow Developer Survey found that 85% of developers worked at least partially remotely. Gartner reports that, by the end of 2023, 71% of the US workforce will be made up of hybrid and remote knowledge workers. If employees in top tech careers continue to perform significant portions of their responsibilities online, perhaps it makes sense for them to train for these roles remotely as well.

Whatever is lost in the shift away from in-person forms of learning and working, the continued growth of the bootcamp market shows that the added convenience of online education has thus far been a bargain that students are willing to make. It is clear that students are ready to take advantage of high-quality online higher education, and now that the vast majority of coding bootcamps have embraced distance learning, online bootcamps won’t be going anywhere.

Innovations in the Bootcamp Model of Education

The bootcamp model is notable for its ability to adapt, whether it be to match the needs of the market, incorporate new modes of education, or to increase accessibility and better meet the needs of adult learners. Recent innovations in the bootcamp model appear to be driven, to a large extent, by these themes.

Increased Flexibility of Program Offerings

While a certain degree of increased remote instruction can undoubtedly be attributed to the COVID-19 pandemic, the fact that online programs have become so pervasive past the point where they are strictly necessary suggests that they have pedagogical or market value in their own right.

Perhaps the most significant benefit of online learning is increased accessibility, ensuring students are no longer limited by geography if they want to attend a program. Additional innovation within the context of remote learning has allowed coding bootcamps to expand upon this accessibility, offering such a wide range of scheduling options that nearly every adult learner could theoretically fit a bootcamp into their timetable.

Part-time and self-paced bootcamp programs are more common than ever before. While some simulate the experience of immersion, providing live online instruction, and requiring regular attendance, others seem perfectly designed for full-time employees or busy parents who need the flexibility to move through the curriculum on their own schedule. The experience of attending an online bootcamp is, to some degree, customizable. With the level of variety available, students can choose a program while taking their personal learning preferences and scheduling needs into account.

On a similar theme of making training more accessible to adult learners, bootcamps have been offering a larger selection of courses in addition to a broader range of scheduling options. Providing programs in subjects like tech sales, cyber security, data analytics, and UX/UI design allows coding bootcamps to service an even larger population of students.

New Pedagogical Methods

As previously discussed, self-paced curricula are rising in popularity, especially when paired with 1:1 or 1:2 mentorship. Offering a prepackaged curriculum allows coding bootcamps to keep their costs down, which translates to more affordable programs for students. The promise of personalized support from mentors or teaching assistants helps self-paced coding bootcamps differentiate themselves from MOOCs and reassures hesitant students that they will have the support and guidance they need, even in the absence of live, instructor-led classes.

Some coding bootcamps, including Launch School and V School, have also been experimenting with mastery-based learning, which is an instructional approach where students must prove they have achieved a certain level of competence with a skill before moving on to the next. Ideally, this technique ensures that learners have the time they need to truly master foundational skills, resulting in graduates who will retain more knowledge than students who have rushed to cover as many skills as possible in a set amount of time.

Online bootcamps that employ mastery-based learning come with many of the same benefits as more traditional self-paced programs. Importantly, they also provide a more customized learning experience, where students are able to move quickly through topics that come easy to them and slow down on skills that require additional work. This individualized approach has the potential to appeal to students in the same way they are drawn to 1:1 mentorship.

Bootcamp Apprenticeships and Employer Networks

Over the last two years, employer networks have proven vital in helping bootcamps place recent graduates in their first tech roles. Some bootcamps have been able to use their strong relationships with relevant businesses to offer students apprenticeship and internship opportunities. This provides students with real-world experience to put on their resumes, increases their personal professional networks, and can ease the transition between graduation and landing a tech job.

Code Platoon, for example, works with its sponsors to provide apprenticeship opportunities in Chicago for students enrolled in its immersive software engineering program. Founders and Coders offers paid apprenticeships that last 12-15 months after students complete the initial 12-week bootcamp. Another example is CodeStack Academy, where students are guaranteed an internship during the final two months of their training.

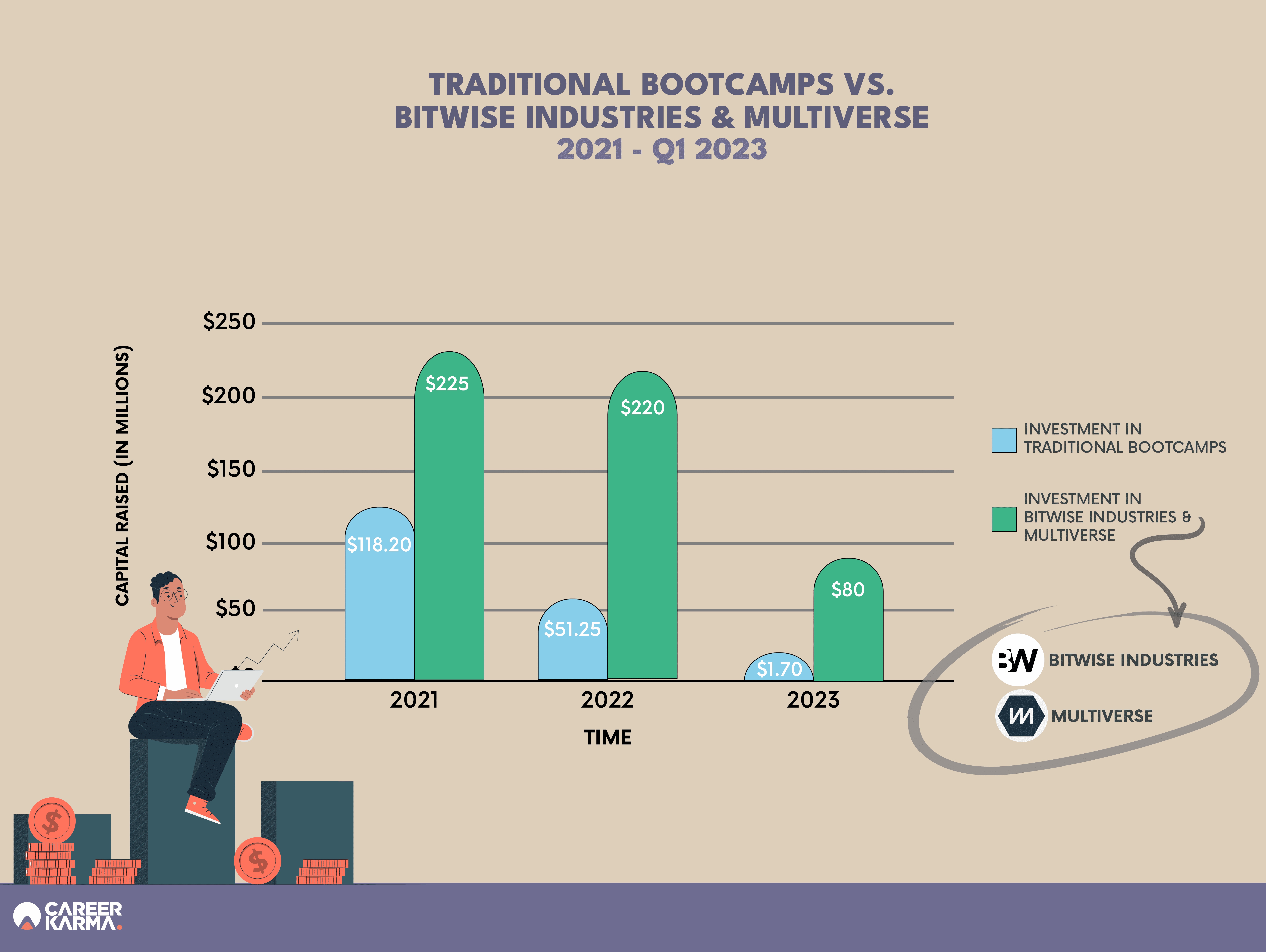

Two other companies, Bitwise Industries and Multiverse, have reinforced their bootcamp businesses by embracing tech apprenticeships. Since the start of 2021, they have raised a combined $525 million in venture capital (see chart below), with Multiverse raising $220 million and Bitwise raising $80 million in their most recent investment rounds. For more information and context about venture funding in the bootcamp space, see Appendix C and Appendix D.

The strong training and apprenticeship programs of Multiverse and Bitwise Industries are an extension of what bootcamps do best: recruit people from diverse backgrounds and underserved communities, and then provide them with skills and support to develop and deliver solutions that are needed right now.

Research shows that apprenticeships are extremely beneficial in training students for jobs that are relatively new in the labor market and are an effective way of improving diversity in the talent pipeline. Similar to coding bootcamps, apprenticeships in the tech sector are able to teach industry- and employer-specific skills and evolving technologies that traditional schools struggle to stay current on.

A study on LaunchCode, a US coding bootcamp that offers a free, paid apprenticeship targeted toward minorities, found that graduates had a STEM employment increase of roughly 50% and saw an average income increase of $20,000. However, these effects were only observed in students who completed both the bootcamp and the accompanying apprenticeship.

Bootcamp apprenticeship programs ensure students build close relationships with potential employers and have the chance to practice essential skills, a continuation of the industry’s longstanding commitment to building bridges between training and employment.

New Forms of Accreditation for Coding Bootcamps

The process of accreditation by which the United States higher education system establishes regulatory standards has not historically applied to coding bootcamps. The pace of innovation in the tech industry is not conducive to the glacial review process, and most bootcamps prefer, rather than stymie curricular development, to prove their worth to prospective students by other means.

The industry has long preferred internal regulation as a means of validating its product, primarily through transparent publication and independent verification of graduate outcomes. In 2016, a group of 11 leading bootcamps created the Council of Integrity in Results Reporting (CIRR), which worked to develop a clear set of reporting criteria that could be used to measure success across the industry. CIRR outcomes data is freely available to the public.

But CIRR remains just one path to regulation. Additional, external forms of accreditation can further increase consumer confidence in the value of bootcamp education, whether that be formal accreditation by third-party organizations, tighter links between training programs and post-graduation employment, or stronger partnerships with local governments. Here are five concrete examples of newer ways that bootcamps are signaling the value of their programs:

- Codeup, formal accreditation under the US Department of Education. In November 2022, Codeup became accredited by the Middle States Association Commissions on Elementary and Secondary Schools (MSA-CESS). In doing so, it became one of the first coding bootcamps, and the first in Texas, to achieve validity in the eyes of the United States government. Codeup founder Jason Straughan decided to pursue this high level of accreditation in order to “prove to the industry that [it is] doing something quality.”

- Kenzie Academy, formal accreditation through its affiliation with Southern New Hampshire University (SNHU). After being acquired by SNHU in 2021, Kenzie Academy made its tech bootcamps part of the university’s academic offerings, rebranding them as accelerated certificate programs. Because these programs are accredited, Kenzie Academy’s students are eligible for federal financial aid and can fill out the Free Application for Federal Student Aid (FAFSA), something that most bootcamps cannot offer. Students who complete one of Kenzie Academy’s bootcamps are also awarded college credit, which they may apply towards an SNHU degree program if they so choose.

- Coding Temple, eligible for federal student aid through the Workforce Innovation and Opportunity Act (WIOA). While most forms of federal student aid are only available to students of accredited programs, WIOA is an exception in that some unaccredited bootcamps can get access to it. Only unemployed or dislocated students are eligible for these federal grants, but the fact that Coding Temple is approved under WIOA means that the law recognizes the value of the program in helping students who have fallen on hard times land on their feet.

- Nucamp, informally regulated by a private alternative to formal accreditation. Nucamp’s alternative to formal accreditation, similar to CIRR but more independent, is the Workforce Talent Educators Association (WTEA). WTEA’s COO Joseph Kozusko has praised Nucamp for “breaking past the traditional bootcamp model to approach outcomes in a way that gives voice to the learner, employer, and their shared workforce outcome.

- CodeStack Academy, fed through a local government agency’s apprenticeship program. Through its affiliation with the San Joaquin County Office of Education, CodeStack Academy not only keeps tuition costs down with government subsidies, but it also benefits directly from the county government’s investments in the local tech community. This is one of the only bootcamps that guarantees students a pre-graduation internship, described by local news as “160 hours of real-world apprenticeship with CodeStack development teams working on live, public facing projects.” Such guaranteed work opportunities function as concrete proof of bootcamps’ central value proposition.

Each of these forms of accreditation raises the bar for the bootcamp industry as a whole, improving its standing within the landscape of higher education. The increased focus on standards underscores bootcamps’ commitment to remaining a universally respected destination for tech-focused, skills-based training.

Conclusion

The success of the coding bootcamp model has always rested in its ability to connect students to high-paying tech jobs. By every quantifiable metric used in this report, the industry as a whole is keeping that central promise, proving resilient amid economic uncertainty. This is corroborated by the results of statistically rigorous surveys, such as those commissioned by 2U and conducted by Gallup, which have shown that bootcamp graduates go on to earn higher salaries and lead happier professional lives than before their programs.

As the bootcamp market has consolidated, tuition costs have stabilized. The inflation-adjusted average price of a tech bootcamp has decreased from $13,676 to $12,953 since our last report, and the variety of available financing options is at an all-time high. Even though income share agreements (ISAs) are now offered by only 23% of bootcamps, compared to 42% in 2021, 30% of bootcamps now offer forms of deferred tuition with repayment terms that students find easier to understand than ISAs. The share of bootcamps that offer these less complicated “buy now, pay later” contracts as one of their financing options will likely increase if ISAs continue to fade.

Responsiveness to industry trends continues to distinguish bootcamp programs from other forms of computer science and information technology education. Whereas almost all of the earliest coding bootcamps focused on software engineering and web development, the model has moved far beyond its coding-specific origins, becoming a versatile method of training for other in-demand tech fields. Over 53% of the bootcamp programs in our sample focused on a non-coding tech discipline, and we expect the share of data science, UX/UI design, and cyber security programs to catch up with traditional coding bootcamps in the coming years.

While many bootcamp graduates continue to congregate in tech hubs, such as New York City, the Bay Area, and Los Angeles, the number of graduates finding success in what one Brookings report calls “rising star metro areas” in the world of tech continues to grow.

Tech could be on the brink of spreading out, prompted by the COVID-19 pandemic and remote work. Specifically, the continued growth of the rising star metro areas—as well as accelerated job growth in dozens of other metro areas during the pandemic—suggests the possibility of a genuine adjustment of the nation’s highly concentrated tech geography in the coming years.

A number of the “rising star metro areas” Brookings named in its report have appeared on our list of the top cities for bootcamp graduates for the first time, including St Louis with 1,029 grads, Nashville with 862, Salt Lake City with 717, and Kansas City with 535. Significantly, these same locations are also home to some of the fastest-growing coding bootcamps in the industry. All of this suggests that, if tech trends continue in the direction they are going, bootcamps could be well-positioned to meet the needs of the market in coming years.

Overall, the proliferation of self-paced programs, the nearly universal adoption of online instruction, the rise of personalized mentorship, the renewed commitment to robust career services, and the industry’s convergence around a set of reliable and reproducible standards are allowing bootcamps to identify and train more people in more places than ever before. As a result, tech communities throughout the country and around the world are benefitting from an infusion of the most diverse body of highly skilled tech talent in human history.

Appendix A: Detailed Methodology and List of Bootcamps

To construct the fullest possible picture of the coding bootcamp market in 2023, we collected and analyzed three types of data: (1) numbers of bootcamp graduates in 2021, 2022, and all time; (2) bootcamp tuition costs and financing options as advertised in early 2023; and (3) investment and acquisition activity within the bootcamp space from 2021 through March 2023.

For (1), we used LinkedIn, from which we collected information about the recent alumni of 107 bootcamps, such as the number of graduates, their tech and soft skills, the companies for which they work, and the places where they live. For (2), we used 115 bootcamp websites, from which we manually collected tuition and financing data. For (3), we scoured Crunchbase’s database of publicly available financial and business transactions.

To situate our data within a broader context, we also sifted a wide range of secondary sources. These sources included news about particular bootcamps, news and analysis about tech industry trends, assessments of the post-COVID economy, and research papers and reports about trends in higher education and distance learning.

Because the bootcamp market continues to evolve, the sample of schools that we analyzed is larger than in our last report. In 2021, we collected tuition data from 101 schools, 86 of which had LinkedIn pages from which we were able to scrape, organize, and analyze graduate data in a meaningful way. This year, we collected tuition data from 115 schools, 107 of which had LinkedIn pages with usable alumni information. We also took note of nine schools that closed since our last report and tracked the business activity of 37 others, for a total of 161 bootcamps.

Of the 115 schools from which we collected tuition data, there were: 99 for-profit coding schools that offer a software engineering or web development program; 10 for-profit bootcamps that specialize in other tech subjects, such as data science, cyber security, UX/UI design, or product management; and 16 non-profit bootcamps with free or heavily subsidized programs. In addition to developing our most complete understanding of bootcamp costs to date, we used this opportunity to learn about the financing options currently available to students.

The limitations of our LinkedIn data are the same as they were last time. Because the bootcamp graduates in our dataset are self-reported, there is a slight bias towards bootcamps that emphasize LinkedIn profiles as part of their career services. The underlying data also fluctuates whenever users join or leave the platform. If on two consecutive days, for instance, we visit a bootcamp’s LinkedIn page and search for the number of graduates in 2022, it may show two different numbers, even though the actual number of 2022 alumni hasn’t changed since December 31, 2022. Since these fluctuations are likely to be randomly distributed across the entire bootcamp market, we believe the effect on the accuracy of our analyses is negligible.

The important thing is to collect the data all at once and use it consistently throughout, and we collected our graduate data from LinkedIn on March 10, 2023. On this basis, we guarantee the internal consistency of our data across the various sections of the report.

Below is a list of all 161 bootcamps from which we collected data for this report. Our graduate data are based on the substantial subset of these schools that both cater to students in the United States and have alumni sections on their LinkedIn pages. US schools from which we did not collect alumni data are marked with an asterisk (*). Schools with foreign headquarters whose graduate data we did not collect are marked with a dagger (†).

| Coding Bootcamps | Other Tech Bootcamps | Closed Since Last Report |

|---|---|---|

| _nology * 4Geeks Academy 10x Academy † Academy Pittsburgh Actualize Ada Developers Academy * Altcademy App Academy Aulab Srl † Austin Coding Academy Awesome Inc Betamore Bethel Tech * Bitwise Workforce Training * Bloom Institute of Technology BoiseCodeWorks Bottega BrainStation Burlington Code Academy Byte Academy Career Foundry Carolina Code School Claim Academy Cleveland Codes Code Fellows Code Immersives Code Institute † Code Platoon CodeBoxx CodeCrew Code School Coder Foundry * Codesmith * CodeStack Academy Codeup Codeworks Coding Dojo Coding Invaders by MentorsPro Coding Temple CodingNomads Covalence Cultivating Coders Deep Dive Coding * Dev Code Camp DevLeague Devmountain DevNation † DevPoint Labs DevX School * Digital House † DigitalCrafts Divergence Academy EBAC Online † Eleven Fifty Academy Epicodus Flatiron School Founders and Coders Fullstack Academy Galvanize General Assembly Grace Hopper Program Grand Circus Hack Reactor Hackbright Academy Hunter Business School Holberton School HyperionDev † JRS Coding School Juno College of Technology Inventive Academy Ironhack Jovian † Kenzie Academy Launch School LaunchCode LEARN Academy LearningFuze Le Wagon Lighthouse Labs Makers Academy Masai School † Mate Academy † Max Technical Training * Microverse Momentum Montana Code School Moringa School † Multiverse † Nashville Software School Newton School † Noble Desktop Northcoders † NPower Nucamp Operation Spark Ostad † PDX Code Guild Picstart Academy † Platform by Per Scholas Podium Education * Prime Digital Academy Pursuit Queens Tech Academy Recurse Center * Resilient Coders * Rithm School Rocket Academy † Sabio Savvy Coders Skill Distillery SkillFactory † Software Guild * Springboard StackFuel † The Tech Academy Tech Elevator Tech Talent & Strategy * Tech901 Techtonica * Thinkful TrueCoders Turing College * Turing School TurnToTech V School VeroSkills * We Can Code IT WeThinkCode_ † Woz U Zip Code Wilmington |

Beginex CeroUno † Climb Hire * CyberVista * Cybint † Data Application Lab * The Data Incubator Data Science Dojo * DataScientest † Designlab The Dev Masters * Evolve Security Academy FunctionUp † iNeuron.ai † Infosec Institute * NYC Data Science Academy Pathstream * Pentester Academy * Product Faculty Product School Rackspace Cloud Academy * The Data Incubator The Dev Masters * |

Alchemy Code Lab Digital Creative Institute * Edge Tech Academy Flockjay Make School Metis Redwood Code Academy Startup Institute * Tradecraft * |

Appendix B: Bootcamp Acquisitions, Q1 2021 – Q1 2023

The following information was compiled using Crunchbase and is current as of April 5, 2023.

| Company | Date Acquired | Acquirer | Transaction Details |

|---|---|---|---|

| Wyncode | January 2021 | BrainStation | Undisclosed price |

| Kenzie Academy | March 2021 | Southern New Hampshire University | Undisclosed price |

| Rackspace Cloud Academy | April 2021 | Codeup | Undisclosed price |

| edX | June 2021 | 2U | $800 million |

| Cybint | August 2021 | ThriveDX | Undisclosed price |

| Pentester Academy | October 2021 | INE | Undisclosed price |

| Burlington Code Academy | January 2022 | Upright Education | Undisclosed price |

| Infosec Institute | January 2022 | Cengage Group | $191 million deal |

| Code Republic | March 2022 | Picstart Academy | Undisclosed price |

| PrepBytes | March 2022 | CollegeDekho | Undisclosed price |

| CeroUno | June 2022 | Revelo | Undisclosed price |

| Aulab Srl | September 2022 | Multiversity Group | Undisclosed price |