Key Findings and Statistics

We evaluated data on 105 bootcamps and 133,392 bootcamp graduates to develop insights about the state of the bootcamp sector today, and our main findings are listed below. This data excludes university bootcamp graduate statistics, whose offerings differ enough to merit being included in their own section.

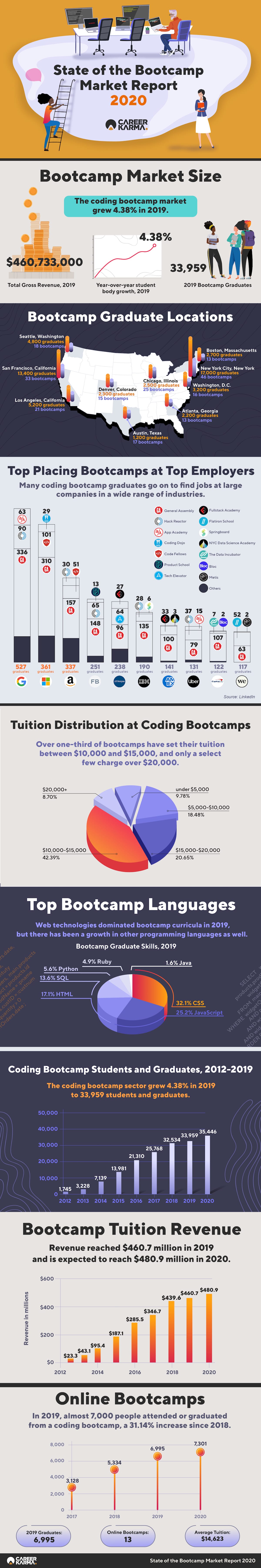

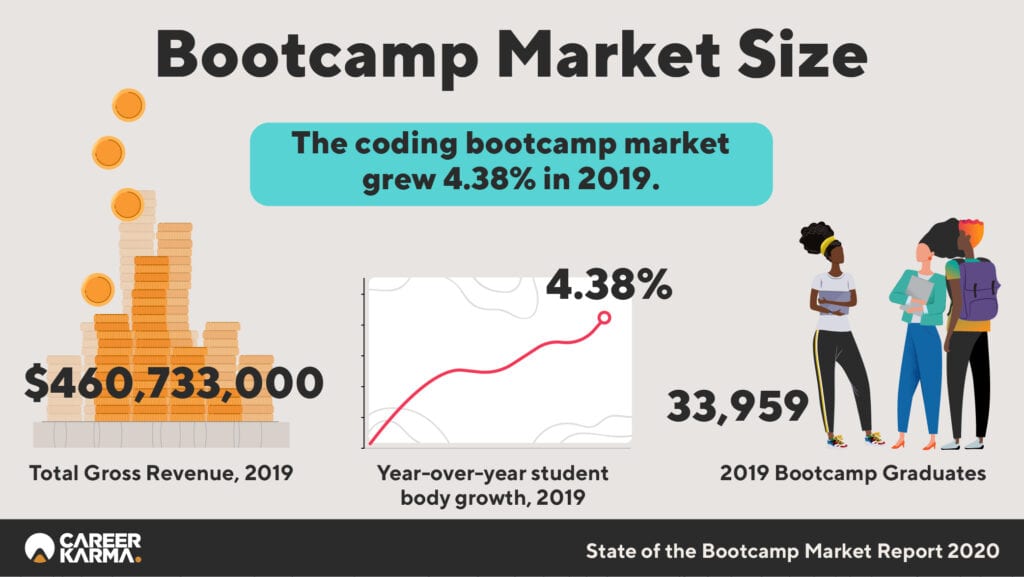

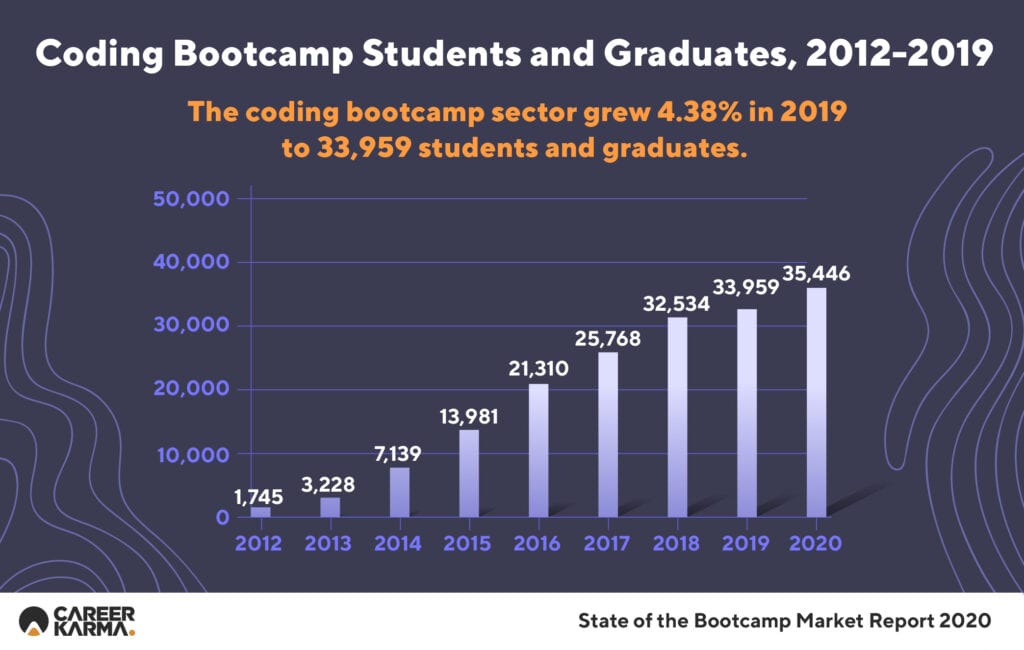

- Bootcamp Market size. In 2019, 33,959 students attended one of the 105 coding bootcamps studied in this market analysis, representing a 4.38% growth since 2018. In 2020, we expect the bootcamp sector to grow to an estimated 35,446 students.

- Bootcamp Revenue. Tuition revenue in 2019 was approximately $460,733,000, a 4.81% increase from $439,581,000 in 2018.

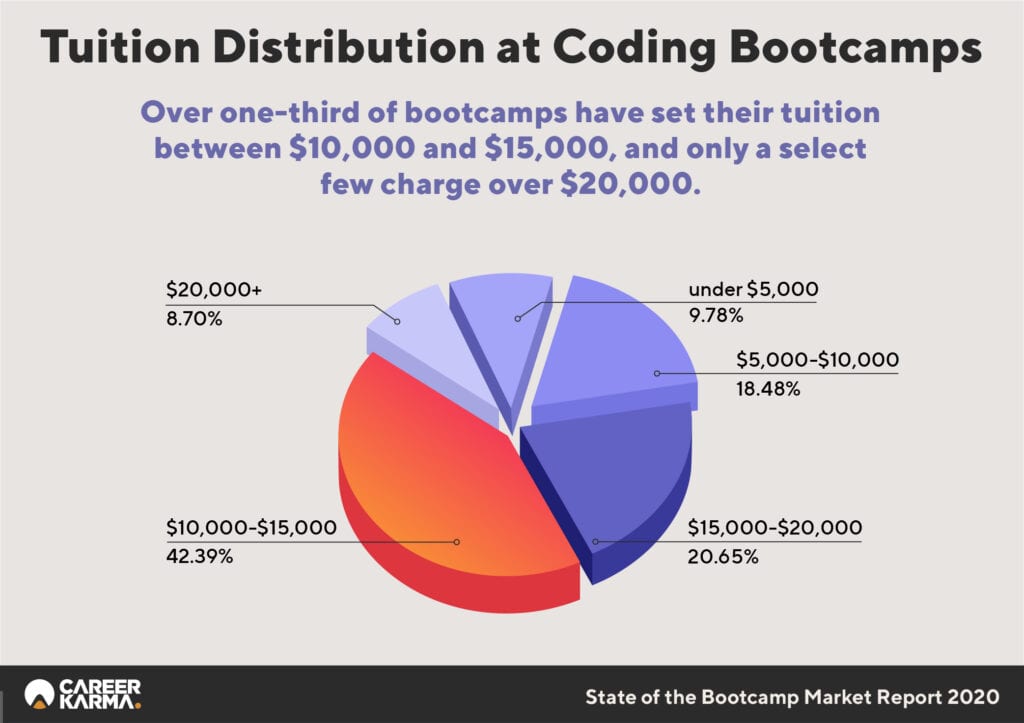

- Bootcamp costs and financing. The average in-person bootcamp cost $13,293 in the US in 2019. The most expensive full-time programs charged over $20,000 in tuition.

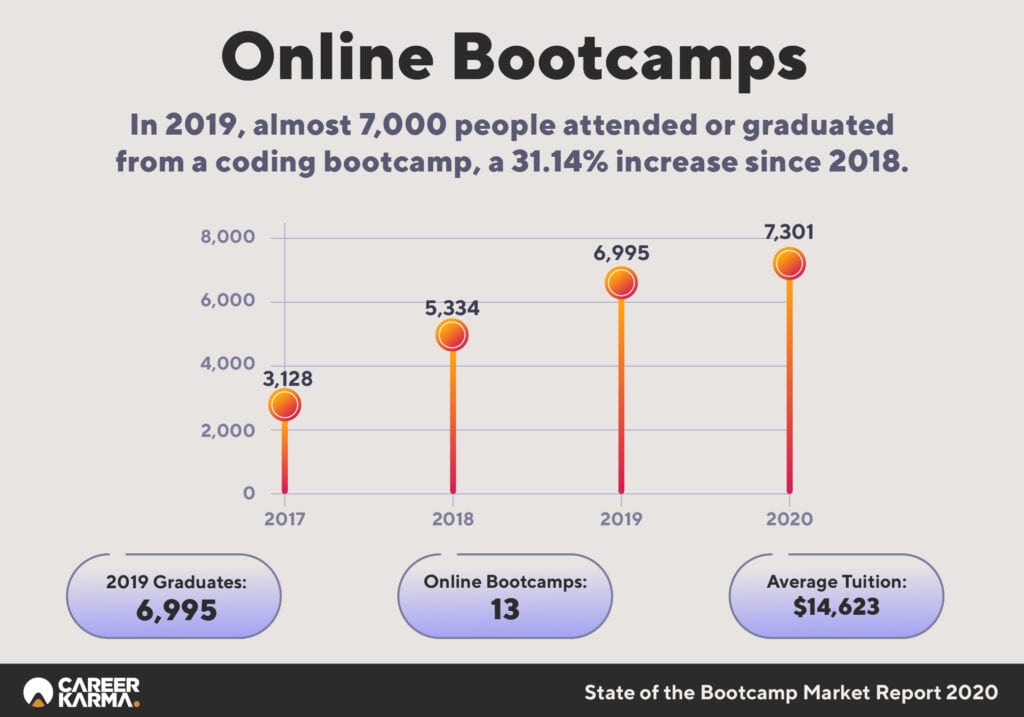

- Online bootcamps. In 2019, 6,995 students graduated from an online coding bootcamp, a 31.44% increase since 2018. The average tuition for these courses was $14,623.

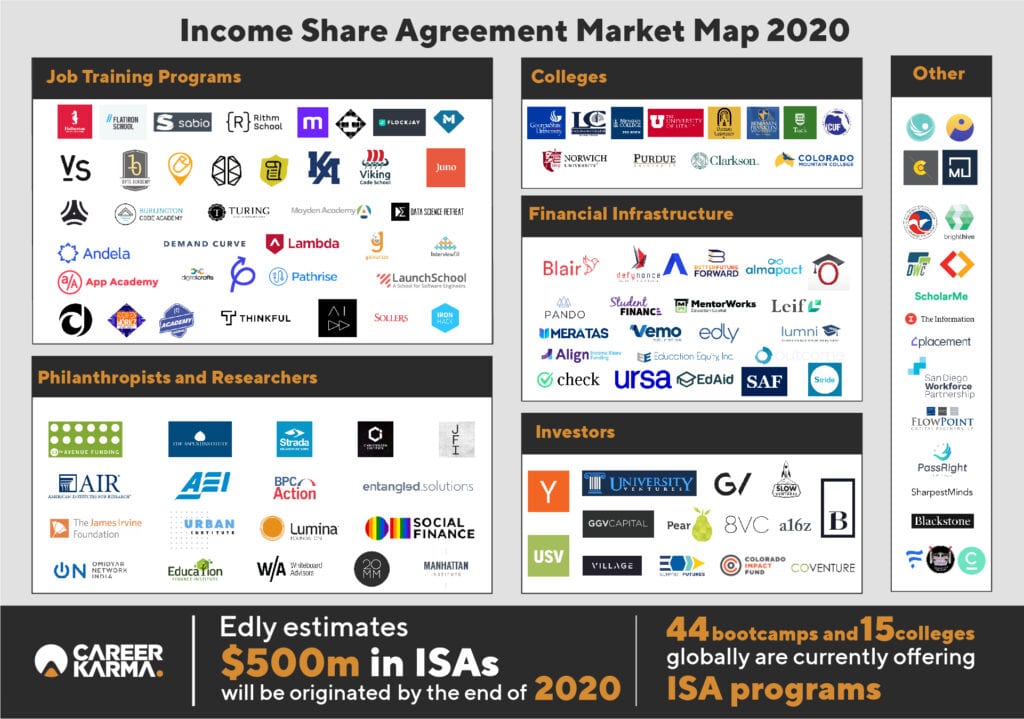

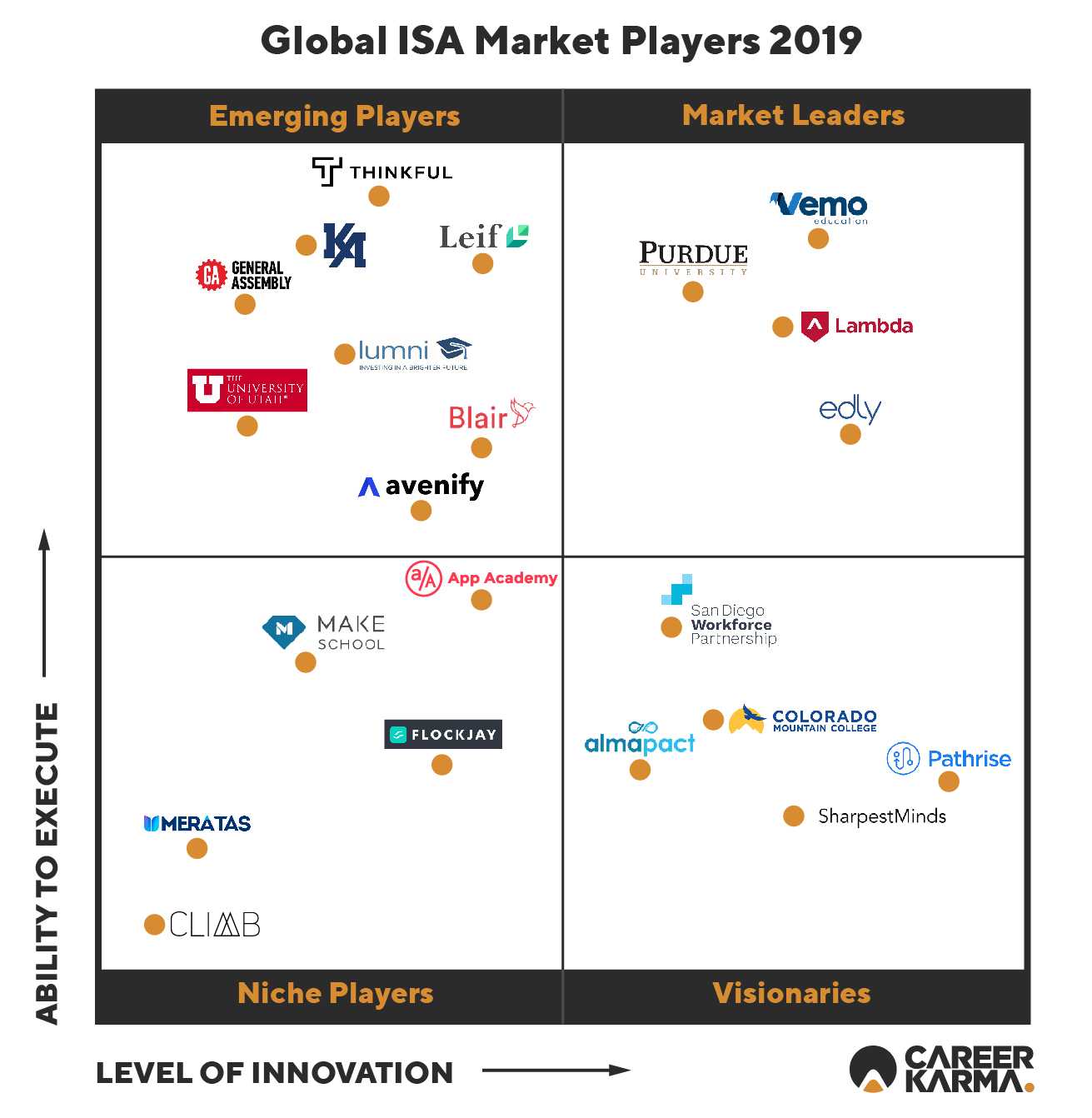

- Income Share Agreements (ISAs). In 2019, 27 US bootcamps offered ISAs to their students. The average terms were a 38 month term (length), $42,476 minimum income threshold, 13.8% income-share percentage, and a $32,754 payment cap.

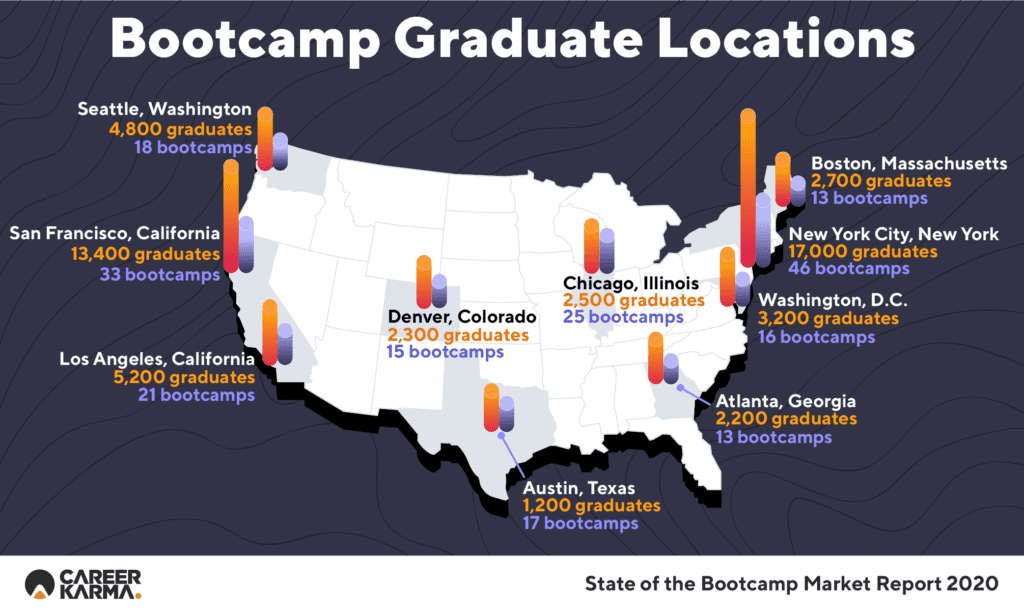

- Bootcamp graduate locations. The top five metropolitan areas in 2019 in terms of how many bootcamp grads are employed in each city were New York City (46 bootcamps), San Francisco (33 bootcamps), Los Angeles (21 bootcamps), Seattle (18 bootcamps), and Washington, D.C. (16 bootcamps).

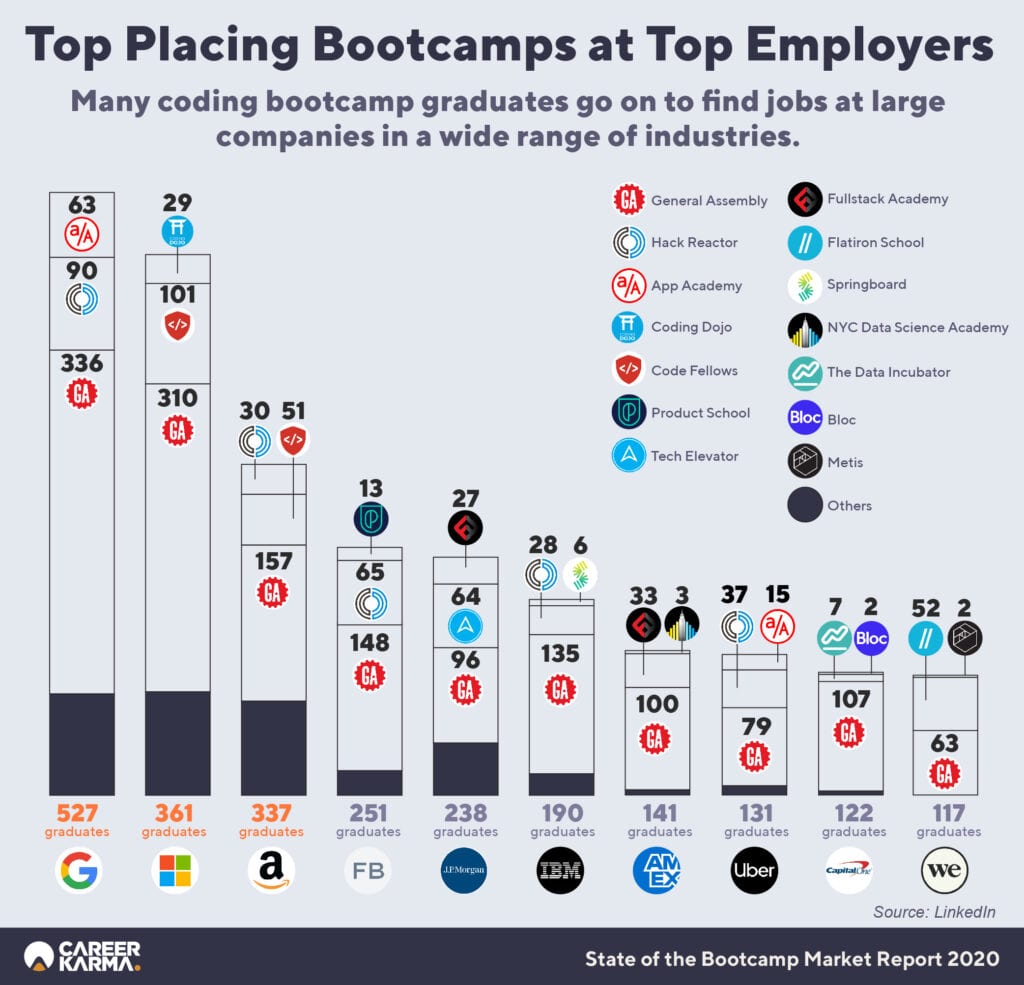

- Top employers. The five top companies who have hired the most bootcamp graduates as of 2019 were Google, Microsoft, Amazon, Facebook, and JPMorgan Chase & Co.

- Largest bootcamps. The ten largest bootcamps in terms of the total size of their student body in 2019 were General Assembly, Hack Reactor / Galvanize, Flatiron School, Ironhack, Bloc, Lambda School, App Academy, Springboard, Thinkful, and Fullstack Academy.

- Largest acquisitions. The top three acquisitions in the bootcamp sector in 2019 were 2U’s acquisition of Trilogy Education Services ($750 million), Chegg’s acquisition of Thinkful ($80 million+), and Bridgepoint Education’s acquisition of Fullstack Academy ($17.5 million + 2.5 million shares).

Executive Summary

Significant growth in the technology industry has led to increased demand for workers with the specialized skills necessary to work with modern technology. A growing number of companies are hiring web developers, software engineers, and other technology workers who use technical skills to streamline their operations and leverage the power of technology within their organizations.

Coding bootcamps have become an important source for companies looking to hire technical talent. These programs, which are short, immersive, and focused on employment, graduated upwards of 33,900 students in 2019 alone. Bootcamps exist as a sector within the broader $1.1 trillion job training industry, falling under the classification of “Certifications, Apprenticeships, and Workforce Training.”1 The sector, overall, is worth $47 billion, according to the most recent data available.

Bootcamps have addressed many of the problems with post-secondary computer science education such as the lack of practical skills taught in college. They have done so by offering immersive programs designed to assist anyone with a passion for technology in mastering the practical skills they need to succeed in the labor market. These institutions are combining both technical instruction and career support to help such workers break into jobs in tech.

However, despite growth in the sector, it has been unclear how the sector is constituted and which factors matter when evaluating its growth. We have identified seven key areas that we believe give insight into the current state of the coding bootcamp market. These factors include:

- Coding bootcamp market size, which tells us about the number of students attending bootcamp and the profitability of the industry;

- Coding bootcamp cost, which helps us understand the target audience for bootcamps, and determine whether cost is a barrier for entry;

- Coding bootcamp locations, which allows us to gain an insight into whether bootcamps are fulfilling a national demand, or whether they exist purely in traditional technology hubs;

- Coding bootcamp skills, which gives us an insight into whether bootcamps are teaching students topics that are in-demand;

- Top companies that hire bootcamp graduates, which helps us understand whether bootcamp students succeed after graduation;

- The market share of online bootcamps, which helps us learn about how the market is constituted;

- The growth of university bootcamps, which has emerged as a larger part of the bootcamp sector; and

- Coding bootcamp merger and acquisition activity in the coding bootcamp space, which tells us about investor sentiment around coding bootcamps.

Bootcamps have positioned themselves as direct alternatives to college degrees, which were previously seen as the best method to acquire an education in programming. This is a bold value proposition and one that deserves in-depth analysis. If coding bootcamps are successfully bridging the technology talent gap, the model could have a major impact on the post-secondary training market.

For Career Karma’s most up-to-date research into the state of the bootcamp industry, check out our 2023 market report.

Acknowledgments

The author of this market study would like to thank the following people* for their valuable feedback on this study:

The author would also like to thank the following colleagues at Career Karma who assisted in the creation of this study: Ruben Harris, Artur Meyster, Chad Crabtree, Justin Forsyth, and Galina Bakinova.

*While comments from these people have greatly improved this study, any problems with this study should be attributed to the author alone. The people listed above read this study in advance and supplied feedback and should not be construed as endorsing or otherwise supporting or opposing the contents of this study.

Conflict of Interest Disclosure

Career Karma matches career switchers to bootcamps and job training programs. Career Karma is paid by bootcamps to help prospective students prepare for and get accepted into a training program based on their needs. In writing this paper, the author acknowledged this conflict of interest and took appropriate action to ensure the paper’s findings were not influenced by any relationships with Career Karma partners, affiliates, or external stakeholders.

James Gallagher, the Career Karma main researcher assigned to this project, was given autonomy over the direction of this market study and the final authority on decisions pertinent to the content of this paper. The author also facilitated feedback from those listed in the “acknowledgments” section to mitigate the prospect of bias during the writing and editing process.

Introduction

Growth in the technology sector over the last decade has resulted in heightened demand for qualified technology workers. However, while the demand for talented workers who hold programming skills has increased, universities have failed to produce enough graduates to satisfy this demand. As a result, a large skills gap has emerged in the sector, with hundreds of thousands of development, user interface design, and data jobs left unfilled.

Over the last decade, coding bootcamps have emerged as an answer to the talent gap problem. A bootcamp is a short, employment-focused program designed to help people transition into careers in technology. They come in a wide variety of focus areas—from coding and software development, to cybersecurity, to UI/UX design.

The skills participants learn in bootcamps are relevant to most in-demand jobs in technology, and many graduates have seen job offers at top tech companies and startups upon completion of the courses. Students also learn how to build the relationships social capital necessary to find and thrive in a job in technology through career workshops and instruction. Considering many of the best jobs are offline or come through referrals, learning about how to build relationships is crucial for people who are breaking into careers in tech.

Most bootcamps have proven themselves a viable way to equip non-tech workers with the technical skills necessary to fill the increasing tech talent needs of companies. Indeed, companies of all sizes and backgrounds, from financial services firms to big tech companies, are actively hiring coding bootcamp graduates, according to the data we have gathered for this study. In addition, bootcamps are starting to garner more respect based on the caliber of companies sourcing employees from these institutions.

Coding bootcamps have also enabled more equity in the software development training industry. Trends such as the proliferation of Income Share Agreements, as well as growing flexibility through part-time and online courses, have facilitated the entry of people who previously would not have been able to attend such a training program. This includes parents, people who are employed and cannot commit to a full-time program, and people who cannot afford to pay upfront for training.

Only a few bootcamps existed in 2012, and their offerings were typically confined to a limited set of courses. Today, there are over 105 bootcamps in the US and hundreds more around the world, offering a wide range of courses.

Methodology

In this market study, we provide an analysis of the overall state of the bootcamp sector in 2019 and make predictions about the state of the market in 2020. We gathered data on 380 bootcamps using various sources, including LinkedIn, Glassdoor, and an internal list of bootcamps maintained by Career Karma.

We define a bootcamp as:

In order to qualify for inclusion in the Career Karma State of the Bootcamp Market 2020 Study, bootcamps had to meet the following criteria:

For part (1) above, “full-time instruction” refers to programs that offer immersive learning. We consider immersive learning to mean an educational approach that centers mentorship, personalized one-on-one counsel, and live instruction as a core part of the offering. Thus, schools like Thinkful are considered a bootcamp under our definition, but companies such as Pluralsight, which offer online non-immersive courses, were excluded from the market study.

For part (2) above, “technical disciplines” included: software engineering, full-stack web development, mobile app development, front-end web development, data science, user experience (UX) design, cybersecurity, and digital marketing. Our analysis included in-person, online, and university coding bootcamps. We did not include bootcamp prep programs or courses.

We used publicly-available information to determine whether to include data on a particular bootcamp in our market study. Our data is accurate as of December 21, 2019.

This left us with 105 bootcamps to include in our analysis (see Appendix A for a complete list), which led us to collect data on over 133,392 graduates. The data used for the “market size and growth,” “bootcamp costs and financing” and “online bootcamps” is all based on 2019 data. The bootcamp location, skills, and employer information are historical, starting from the first year in which data was available on LinkedIn.

Shortcomings in LinkedIn data—such as incomplete profiles, students without LinkedIn profiles and the lack of auditing on data—may influence the accuracy of the claims made in the study. Despite limitations, we see great value in using data from LinkedIn.

This market study uses LinkedIn data for a number of reasons. Collecting information from LinkedIn allows us to use self-reported data from bootcamp graduates to assess graduate success. LinkedIn has a strong reputation as a database featuring information on employment and a wide array of school pages with alumni information. With that said, LinkedIn is not specifically known for its bootcamp data.

"Career Karma entered my life when I needed it most and quickly helped me match with a bootcamp. Two months after graduating, I found my dream job that aligned with my values and goals in life!"

Venus, Software Engineer at Rockbot

Surveys published by leaders in the bootcamp space are based on information reported directly by schools. While valuable, this methodology has its own limitations. Such studies are often based on information reported directly from bootcamps. This potentially presents a problem because, without verification from an external source—crowdsourced data or an auditing firm—the data submitted may be more likely to favor the bootcamp.

Of course, there are limitations to our method of research. Not all students will necessarily have a presence on LinkedIn. Self-reported LinkedIn data (e.g. employment, association with a bootcamp) is not verified by any third-party, which may affect the accuracy of the numbers presented in the market study. Bootcamp students and graduates may choose not to include bootcamp information on their LinkedIn profile. LinkedIn members may choose to list a bootcamp education on their profile when they did not attend a bootcamp or did not graduate, and data is subject to change over time.

In order to ensure the accuracy of our market study, we conducted qualitative analyses of individual school websites. First, we visited the websites of all 105 schools in our study to verify that they met our aforementioned inclusion criteria. We read over those website’s homepages and scanned their offerings to ensure they were still active. This allowed us to gather data on tuition for each school in our study and better understand the size of individual schools. In addition, we referred to various articles about bootcamps, especially for the “Acquisitions and Venture Capital” section of the study, to inform the direction of our paper and gather relevant context. Where such articles assisted in our report, we cited them in the references section of the study.

History of Bootcamps

Bootcamps have emerged in recent years as a popular alternative to a university degree for people interested in pursuing a career in technology. Before delving into the current state of the market, let us first look at the history of bootcamps.

Foundation of the Bootcamp Model

In the 2000s, online courses gained popularity among people looking to learn new skills. This was part of a larger trend where people were starting to value self-served education—where students could learn on their own terms, based on their needs—more highly. Indeed, YouTube and other media sharing platforms started to become known for their educational content.

However, this model has proven limited in its utility. Massive Open Online Courses (MOOCs), as these online courses are now called, struggle to retain customers. A 2019 article in Inside Higher Ed analyzing a research paper on MOOCs published by Justin Reich and José A. Ruipérez-Valiente found that only 7% of people who enrolled in an MOOC in 2016-2017 were still participating in an MOOC in 2017-2018.2

Bootcamps started to appear in the early 2010s as an alternative to university degrees and MOOCs. Instead of attending a four-year college course or participating in a short-term online course with no mentorship, people could opt to attend an in-person, short-term, tech skills-focused bootcamp. One of the most notable of these organizations is General Assembly, founded in 2011, which was a pioneer of the immersive bootcamp education model. Today, General Assembly is the largest coding bootcamp and has served over 42,000 students in its nine-year history.3

Bootcamps offered a number of benefits to students. The cost and time commitment were usually less than those of a college degree, thus enabling people to develop new skills more quickly and cheaply. Bootcamps also prepared students for specific careers; for example, if you wanted to become a web developer, you could attend a bootcamp focused on that particular field. Schools such as App Academy and Bloc were among the first to enter into this market, offering comprehensive bootcamp-based courses in fields such as web development and software engineering.

Growth in the Early 2010s

During the early 2010s, few bootcamps existed. At the time, people saw college as the best way to acquire a good education in computing. However, in the mid- to late-2010s, coding bootcamps started to gain more traction, and the number of annual bootcamp graduates is quickly catching up to the number of university computer science graduates. Code.org estimates that there are over 500,000 open “computing jobs” in the US4; however, the US only produces about 65,000 computer science graduates each year.5 Perhaps as a result, a number of companies such as Apple, Costco, IBM and Google have dropped their requirement for applicants to have college degrees.6

Evidently, universities have struggled to keep up with the demand for qualified tech workers. Further, given the intense demand for workers, many companies became more skeptical of the need for a four-year college degree for entry-level positions in technology. In an interview in 2014 about coding bootcamps for WIRED magazine, Adam Seligman, vice president of developer relations for Salesforce, stated that “Every company is racing to build apps faster. They need developers and platforms that can move as fast as their business.”7

The lack of developers was not the only problem employers encountered, however. Online courses had many limitations. These courses were limited in scope, lacked a mentorship element, and mechanisms to ensure students were engaged with the course over the long-term and were designed as a one-size-fits-all solution. Thus, the extent to which these courses could assist companies in adequately training their workforce was limited.

Bootcamps, on the other hand, would train many workers through immersive, intensive technology courses. This is important because immersive learning, where students learn in a highly interactive environment, enables students to practice their skills in an environment similar to that which they can expect when entering a job.

Bootcamps simulate professional development environments by offering time-focused assignments and using real-world techniques, thereby introducing students to the type of environment in which they will work before they even enter the labor force. This is unique to bootcamps because, unlike online courses, students had mentors who held them to account and ensured they submitted assignments on time. Immersive pedagogies also encourage students to develop mastery over a topic, as students can actively seek help from advisors, mentors, and instructors who are available to support students through the bootcamp program.

Whether true or not, bootcamps were seen to provide access to an innovative skills-based education for populations underserved by the traditional system of expensive, years-long computer science degree programs. For example, innovation in how bootcamp educations have been financed over the years—such as the introduction of “Income Share Agreements”—has bolstered access, as has the proliferation of online bootcamps.

While it is unclear exactly how much bootcamps have facilitated greater diversity in the technology sector, bootcamps are an alternative to college for career changers.

Growth in the Mid- to Late-2010s

Perhaps as a consequence of their affordability, speed, and accessibility, enrollments in bootcamps grew significantly between 2012 and 2019. There are over 105 full-time bootcamp programs in the United States today, with hundreds more around the world.

Moreover, over the last few years, the bootcamp sector has continuously transformed itself to accommodate growing student demand and changes in the technical needs of employers. Evidence of this can be seen by the growing range of courses offered by bootcamps, as well as the fact bootcamps are continuing to teach the skills employers demand, as we discuss in the “graduate skills” section of this study.

In the mid 2010s, after bootcamps began gaining traction, online bootcamps started to emerge in popularity. Originally, bootcamps were synchronous — students had to learn when classes were taught — but that has since changed. Today, a growing number of bootcamps are offering asynchronous programs that can boost student learning. This may be, in large part, because asynchronous programs allow students to learn on their own terms — they don’t have to be in a classroom or study during certain times — and so they are free to go back to revisit past concepts that they may not have grasped in class.

Schools such as App Academy, General Assembly, and Flatiron School started to offer more online courses in addition to their in-person offerings. This would eliminate a major limitation for aspiring bootcamp students: location. Since then, online offerings have become standard, offering people living in places without a bootcamp presence access to the intensive technical education that bootcamps provide. Some schools, such as Springboard and Microverse, offer exclusively online courses. In addition, online courses can help prepare students for job opportunities that are remote, which are becoming more common.

The growth in the number of bootcamps also led to more diversity in educational offerings. For example, more bootcamps have begun to offer part-time, immersive programs. These programs claim to provide the same education as a full-time course but over a longer period of time.

For people who cannot afford to quit their job, this option gives them access to bootcamps. Bootcamps have also started to offer instruction in more subjects. Web development and software engineering were initially the main courses offered by bootcamps. Today, bootcamps offer programs and courses in cybersecurity, data science, digital marketing, UX design, and other subjects.

Over the last few years, it has become evident that coding bootcamps are aiming to create a new model of private training for modern technology workers outside of the traditional system. While some bootcamps, such as Make School and partners of Trilogy, work with universities, most bootcamps operate as independent institutions. This approach, where bootcamps disrupt education from the outside-in, is prudent given the fact that a large part of their core value proposition is based on fast iteration. Indeed, high-quality bootcamps purport to change their curricula as the technology industry evolves.

Transparency and Policy in Coding Bootcamps

Alongside the growth of bootcamps, there has been a growing focus on transparency.

The Council on Integrity in Results Reporting (CIRR) was founded as a coalition of coding bootcamps to independently verify the quality and outcomes of such schools.8 Today, the body conducts annual audits of the outcomes for dozens of coding bootcamps, based on a set of standardized criteria. In addition, other coding bootcamps have made independent commitments to disclosing outcomes data. 9 10

In recent years, the federal government has recognized the potential of bootcamps and has introduced policies to help foster growth in the bootcamp space. In 2015, the White House launched TechHire, a program designed to pair workers with training programs in technology. 11

Also in 2015, the US Department of Education started the Educational Quality through Innovative Partnerships (EQUIP) program, offering selected bootcamps the ability to become eligible for Title IV financing (a legal provision under which college students can access federal student loans and grants to finance their education). Some bootcamps also have courses that are eligible for G.I. Bill funding, thus increasing access for military veterans dependents of military personnel.

Challenges With the Bootcamp Model

Bootcamps have encountered a number of challenges in their short history. The EQUIP program, which offered select bootcamps the ability to become Title IV eligible, has not received much attention in recent years. The programs chosen to participate in EQUIP are still pending approval, and the Department of Education has not acted decisively to support bootcamps since.

There have also been widespread concerns about the efficacy of the bootcamp model. In a 2017 Inc article, columnist Geoffrey James wrote, “the idea of a bootcamp for coding is just as practical as the idea of a bootcamp for surgery. Some skills are too complex for short-term intensive training to be effective.”12

This complaint has been echoed by many others since bootcamps started to proliferate. Another New York Times article reported, “… just how much [bootcamps can grow] is uncertain. “It’s pretty clear that they can do it at the scale they have,” said Thomas Eisenmann, a professor and lead author of the study. “What’s not clear is whether it can go from a hundred or a few hundred to thousands and thousands.”13

Despite these challenges, bootcamps continue to work on establishing their authority in the education space, and students are listening. As we note in this study, 33,959 students graduated from a bootcamp in 2019 alone, which may be due, at least in part, to students’ increased confidence in the efficacy of the bootcamp model, the growth in the number of bootcamps, and the growing number of reputable companies who are starting to partner with bootcamps. Universities are also starting to launch their own coding-specific bootcamps, often by partnering with private companies such as Trilogy.

Market Size and Growth

| Total Gross Revenue, 2019 | $460,733,000 |

| Year-Over-Year Growth in Revenue, 2019 | 4.81% |

| Year-Over-Year Growth in Students, 2019 | 4.38% |

| 2019 Bootcamp Students and Graduates | 33,959 |

| Number of Full-Time, In-Person Bootcamps | 105 |

According to our analysis, 33,959 students graduated from an in-person bootcamp in the US in 2019. This represents a 4.38% growth over the previous year. Based on our calculations, bootcamps earned a total of $460,733,000 in gross revenue from these students as of December 21st, 2019. These figures exclude data from university bootcamps, which have their own business models.

We suspect that several factors contributed to growth in the bootcamp sector in 2019, which are: (i) increased flexibility for students who are underserved by the current system; (ii) better outcomes and; (iii) lower costs.

Increased Flexibility

One of the primary factors associated with the growth of bootcamps is their increased flexibility, which is especially beneficial for people who are underserved by the traditional system. Historically, career-changers and aspiring programmers needed to earn a university degree in computer science to qualify for good technology jobs. Today, however, bootcamps present themselves as an alternative.

The university model does not work for everyone. Learners who are parents and have family commitments, who cannot afford to quit their jobs, or who are otherwise unable to commit to a university program, could not attend a university program. People who live in so-called “education deserts,”—where there is no college or university nearby—are also unable to benefit from going to university without traveling long distances, which is not an option for everyone.

Those who have been left behind by the opportunity gap — who have perhaps lost their jobs due to automation and have been relegated into a lower economic class — are also less likely to be able to participate in a university program, due to the high upfront costs of enrolling in college.

Bootcamps offer people in these groups the ability to participate in a training program. The shorter duration of bootcamps — months instead of years — opens up educational opportunities for people who could not participate in a four-year college degree. In addition, the existence of online bootcamps and part-time and self-paced programs allows people for whom location and time is an issue to participate in a training program.

Better Outcomes

The best bootcamps get to know the specifics of particular jobs in tech and invest heavily in helping people find a job, unlike colleges that have multiple value propositions: research, offering a liberal education, and preparing students for a job. Indeed, many bootcamps have innovative career support programs and employer partnerships that help accelerate the transition from education to the labor market.

This focus on outcomes has evolved over time as bootcamps have learned that they cannot just teach technical skills, but that they have to get involved with placement in order to help their students transition into the labor market.

Dozens of bootcamps now openly disclose their outcomes statistics. For example, the Juno College of Technology reported to the Council on Integrity in Results Reporting (CIRR) that within 180 days of graduating, 88.3% of students in their H2 2018 Web Development course were employed in-field.14 Fullstack Academy’s H2 2018 outcomes report for their Chicago program reported that 73.3% of students were employed in-field within 180 days of graduating.15 Both of these reports were audited by the CIRR, which monitors the outcomes of its members

In addition, thousands of bootcamp graduates have gone on to work for companies such as Microsoft, Google, and Facebook, which indicates the fact that bootcamps are successfully placing students in large technology companies, which typically have rigorous hiring standards. See the “Top Employers for Bootcamp Graduates” section for more information. Perhaps, in part, because schools are living up to this value proposition, bootcamps continue to grow.

Lower Costs

One appeal of bootcamps is the relatively low cost of education. We suspect that attending a coding bootcamp would prove, in many cases, more affordable than completing a four-year university computer science degree. For four-year degrees, the average annual cost of going to college—including tuition, room, and board—was $26,59316. Yearly costs in the 2016-17 school year for “private nonprofit and for-profit institutions” as per the National Center for Education Statistics data cited above were even higher.

In comparison, the average tuition for attending an in-person bootcamp was $13,293 in 2019, and the average tuition for an online bootcamp was $14,623. Of course, this does not include the cost of room and board; nevertheless, considering the shorter duration of bootcamps, even if the cost of room and board were included, the average overall costs would lower for the average bootcamp than for the average four-year university degree.

Further, there is an opportunity cost to consider. Bootcamps typically last one year or less, whereas university degrees take four years to complete. While it’s difficult to calculate the exact opportunity cost, suffice to say that bootcamp grads are able to enter the labor market quicker than their college graduate counterparts, given the duration of their education. That said, bootcamp graduates may earn less than their college graduate counterparts over the long term, as college degrees have proven to be a source of long-term value.17

In addition, bootcamps have also experimented with models such as deferred tuition and Income Share Agreements (ISAs). Deferred tuition does not need to be paid back unless a student finds a job, and ISAs are only paid back if a student is successful at finding a job that pays over a certain amount.

Education finance experts such as Richard Price, a researcher at the Christensen Institute, have compared this to “insurance,” offering a guarantee to students—students pay for college up front, and tuition is due irrespective of an individual graduate’s success.18 While universities such as Purdue University and the University of Utah are experimenting with similar models, these programs cater to a small number of students relative to the number of people who enroll in college each year. For context, 43,411 students enrolled in Purdue University in the fall of 2018 19 and the Purdue “Back a Boiler” program, perhaps the most notable among universities, has only issued 1,000 ISAs since launching in 2016.20

Other factors likely contribute to the growth of bootcamps. Perhaps due to their smaller size—at least in comparison to many universities—they may find it easier to iterate more rapidly. While this remains to be fully seen, it appears as if bootcamps have found a sustainable business model in which student tuition can cover the costs of their programs without relying on the federal subsidies or aid that many universities rely on.

That said, the growth in student bodies and graduates realized by coding bootcamps in 2019 was less than that of previous years. In 2018, for example, the coding bootcamp sector grew by 26.26% in terms of students and graduates. See the below table “Coding Bootcamp Growth Rates, 2013-2019” for more information.

| Year | Year-Over-Year Growth (%) |

| 2013 | 13.58 |

| 2014 | 121.16 |

| 2015 | 95.84 |

| 2016 | 52.42 |

| 2017 | 20.92 |

| 2018 | 26.26 |

| 2019 | 4.38 |

The exact reasons behind slower sector growth in 2019 are unclear. The main factor we believe is responsible is that the market for coding bootcamps in popular technical disciplines such as web development and software engineering is starting to enter the “maturity” stage, meaning growth is slowing. Coding bootcamps have a specific target market — people looking to transition into a new career in tech quickly — which does not resonate with everyone seeking training in technological skills, and so as bootcamps have grown, they have become closer to reaching their total addressable market.

We believe this is the case for two reasons. Firstly, more bootcamps are offering courses in new areas such as UX design and cybersecurity, which demonstrates that bootcamps are looking for new ways to expand outside of their current course offerings. In addition, as we note in the “Venture Capital” section of this study, many of the smaller industry financing rounds have been in new bootcamp models, which leads us to believe investors are realizing that more innovation in the sector is necessary to sustain growth.

Bootcamp Growth

According to our analysis, the bootcamp sector will grow to serve 35,446 students in 2020, based on the growth the sector has realized in its history.

We also identified the largest bootcamps by the total size of their student and graduate body. See the table below for the top ten bootcamps by the total number of students and graduates each school has served since being founded, as of December 21, 2019.

| School Name | Students and Graduates (as of December 21, 2019) |

| General Assembly | 44,800 |

| Hack Reactor / Galvanize | 6,300 |

| Flatiron School | 5,600 |

| Ironhack | 4,500 |

| Bloc | 3,200 |

| Lambda School | 3,100 |

| App Academy | 3,000 |

| Springboard | 3,000 |

| Thinkful | 2,900 |

| Fullstack Academy | 2,700 |

There is a dramatic difference between the top provider, General Assembly, and all the other major coding bootcamps. We believe there are two main reasons for this division. Firstly, General Assembly started its education business on February 1, 2011, which was at the start of the bootcamp sector.21 Thus, they have been able to spend years more on student acquisition than other bootcamps. Secondly, General Assembly has used their additional time in the market to offer programs such as bootcamp-based enterprise training, which has allowed them to accrue a larger student body.

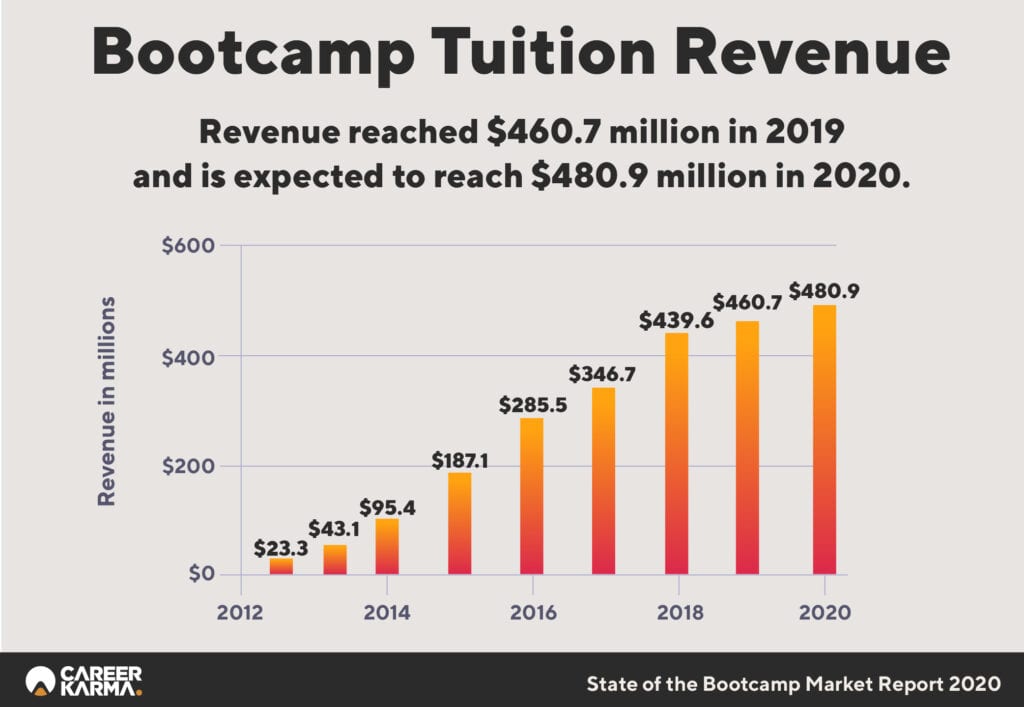

Historical Gross Revenue, 2012-2019

The following chart illustrates gross tuition revenue for bootcamps in the United States between the years 2012 and 2019, using information from LinkedIn and Career Karma.

Historical Alumni Statistics, 2012-2019

The following chart shows the number of students graduating from bootcamps in the United States each year between the years 2012 and 2019. This data is not cumulative, and represents the number of graduating students in each year.

Bootcamp Costs and Financing

In 2019, the average tuition for a bootcamp was $13,249. Our study focuses on full-time courses, which typically last between three months and one year. This average tuition statistic excludes bootcamps who only offer income-share models and have no upfront payment alternative, and non-profit bootcamps who charge no tuition.

There has been a push in the bootcamp sector in recent years to provide an affordable experience to students. We suspect that cost is one of the biggest considerations for people who are thinking about pursuing education in computer science. Of note, this could be a promising idea for future research: surveying students to ascertain their considerations when choosing a school more directly.

Online bootcamps were—to our surprise—on average, more expensive than in-person bootcamps included in our analysis in 2019. The average tuition for online bootcamps was $14,623, over $1,000 higher than the $13,249 average tuition for in-person bootcamps. This can perhaps be attributed to the longer length of many online programs. Holberton School’s full-time program, for example, lasts for two years overall; Kenzie Academy’s full-time software and UX engineering courses last one year.

The price of bootcamps does vary between schools. 8.70% of bootcamps included in our analysis charged tuition upward of $20,000. 42.93% percent of bootcamps charged tuition between $15,000 and $20,000. 20.65% percent of programs cost between $10,000 and $14,999. See the graphic below for more information.

In our research, we found that bootcamps were offering a number of financing options to students. While analyzing coding bootcamp websites, we discovered that student loans and upfront or installment payment options were the most common. We also noticed an increase in the number of bootcamps offering Income Share Agreements, as we note below. Some bootcamps, such as General Assembly and Flatiron School, offered scholarships to their students; some other bootcamps offered G.I. Bill financing to their students, too.

This demonstrates a growing trend in the bootcamp sector toward offering more financing options to students. When the sector was getting started, upfront payment options were the most common. Given the nascency of the sector, there were few lenders who knew about the specifics of bootcamps.

Today, there are dozens of providers such as Skills Fund which offer loans to bootcamp students. Companies like Leif and edly, on the other hand, provide support to bootcamps which use Income Share Agreements. We believe the growing diversity among financing options is down to the fact that no one financing option is good for every student. ISAs, while useful for some students, do not make sense in a case where a student already has most of the money they need to finance their education or who know they could manage the payments of a loan well.

Income Share Agreements

In 2019, the bootcamp sector saw an increase in the number of bootcamps offering Income Share Agreements (ISAs) as a method of payment. According to our analysis, 27 US-based bootcamps offer ISAs to their students. (Note: our analysis for this section on ISAs includes Viking Code School and Dev Code Camp, two bootcamps that were not considered for the full study. In other words, 25 out of the 105 schools that we considered a bootcamp for this paper offer ISAs to their students, but 27 US-based coding bootcamps offer ISAs to their students.)

Before 2019, only a select few bootcamps offered ISAs or deferred tuition as methods of payment. For example, App Academy launched its deferred tuition program in 2012.

We believe a couple of factors contributed to this growth. First, students only pay when they command salaries higher than a predetermined amount. This acts as a form of insurance for students: if they derive no value from their education, they will pay back less, or perhaps nothing. This, in turn, has the potential to reassure students that the school will work to help them succeed so they can collect tuition later.

Thus, ISAs give students more confidence in their decision to learn to code at a bootcamp. This is especially important because attending a bootcamp may be riskier than attending college due to the former’s recent arrival to the computer science education space. Additionally, most bootcamps are not accredited, unlike colleges.

For bootcamps, ISAs act as a sales and marketing tool: if a prospective student knows they will only pay if they succeed, they may be more likely to enroll in a coding bootcamp. This has the potential to drive down Customer Acquisition Costs for bootcamps — the more confident students feel about a bootcamp course, the more likely they are to enroll — thereby allowing them to grow without spending as much on customer acquisition.

Another contributing factor to the growth of ISAs is the development of new technological and financial infrastructure to facilitate their administration. Companies such as Vemo Education and Leif have created solutions to help universities and code schools start and maintain their ISA programs. This has helped existing programs streamline their operations and has facilitated bootcamps without ISA programs to create their own tailored offerings.

Other companies (e.g., edly) have made it easier for bootcamps to raise the capital they need to offer an ISA program. Instead of hiring internal investor relations staff and/or raising venture money, a bootcamp can instead enlist a third party to help them raise the capital they need to establish and administer their ISA program. Such companies have also helped connect professional institutional investors with bootcamps, which has played a major role in legitimizing the efficacy of this model of education financing.

With that said, it has become clear that ISAs are not for every student. The majority of coding bootcamps continue to offer upfront or installment payment plans, in addition to ISAs. This suggests that ISAs are not being seen as a replacement for other models of financing, rather an additional option for students. This is important because, for students who already have savings, or who are averse to the prospect of paying back multiples more than the cost of tuition, ISAs are not a good option.

Given the significant growth of ISAs in 2019, we expect them to continue to gain traction and constitute an even larger share of bootcamp financing in 2020.

However, in order for this growth to be realized, all bootcamps offering ISAs will need to implement best practices in terms of structuring and administering their programs. This begets a note stating that the advantages above can only be realized by properly structured programs — incentive alignment and access only work when a bootcamp operates in good faith and in the best interests of their students.

Most bootcamp ISA programs offer short terms (i.e., the duration students repay a portion of their income as tuition, represented as a number of months). Most ISA terms range from one to four years. In addition, bootcamp ISAs often have higher income-share percentages, ranging from 10 percent to 20 percent of a student’s post-graduation income, due to the short terms they offer. Minimum income thresholds are also higher among bootcamp ISAs given the projected salaries for careers in technology, which can enter easily exceed $50,000; most programs offer thresholds of $40,000 or above.

In order to gather statistics on the Income Share Agreement programs offered by schools, we searched for terms using their websites. This approach was taken to ensure we could gather up-to-date program information that incorporates any changes secondary sources may not have made. Most of the websites we visited had prominently displayed terms on their website.

The most common approaches were to have ISA terms listed on the homepage, or a link to a page all about a school’s ISA program. That said, some schools’ terms were more difficult to find—for example, the information was buried in their enrollment pages. This is important to highlight because transparency is crucial to the development of the space. Given the relative obscurity of ISAs in comparison to student loans, having clear explanations of ISA terms is in the best interests of schools and their students.

We found that the average minimum income threshold for bootcamp ISAs was $42,476 in 2019. In the same year, the average term was 38 months and the average income-share percentage was 13.9 percent. In addition, the average repayment cap (the maximum amount students can pay before an ISA was forgiven) was $32,754.

The school with the highest minimum income threshold was C4Q with a $60,000 income threshold; the school with the lowest was Microverse, with a $12,000 income threshold. That said, most of the minimum income thresholds were between $40,000 and $50,000, Microverse’s program is positioned toward an international market, where salaries may be significantly lower for local tech workers than those realized by US tech workers. This was expected given the high salaries tech workers can command if they have the right skills.

In addition, the school with the highest payment cap was Make School, at $90,000; the lowest payment cap was joint between Microverse and Burlington Code Academy at $15,000. The school with the longest term was BrainStation at 96 months; the school with the shortest term was Viking Code School at 12 months. Most terms, however, were between 24 and 48 months.

As ISAs gain more traction—and perhaps regulatory scrutiny—having transparent terms will become a crucial part of the sector. As such, we hope to see all schools display tuition information prominently on their sites (in cases where that is not already happening).

See the “Income Share Agreement Terms, 2019” table for more information. Raw data for this analysis can be found in Appendix B.

Income Share Agreement Terms, 2019

- Average Term: 38 months

- Average Minimum Income Threshold: $42,476

- Average Income Share Percentage: 13.8%

- Average Payment Cap: $32,754

Online Bootcamps

- Online Bootcamps: 13

- Online Bootcamp Graduates: 6,995

- Average Tuition: $14,623

Online coding bootcamps, which are largely based on the bootcamp model of short-term, immersive, intense courses, continued to grow in popularity in 2019. (For context, all of these programs were founded before 2019.) For this study, 13 online bootcamps were included in our analysis. We found that 6,995 students graduated from an online bootcamp in 2019. Thus, online student graduations constitute 20.59 percent of overall bootcamp graduations.

See “Historical Online Bootcamp Alumni, 2017-2020” for a historical breakdown of enrollments at online bootcamps.

According to our analysis, the average tuition for online bootcamps was $14,623 in 2019.

Online bootcamps fill a strong need. As of 2010—the year in which the last census was calculated—19.3 percent of the population of the United States lived in rural areas.22 Bootcamps are primarily based in large population centers. Therefore, online bootcamps fill a strong need as people who do not live in a city with a bootcamp nearby are unable to attend a bootcamp. While university bootcamps are helping to expand access to in-person bootcamps, their impact is limited. Online bootcamps give people in this situation—people who do not live near a bootcamp—the ability to participate in a structured computer science education program. With that said, many of the opportunities — unless the job into which a graduate enters supports remote working — coding bootcamps unlock may only be available to those willing to move to a city, so the extent to which bootcamps enable economic opportunity in rural areas is limited but still present.

While online programs have been around since toward the start of the bootcamp sector, they became more popular in 2019. Many bootcamps offer online courses to their students in addition to their in-person offerings.

One of the more notable trends in online bootcamps is the rise of fully-online schools. Bloc, Thinkful, Springboard, and Lambda School are four examples of schools with no physical campus; their offerings are entirely online.

In simple terms, this model reduces costs on the part of the bootcamp—there are no campuses to operate, and fewer overhead costs. Some schools have also found great success in operating online bootcamps. For example, Lambda School was established in 2017 and served only a few dozen students in their first year. Today, Lambda School has enrolled over 3,000 students into their online offerings. Microverse, another coding bootcamp, was admitted into the Y Combinator bootcamp as well, which offers an online-only bootcamp.

The growth of online technologies such as Zoom and Slack has made it easier for bootcamps to offer online courses and for fully-online bootcamps to exist. These technologies allow for synchronous and asynchronous communication. Other tools such as Github are used to collaborate on code from multiple locations. We suspect that bootcamps offering online components will continue to utilize these and other “remote tools” that facilitate long-distance collaboration.

Providing online programs may be a competitive advantage for bootcamps. Offering access to a greater number of students, eliminating many of the physical requirements of running a school—such as operating a campus and using existing curricula from an in-person program are all attractive benefits from a financial perspective.

Nevertheless, drawbacks for online bootcamps likely exist. For example, students who are less motivated to participate in a course may find it difficult to stay on track throughout the program because there is no in-person instructor who can facilitate their learning journey. However, an in-depth discussion of the relative merits of online versus in-person bootcamps is beyond the scope of this study.

Bootcamp Alumni Geographical Breakdown

As of December 28, 2019, there were 105 schools that we are considering bootcamps serving the US market, 13 of which were online schools.

According to LinkedIn data, bootcamp graduates are based in cities all across the United States. Unsurprisingly, there is a large concentration of bootcamp graduates in cities historically known as technology hubs, such as San Francisco and New York City. Indeed, New York City has the largest number of resident bootcamp alumni in the country. This is likely due to the fact that these cities all have strong labor markets for positions in technology where many companies are hiring.

In addition, the number of bootcamps in these top cities is high: New York has 46 bootcamps; San Francisco has 33 bootcamps; Los Angeles has 21 bootcamps. As seen in the table below, there is a positive correlation between the number of bootcamps in a location and the number of graduates in that city. That said, some cities such as Austin and Chicago have more bootcamps than other areas and fewer graduates. We believe this could be due to how more bootcamps are opening in cities but are yet to create significant alumni bodies in those areas.

In the table “Bootcamp Graduates in Top Cities, 2019,” we list the cities with the largest number of bootcamp graduates. The locations listed in this table are based on the locations given on LinkedIn’s school pages for graduates of a particular school. This data is also cumulative, and so it represents all bootcamp graduates’ locations in 2019, rather than all locations of bootcamp students who graduated in 2019.

We suspect this is the case for a number of reasons. The majority of bootcamps we studied for this study are in-person schools, which are often based in larger cities with attractive labor markets. Perhaps as a result, large concentrations of graduates can be found in these cities.

Despite the large concentrations of bootcamp graduates in the cities listed below, it is worth noting that, comparatively speaking, the number of bootcamp graduates in each city constitutes a small portion of technology workers. 13,400 coding bootcamp graduates are based in San Francisco, for example, yet the labor market for the city’s technology workers is significantly larger. Thus, while bootcamps are indeed major talent funnels in a number of cities, they still comprise a relatively small number of placements.

Historical Bootcamp Graduates in Top Cities

| Location | Bootcamp Graduates | Bootcamps in Location |

| Greater New York City Area | 17,000 | 46 |

| San Francisco Bay Area | 13,400 | 33 |

| Greater Los Angeles Area | 5,200 | 21 |

| Greater Seattle Area | 4,800 | 18 |

| Washington D.C. Metro Area | 3,200 | 16 |

| Greater Boston Area | 2,700 | 13 |

| Greater Chicago Area | 2,500 | 25 |

| Greater Denver Area | 2,300 | 15 |

| Greater Atlanta Area | 2,200 | 13 |

| Austin Texas Area | 1,200 | 17 |

In addition, traditional tech hubs often have stronger job prospects, which may make those places more attractive to bootcamp graduates. San Francisco, for example, has perhaps the best labor market for coders and also has the most bootcamp graduates. Tech cities may also have more bootcamp graduates at least in part because local tech companies may be more likely to support local training programs to refine their talent pools.

With that said, there are a large number of coding bootcamps that operate outside of these cities. This is important to mention as one of the great promises of the bootcamp model is to enable economic opportunity for people who are underserved by the traditional system, and one of the greatest barriers of the traditional system is the concentration of high-quality educational institutions in big cities. See the table below for a list of a random selection of 10 non-tech hub cities with a bootcamp graduate presence:

Historical Bootcamp Graduates in Random Non-Tech Hub Cities

| Location | Bootcamp Graduates |

| Detroit, MI | 351 |

| Raleigh-Durham, NC | 70 |

| San Antonio, TX | 465 |

| Baltimore, ML | 20 |

| Philadelphia, PA | 343 |

| Columbus, OH | 407 |

| Indianapolis, IN | 313 |

| Kansas City, MO | 126 |

| Eugene, OR | 11 |

| Phoenix, AZ | 585 |

Bootcamp Graduate Skills Breakdown

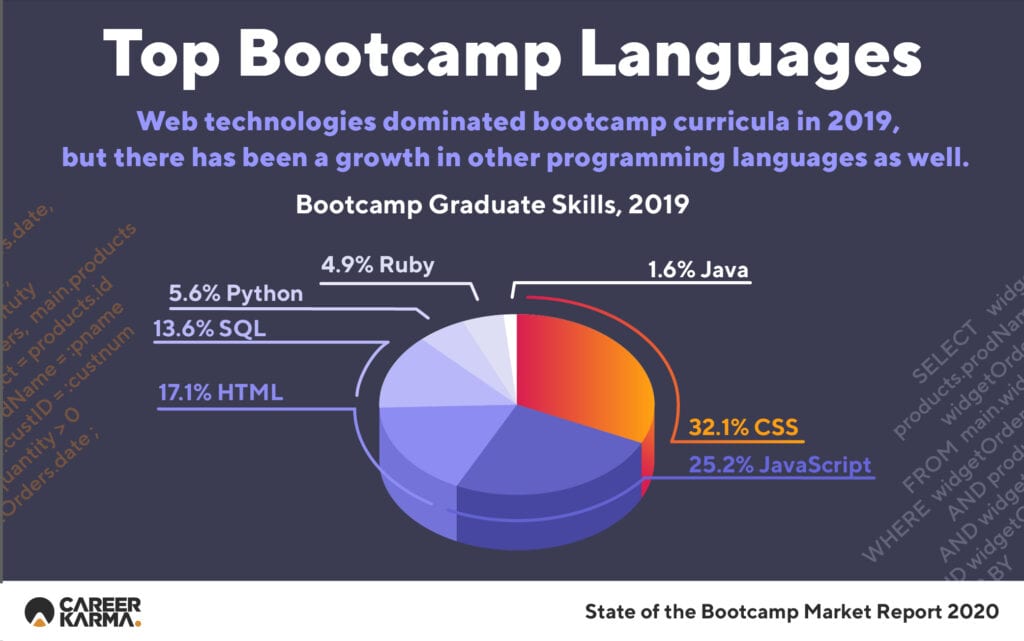

We gathered data from LinkedIn to determine the main skills reported by bootcamp graduates since each school was founded. Of note, most bootcamps in our study were founded after 2010, which should be the earliest year for which data is available in any particular case. The data, accurate as of December 21, 2019, represents the skills reported by all bootcamp graduates and students since data started to become available on LinkedIn.

Technical Skills

The top five courses offered by bootcamps, ranked in order of popularity are:

Correspondingly, the top technical skills reported by bootcamp graduates on LinkedIn are all taught in the top five courses offered by bootcamps, which can be seen below:

The top five programming languages reported by coding-specific bootcamp graduates on LinkedIn were:

Web development courses comprise a significant portion of bootcamp enrollments. All of the five top technical skills reported by coding bootcamp grads, as well as the top four programming languages used by bootcamp graduates, are all related to web development. We suspect that the long history of web development bootcamp courses in relation to other subjects, the favorable labor market for web developers, and the large repository of resources available to assist aspiring web developers are all contributing factors to the prominence of web development courses.

Software engineering is currently a popular field among bootcamp graduates and we suspect this is for the same reasons we attributed to the popularity of web development courses/programs. See the chart “Historical Bootcamp Graduate Skills, Updated December 2019” for a more detailed breakdown of the programming language data. This data is based on the LinkedIn profiles of 133,392 bootcamp graduates.

Program Offerings

Over the last few years, there has been a growing diversity in bootcamp program offerings. In the past, most bootcamp courses focused on software engineering and web development, which were—and still are—fields in which there is a high demand for qualified workers.

Today, we assume that fields such as data science and UX design are becoming more popular. This assumption is based on these fields entering the top five courses being offered by bootcamps and skills like Python and SQL — common in data science — being in the top five programming languages known by coding bootcamp graduates.

In addition, fields such as technology sales are on the rise, evidenced by the growth of bootcamps such as SV Academy and Flockjay. However, this is outside the scope of this market study and merits further research. There is also a broader question that needs to be answered: will bootcamps be able to evolve as technology undergoes significant changes, such as the wide-scale adoption of cloud technology and machine learning? This would be best tackled in a separate study.

Soft Skills

Of course, bootcamps teach more than technical skills. While a significant portion of the average bootcamp syllabus is focused on technical training, bootcamp graduates also spend significant time learning a range of “soft” skills. For example, bootcamp students often work on collaborative projects to develop and hone team-working skills.

Students also acquire a wide range of relationship building and social capital skills such as how to reach out to employers and approach recruiters, which are useful when students start their job search. Indeed, a 2013 Wall Street Journal article reported that 80% of jobs are not listed online, which means that, in order to be successful in finding the right job, people need to have good relationship building skills.

A large part of the bootcamp value proposition is to prepare students for jobs, which means students need to be equipped with certain interpersonal skills to thrive after graduation. Based on the same LinkedIn data that we used above, we have found the following to be the most commonly reported soft skills by coding bootcamp graduates, ranked in order of frequency:

Top Employers of Bootcamp Graduates

One of the main concerns prospective students have about bootcamps is that of employment. Will employers respect graduates’ experience in a bootcamp? College degrees are still perceived to be the best way to enter into a career in technology. However, as bootcamps have gained traction, graduates have continued to find jobs in technology.

Computer science jobs are growing at twice the rate of the national average, according to Code.org 23, and universities have not been able to keep up with demand. This leaves employers with a problem: there are more jobs to be filled, but the place to which they have traditionally turned for qualified workers is not yielding enough graduates. To resolve this problem, companies of all sizes are turning to reputable bootcamps as a potential source of talent for their organizations.

One study of 1000 HR managers and technical recruiters at US companies by Indeed found that 72% of employers “think bootcamp graduates are just as prepared and likely to be high performers as candidates with computer science degrees,” which demonstrates the positive perception employers have of coding bootcamp graduates.24 While this does not necessarily mean those companies have hired bootcamp graduates, it does show that employers think bootcamp graduates are adequately prepared for jobs in tech.

In addition, according to Hired.com’s 2019 “The State of Software Engineers” report, 76% of software engineers surveyed believed their bootcamp education helped them “prepare to get an engineering job.”25 While some employers are still hesitant to hire a bootcamp graduate, 57% of software engineers surveyed said they would “hire a bootcamp grad for an open role” if they were in a position to do so.

There are a few reasons why employer sentiments toward hiring bootcamp graduates are favorable. Firstly, as we note below, a number of large technology companies such as Microsoft have hired bootcamp graduates, which typically have rigorous application standards. Secondly, as more bootcamp graduates find jobs in technology, hiring managers will be able to develop a greater sense of what skills bootcamp graduates hold.

Another potential reason is that bootcamps such as General Assembly are starting to work with companies like Microsoft to offer corporate training, which allows the bootcamp to develop closer relationships with hiring managers of employers. However, other factors such as hiring managers lowering their standards due to the tightness of the labor market may also contribute to this trend.

Below we list the top 10 employers of bootcamp graduates to demonstrate the types of companies that have hired bootcamp graduates in the past. This data was gathered from LinkedIn’s school pages. Further, this data excludes bootcamps. This is because many current and former students list their bootcamp education as “work experience,” on LinkedIn, but does not necessarily mean the graduate has been employed by the bootcamp.

Historical Top Employers for Bootcamp Graduates

The following table shows the top ten companies who have hired bootcamp graduates by the number of bootcamp graduates employed, as per LinkedIn data.

| Company Name | Number of Bootcamp Grads Employed |

| 588 | |

| Microsoft | 361 |

| Amazon | 330 |

| 250 | |

| JPMorgan Chase & Co. | 238 |

| IBM | 190 |

| American Express | 141 |

| Uber | 140 |

| Capital One | 122 |

| WeWork | 117 |

It is worth noting that, in relation to the sizes of these companies’ workforces, coding bootcamp graduates constitute a small portion of their overall workforces. For example, Google has a workforce of over 184,000 employees 26; IBM employs over 502,000 workers 27; American Express controls a workforce of almost 65,000 employees.28 Thus, while these numbers demonstrate that some coding bootcamp graduates go to work in large tech companies, bootcamps are not a primary source of talent for these companies.

Bootcamp Acquisitions and Venture Capital Financings

Acquisitions

Over the last few years, there have been a number of high-profile acquisitions in the bootcamp space. There are a couple of reasons why we believe this has occurred.

One of the primary reasons is that the bootcamp sector is diverse and relies upon a number of business types to operate successfully. We believe this creates the potential for companies to consolidate as they grow, to command a greater share of the bootcamp sector.

Some companies in the bootcamp space are the bootcamps themselves, such as Kenzie Academy. Other companies in the space operate as financiers, such as Skills Fund and Leif. Some bootcamps and financiers work with universities through partnerships. Some companies are online learning platforms. When companies have established their presence in one area, some have sought to expand into other areas to increase their market share.

In addition, acquiring a bootcamp allows traditional and publicly-traded education companies that may not directly offer instruction to students the ability to experiment with their own course offerings through a subsidiary bootcamp. In many cases, this may be more appropriate than changing a company’s core business—which would be time consuming—to experiment with bootcamps.

For example, in September 2019, Chegg, a publicly-traded student services company, announced that they would be acquiring Thinkful, an online bootcamp.29 While Chegg itself is not a bootcamp, they operate within the education space, and their acquisition of Thinkful offers a number of opportunities. Other such examples exist, as listed in our table, “Top Three Bootcamp Acquisitions, 2019.”

Consolidation has also become common in the bootcamp space. We suspect that at least some of this is due to some bootcamps focusing on short-term revenue growth at the cost of building a sustainable business model that would succeed over the long-term. In the mid-2010s, a number of bootcamps opened that have since ceased operations. Two (of many) examples are Iron Yard (2012-2017) and DevBootcamp (2012-2017). We suspect that these schools closed because they did not end up meeting the evolving needs of students and instead tried to capitalize on the fast growth of private-market bootcamps to earn an easy profit with no long-term strategy in place.

In an interview for Forbes in 2017, Jake Schwartz, CEO of General Assembly, discussed the belief that many bootcamps were seen as primarily short-term money-making opportunities, rather than longer-term strategic organizations:

“The barrier to entry for basic coding bootcamps wasn’t very high—and as it turns out, education, at any level, is not the easy-money scheme many thought it was. A lot of these companies were capitalizing on a short-term market opportunity without a broader vision.” 30

Top Three Bootcamp Acquisitions, 2019

In April 2019, 2U, an education technology company that helps universities offer online degree programs, acquired Trilogy Education Services, a company that partners with universities starting their own coding bootcamp courses.31 2U acquired Trilogy, founded in 2015, for $750 million—$350 million paid in shares, with the rest paid in cash.

According to 2U, they acquired Trilogy to expand their enterprise channels, double their university partner client portfolio, create additional marketing leverage, and generally help the company expand their educational offerings.32

In September 2019, Chegg announced plans to acquire Thinkful, a Brooklyn-based online bootcamp. Reports indicated the acquisition would be worth $80 million, with possible additional payments of up to $20 million in cash or stock based on performance.33

Chegg’s acquisition of Thinkful allows Chegg to expand its direct-to-student learning platform and add more technology career offerings to its portfolio. On Thinkful’s side, the acquisition gives the school more resources to leverage when developing courses and extended reach for those courses.

In March 2019, Bridgepoint Education, which owns Ashford University and offers online program management products, acquired the bootcamp Fullstack Academy. The acquisition was reportedly set at $17.5 million in cash and 2.5 million shares of common stock upon the closing of the deal.34 Another 2.25 million shares are to be issued if Fullstack met certain milestones after the acquisition.

This acquisition gave Fullstack Academy the ability to work with more universities and governments and gave Bridgepoint a place where they could experiment with new ideas around bootcamps.35

In January 2020, Galvanize, the coding bootcamp and co-working space company, announced that K-12, Inc., a publicly-traded education company, has agreed to acquire them. Galvanize is being acquired for $165 million in cash, according to a report by The Information, which reviewed an email sent to Galvanize shareholders.36 This acquisition further shows the extent to which consolidation is present in the coding bootcamp sector, and suggests continued interest by large education companies in the space.

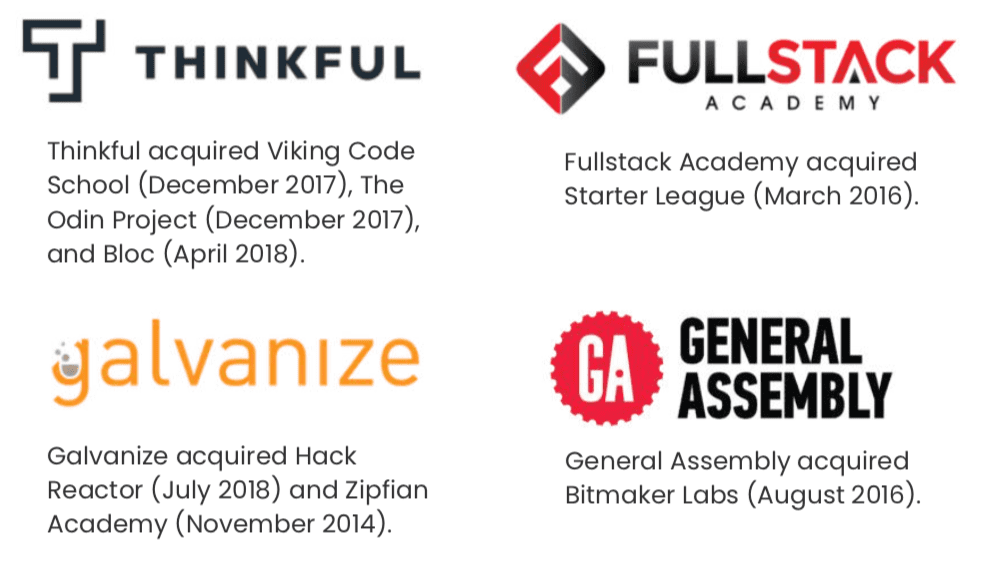

Industry Consolidation

According to our analysis, bootcamp acquisitions have been steady over the last few years, and there has been at least one acquisition in the space every year since 2014. In 2014, there were three bootcamp acquisitions; in 2015 there another three; in 2016 there were five; in 2017 there were two; in 2018 there were four; in 2019 there were three. The majority of acquirers were already in the education space prior to acquiring a bootcamp company. This suggests that education companies see bootcamps as a strategic opportunity for growth. See Appendix C for a list of historical acquisitions.

Some acquirers were other bootcamps:

Bootcamps may wish to acquire other bootcamps for a number of reasons, including to grow their student body and to reach a wider audience by capitalizing on the brand of the bootcamp they acquire. Such acquisitions may also help a bootcamp increase its profitability and learn about different educational techniques and pedagogies.

In addition, we may see more acquisitions in the future as Customer Acquisition Costs (CAC)– the cost of obtaining a customer — in the sector increase. We expect that CACs will increase in the future because most coding bootcamps are based upon a similar value proposition, and that value proposition will only resonate with a certain audience: people looking to retrain and transition into a job in technology.

This should affect acquisitions in the space, as bootcamps that realize higher CACs may resort to buying other companies to lower those costs and gain more control over other areas of the bootcamp sector (i.e., financial servicing and job placement).

It is worth noting that most of the acquisitions that have taken place in the bootcamp sector have been fairly small, under $100 million. Thus, while acquisitions are taking place, it is unclear whether the sector is mature enough to warrant larger acquisitions.

Venture Capital

A number of fast-growing bootcamps have relied on venture capital financing to help expand their businesses. For bootcamps, raising venture capital helps them finance resources relevant to their expansion and offer competitive tuition rates. In return, investors have the opportunity to own a stake in a potentially profitable enterprise.

Investors have become increasingly interested in bootcamps over the last few years, given the growth in student numbers and revenues in the bootcamp sector. In 2019, there were many notable venture capital financing rounds in the bootcamp space. For example, in January 2019, Lambda School raised a $30 million Series B round from investors such as Bedrock Capital, Google Ventures, and Y Combinator. Lambda School’s Series B round valued the company at $150 million, post-money.37

We believe that Lambda School raising a Series B round demonstrates how serious investors are about coding bootcamps and signals high investor interest in the business model underlying well-structured bootcamps.

Other notable venture capital rounds in 2019 included Make School’s $15 million Series B, Kenzie Academy’s $7.7 million Series A, Springboard’s $11 million post-Series A, and Bitwise Industries’ $27 million Series A. In addition, Kenzie Academy raised a $100 million debt financing round to use towards their Income Share Agreement program. See “Top 10 Bootcamp Venture Capital Rounds, 2019” below for more.

That said, it is unclear whether venture capital firms will have sustained interest in new coding bootcamps in the future. Indeed, almost all of the most notable rounds from 2019 featured already-established coding bootcamps, and investments in newer companies were typically focused on new educational models.

Flockjay, for example, is offering a technology sales platform; Microverse is aiming to create a fully-online school to enable people from around the world to access highly-compensated jobs in tech. While the data is inconclusive, such investments in smaller, non-coding bootcamp training providers may be more attractive to investors, as these companies are looking to expand the bootcamp model and enter new markets in the process.

Top 10 Bootcamp Venture Capital Rounds, 2019

| Bootcamp Name | Capital Raised | Round Type | Investors |

| Lambda School 38 | $30 million | Series B | Y Combinator, Vy Capital, Pioneer Fund, Geoff Lewis, GV, GGV Capital, Bedrock Capital, Ashton Kutcher |

| Cybrary 39 | $15 million | Series B | Gula Tech Adventures, BuildGroup, Arthur Ventures |

| Make School 40 | $15 million | Series B | Venrock |

| Springboard 41 | $11 million | Post-Series A | Reach Capital, Pearson Ventures, Learn Capital, International Finance Corporation, Costanoa Ventures, Blue Fog Capital |

| Kenzie Academy 42 | $7.7 million | Series A | One Way Ventures |

| Kenzie Academy 43 | $100 million | Debt | Community Investment Management |

| Ironhack 44 | $4 million | Series A | Jose Manuel Entrecanales Venture Capital, Brighteye Ventures, All Iron Ventures |

| Flockjay 45 | $2.98 million | Seed | Y Combinator, Will Smith, Tom Willerer, Serena Williams, SV Angel, Paul Buchheit, Lightspeed, Liat Bycel, John Thompson, Index Ventures |

| SV Academy 46 | $9.5 million | Series A | Uprising, Strada Education Network, Rethink Education, Owl Ventures, Kapor Capital, Bloomberg |

| Bitwise Industries 47 | $27 million | Series A | Reach Capital, Quality Jobs Fund, Plum Alley, New Voices Fund, Motley Fool Ventures, Kapor Capital, Aera VC |

Notably, Y Combinator, a startup accelerator, invested in a number of early-stage bootcamps this year. In 2019, Y Combinator announced investments in the Juno College of Technology, Flockjay and Microverse.48 Y Combinator has a long history of investing in bootcamps; they invested in Fullstack Academy in 2012, Make School in 2012, and Lambda School in 2017.49

University Coding Bootcamps

Coding bootcamps were initially popularized in the private sector. However, in recent years, the model started to gain traction among universities. While the structure of these “university bootcamps” varies—some universities have their own internal bootcamps; others partner with existing bootcamps—they all have the same value proposition: to help train people in the practical skills they need to pursue a career in technology.

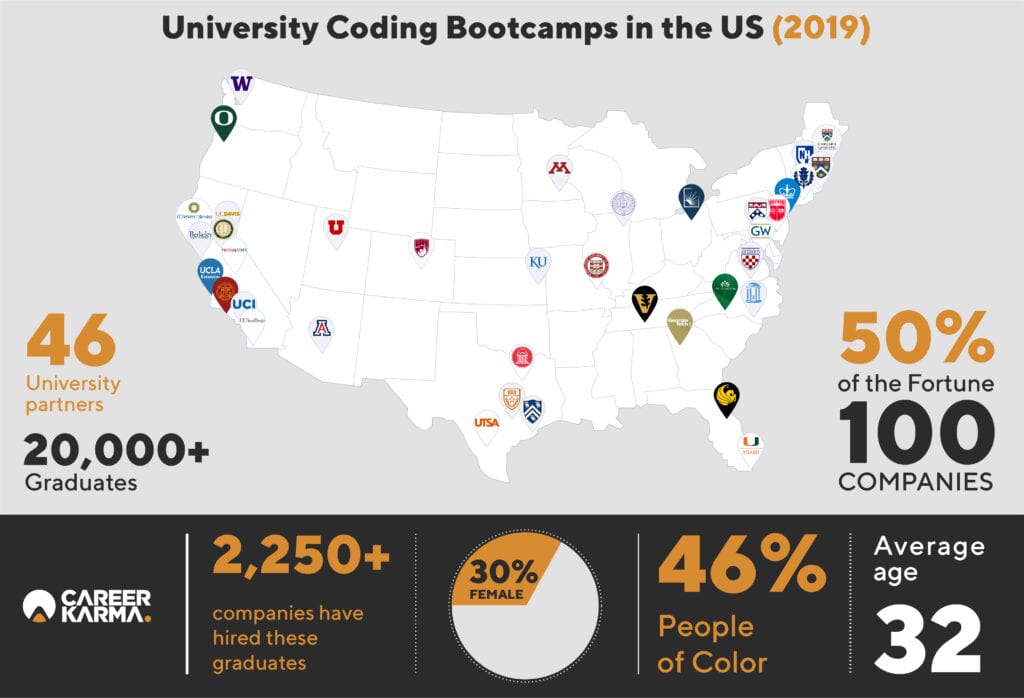

Companies like Trilogy Education Services have found a strong business model in helping universities offer bootcamp courses as a supplement to their school’s existing degree offerings. To date, Trilogy has worked with 46 university partners to offer coding bootcamps. So far, these programs have served a total of over 20,000 graduates.50 2U, an education technology company that works with universities to offer online degree programs, acquired Trilogy in early 2019.51

For the purposes of this study, we researched universities that offer coding bootcamps and compiled a list of 40 university bootcamps. The bootcamps we studied are those that are currently active and serving students and have an alumni body. Then, we used the same methodology as we did to evaluate the bootcamp LinkedIn profiles to determine which bootcamps had enough data for us to analyze. This resulted in our sample being reduced to 10 university bootcamps, who each had complete LinkedIn school pages.

We suspect that there are a number of factors that may have contributed to the growth of university coding bootcamps. One of these is that university bootcamps may provide a space for universities to experiment with different educational model(s) that may better serve certain students without changing their traditional computer science offerings.

Universities, which are often governed under strict accreditation rules that influence the structure of their offerings52, may use bootcamps as a tool to experiment with new pedagogies for teaching computer science. Existing computer science degree programs, on the other hand, are authorized and approved by accrediting bodies, which may make it more difficult for experimentation to occur.

In addition, university bootcamps may be growing in response to pressures associated with lower enrollments in their traditional programs. 2019 was the eighth year in which enrollments declined, which will stress the resources of some colleges.53 Offering coding bootcamps gives universities the ability to show their interest in alternative education models and attract new students when enrollments in traditional programs decline.

University bootcamps confer a number of advantages to students. For example, universities may—although this is not always the case—review their bootcamp’s curriculum. This could, in turn, provide a sort of quality control for the education that students receive at bootcamp. That said, such quality controls are not required and so may not exist in every university bootcamp program.

The growth of university bootcamps also has a positive impact on the general bootcamp sector. At present, in order to attend an in-person bootcamp, most people would have to move, as most bootcamps are concentrated in big cities. However, university bootcamps may allow more students who already have a university in their local area—or at least nearby—to benefit from a bootcamp-style education.

University bootcamps still constitute a relatively small portion of the market in terms of the number of programs, but the total number of students who have gone through these programs is significant. We suspect that university bootcamps will enroll higher numbers of students in the future as the model gains traction.

Corporate Training

Corporate training offers coding schools another opportunity for expansion. While serving individual students has proven to be a strong business model in many cases, corporate training programs would allow bootcamps to tap into a new market and access more potential revenue streams.

Companies are investing greater resources in training employees in new skills — partly due to an increase in automation that has displaced workers and disrupted the labor market. In line with this, McKinsey & Company estimated that almost one-third of American workers will need to shift to a new occupation by 2030 as a result of this increased automation.54 In addition, there are now more job openings in the US than there are unemployed Americans.55 In the tech space, companies are struggling to find the talent they need to fill technical roles as well. 56 In response to these trends, companies are looking for new ways to train their workers.